Although non-residential building held up longer than residential activity in the current recession, the non-residential downturn now has started and is expected to continue into 2010.

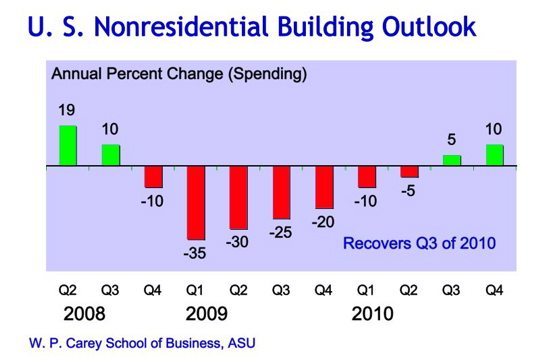

Non-residential building began to increase strongly at the beginning of 2006, just as residential activity started to sag. Double-digit growth continued in seven of the next 10 quarters, propping up the economy and partially offsetting the drag on GDP created by the residential downturn. But non-residential building hit the skids in the fourth quarter of 2008, with an annualized decrease of 9 percent. However, that was a minor dip compared to the latest GDP figures. In the first quarter of 2009, spending on non-residential building was down a whopping 44 percent. Double-digit quarterly decreases in non-residential building outlays are expected through 2009. If forecasts from Arizona State University’s W. P. Carey School of Business prove to be correct, spending on non-residential structures won’t move back into the positive range until the third quarter of 2010, after nearly two years of decline.

Just as residential building has been hit by a weak economy, non-residential construction is now feeling the effects of reduced demand for office space and facilities of all types.

Moreover, tighter credit standards, originally linked to residential mortgage problems, are now affecting non-residential financing, while commercial real estate borrowing is plummeting. According to surveys of bank loan officers by the Federal Reserve Board of Governors, non-residential construction loan credit standards have grown tighter in each of the past 12 consecutive months. Meanwhile, bank loan demand by builders of commercial real estate declined in each of these months.

A collapse in non-residential building will have a sharp impact on an already weak construction industry in metropolitan Phoenix. In 2005, at the peak of the housing boom, residential permits accounted for approximately two-thirds of the $14 billion total value of building permits for the year, while non-residential made up the remaining third. By 2008, the relative importance of residential and non-residential activity switched, as non-residential permits of $6.6 billion accounted for two-thirds of the total, and residential permits fell from $9 billion in 2005 to less than $3 billion in 2008.

Observers expect the value of non-residential permits will fall by as much as one half this year, offsetting any meager gains if residential housing shows signs of life.

New retail, office and industrial space actually put in place is expected to be less than 10 million square feet this year, down two-thirds from more than 30 million square feet in 2007. And 2010 will be even weaker. The consensus among real estate analysts is that new retail, office and industrial space added next year will not reach 4 million square feet.

Non-residential building has posted many instances of sustained downturns, the most recent being the six consecutive quarters beginning with the fourth quarter of 2001, after the attacks of Sept. 11.

As long as labor markets are weak, financial markets are tight and securitization barely exists, it is unlikely that non-residential building will show strong signs of life nationally or in the Phoenix metro area.