U.S. home prices accelerated in November compared with a year ago, pushed higher by rising sales and a tighter supply of available homes.

The Standard & Poor’s/Case-Shiller 20-city home price index rose 5.5 percent in November compared with the same month a year ago. That’s the largest year-over-year gain in six years.

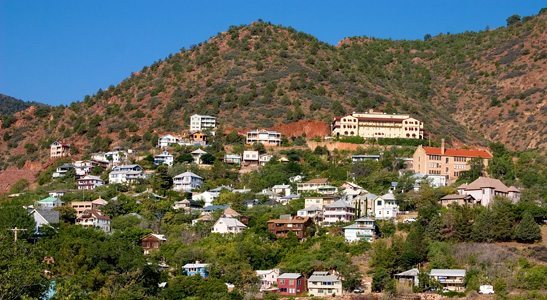

All but one of the cities in the index posted annual gains. The largest gain was in Phoenix, where prices jumped nearly 23 percent. It was followed by San Francisco, where prices rose 12.7 percent, and Detroit, where they increased 11.9 percent.

New York was the only city to report a drop from a year ago.

Prices also rose in 10 of the cities measured by the index in November from October. That’s up from seven in October from September. The biggest monthly gains were in San Francisco, Phoenix and Minneapolis.

Monthly prices are not seasonally adjusted and frequently decline over the winter. The 20-city index dipped in November from the previous month.

Steady price increases should help fuel the housing recovery. They encourage more people to buy before prices rise further. Higher prices also build homeowners’ wealth, which can spur more spending and economic growth.

The data “show a broad-based recovery in housing activity and prices across the country,” said Michael Gapen, an economist at Barclays Capital. “We expect this housing recovery to continue in the coming years.”

The S&P/Case-Shiller index covers roughly half of U.S. homes. It measures prices compared with those in January 2000 and creates a three-month moving average. The November figures are the latest available.