The Arizona Hospital and Healthcare Association (AzHHA) and the Arizona Chamber Foundation are joining forces to stop what we call a hidden health care tax on businesses and consumers. According to a study released by the Arizona Chamber Foundation, which is associated with the Arizona Chamber of Commerce and Industry, Arizona employers and the state’s 3.5 million privately insured consumers pay 40 percent above cost for hospital services, primarily because the state and federal governments significantly underpay hospitals for those same services.

“This study shines a light on what Arizona business and health care leaders refer to as the hidden health care tax,” says Suzanne Taylor, executive director of the Arizona Chamber Foundation. “The study demonstrates that when state or federal lawmakers reduce hospital payment levels to below their costs, Arizona businesses and consumers pick up the tab in the form of higher health insurance premiums.”

The study, An Analysis of Hospital Cost Shift in Arizona, was conducted by the nationally recognized Lewin Group. It found that in 2007, private insurance payments for Arizona hospital services exceeded costs by $1.3 billion in order to offset underpayment from:

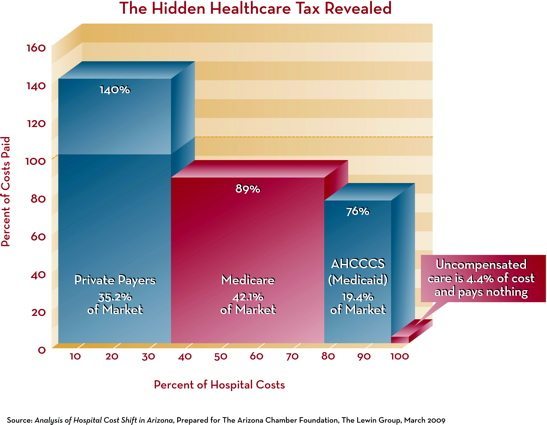

- State government — The Arizona Health Care Cost Containment System (AHCCCS), Arizona’s Medicaid program that paid 79 percent of hospitals’ costs for providing services, underpaid Arizona hospitals by $407 million.

- Federal government — Medicare, which paid 89 percent of Arizona hospitals’ costs for delivering services, underpaid Arizona hospitals by $481 million.

Uncompensated care — Arizona’s hospitals absorbed $390 million in 2007 — 4.4 percent of their total costs — for services they delivered, but for which they received no compensation.

Public insurance programs such as AHCCCS and Medicare are the primary drivers behind the hidden health care tax, paying hospitals below what it costs to treat patients. To cover these costs, hospitals shift the burden to private health insurers by negotiating higher rates to provide coverage.

“In this downturn, the hidden health care tax is particularly harmful to the economic well-being of our state,” Taylor says. “Employers throughout Arizona are grappling with incredible challenges ranging from declining revenues to shrinking credit. The hidden health care tax is another weight on businesses that want to continue providing employer-based insurance to their employees.”

Arizona employers and their employees typically share the cost of health insurance coverage, with employers paying an average of 81 percent of a single policy and 75 percent of a family policy for workers enrolled in their respective health plans. According to the study, in 2007 inadequate payment by AHCCCS and Medicare, as well as uncompensated care, increased private health insurance premiums in Arizona by 8.8 percent or $361 for every privately insured person.

The study revealed that public program underpayment in 2007:

- Added $1,017 — $324 of which is due to AHCCCS underpayment — to the annual price tag of a typical family health insurance policy, bringing the cost to $11,617.

- Increased by $396 — $126 of which is due to AHCCCS underpayment — the annual cost of a single health insurance policy, bringing the price tag to $4,519.

Underpayment by public insurance programs for hospital services exacts a steep price on employers, their workers and private purchasers of health insurance. In 2007, the cost shift due to AHCCCS, Medicare and uncompensated care cost: employers an additional $941.7 million, $301.3 million resulting from AHCCCS underpayment; employees an additional $292.8 million, $93.7 million of it due to AHCCCS underpayment; and private purchasers of health insurance an additional $41.4 million, $13.2 million of it resulting from AHCCCS underpayment

AHCCCS payment rate freeze.

- Five percent AHCCCS payment rate reduction.

- Disproportionate share hospital payments.

- Graduate medical education.

- AHCCCS payments to rural hospitals.

- State savings of $95 million.

- Lost federal funds of $250.4 million.

Total dollar increase in private insurance premiums due to the cost shift of $1.48 billion in 2009 and $1.63 billion in 2010.

Individual increase in premiums of 19 percent for privately insured Arizonans due to the cost shift.