Mobile finance is about to boom (some say we’re already there). You may have dabbled a little with your own bank’s mobile app for easy money transfers and to check balances. Or you might be quite savvy with Google Wallet and PayPal on your phone. There are a myriad of new apps to help you with all of your financial needs and are great for both personal and business use.

Most of these apps are available across Apple, Android and Blackberry platforms, and new ones are coming out every week. They help with everything from debt reduction, to managing how payments, to investing.

Here are five mobile finance apps to check out:

Debt Tracker

Most Americans are carrying some debt right now, and businesses are no exception. Debt Tracker helps you store all of your debt information in one place, plan how to pay it off quickly, and it calculates how long it will take you to pay off each debt. This app subscribes to the popular “snowball theory” of debt-repayment — where you aggressively pay off one debt at a time, while paying the minimums to the rest — and has tools to help guide you through. Free and paid versions are available.

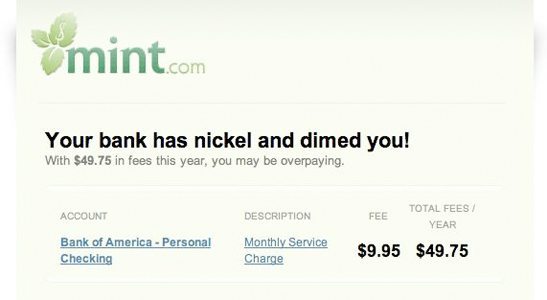

Mint

You’ve probably heard of Mint.com, as one of the first free and easy-to-use budgeting tools to hit the Web. This app is free and connects your phone to your bank accounts. It helps you track spending, and stick to a budget. The features in both the online version and the app make it almost a no-brainer, doing all of the hard work for you. If you’re trying to stick to a budget, this is a dependable way to go.

Pageonce

This company claims to manage all of your financial data, and lets you pay bills, from one simple app. They also claim to take security quite seriously, which is important for anyone accessing financial data online. Keep in mind that the payment card industry hasn’t kept up with mobile transactions, in terms of security standards. Anyone who accesses financial information via a mobile device should heed this. However, Pageonce makes a point of touting security as one of the best values of this application.

BillTracker

Sometimes you just forget to pay a bill. It happens to even the most responsible of us. BillTracker keeps you in line and lets you know when bills are due, so you’ll never suffer from a late fee again.

iExpense

Wouldn’t it be nice to have a little financial planner in your pocket? That’s the point of this nifty app. iExpense does more than just help you budget and make payments, it actually gives you advice on how to achieve financial goals — whatever those goals are. This app was designed by financial advisors. While it can’t quite replace a real professional, it can act almost like a coach to keep you in line between that annual visit with your planner.

Just keep in mind that mobile finance apps like these are only as good as the person using them. They won’t suddenly make you a financial guru or do all of the work for you. But they can help keep you in line to achieve your financial goals — whatever they may be.