You’re staring at another bill, wondering how much longer you can juggle due dates and late fees before something gives. Debt feels like quicksand, and the harder you kick, the deeper you sink.

If selling the house is on your mind, the detailed guide at We Buy Gretna Houses shows what a straightforward cash offer actually looks like. Use it to weigh options and decide whether a fast deal fits.

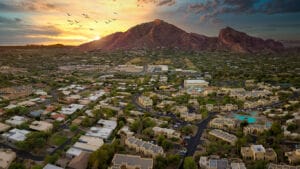

LOCAL NEWS: 10 Arizona housing events that offer festive charm

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

Assess Current Debts

Begin by shining a bright flashlight on every balance you carry. Knowing the exact numbers instantly transforms an overwhelming fog of worry into a concrete action plan.

- List every creditor on a single spreadsheet, noting interest rates, minimum payments, and due dates to see which balances drain cash fastest.

- Pull fresh credit reports from all three bureaus; accuracy matters because hidden or outdated accounts can sabotage the most diligent payoff strategy.

- Rank debts strategically by either avalanche (highest rate first) or snowball (smallest balance first) so progress feels visible and keeps motivation high.

With a clear table in front of you, next month’s paycheck already seems more powerful because it now has a precise mission rather than vague desperation.

Cut Monthly Expenses

Trimming recurring costs frees cash immediately. Approach the process like decluttering a closet: ruthless decisions today give tomorrow’s budget fresh breathing space.

- Slash subscription creep by canceling streaming channels you rarely watch and unused phone apps silently billing your card each month.

- Renegotiate essentials such as insurance and internet; comparison shopping often uncovers loyalty penalties that disappear once you request competitor pricing.

- Adopt cash-only groceries for thirty days; walking into Rouses Market with envelopes prevents impulse purchases that digital swipes disguise.

Every dollar saved becomes a miniature employee working overtime toward debt freedom, amplifying the speed of your entire payoff timetable.

Boost Immediate Cashflow

Extra income accelerates results faster than budget cuts alone. Gretna offers plenty of quick, creative ways to transform skills and assets into spendable dollars.

Leverage weekend gigs

Delivering meals along the Westbank Expressway or pet-sitting in Timberlane typically produces $100–$150 weekly without disrupting your primary job schedule.

Turn clutter into cash

A Saturday sidewalk sale on Huey P. Long Avenue converts dusty furniture into payments that shrink credit-card principal before more interest accrues.

Explore overtime opportunities

Ask supervisors about temporary projects; a few extra shifts at the plant or hospital may cover an entire month of minimum payments in one paycheck.

Negotiate Creditor Terms

Lenders prefer partial recovery over default, so confident communication often secures lower balances or reduced interest, lightening your load dramatically.

Validate every claim

Request written verification before discussing money. The CFPB’s guidance outlines the exact disclosures collectors must provide.

Create a realistic offer

Compare disposable income with owed amounts, then suggest lump-sum settlements or extended plans you can actually meet without sabotaging other bills.

Capture agreements in writing

Insist on signed documents stating that the agreed payment satisfies the debt and collection calls will cease once funds clear your account.

Stop Penalty Charges

Fees feel like mosquitoes—small individually but relentless in swarms. Eliminating them preserves cash while reducing stress linked to compounding obligations.

- Automate on-time payments so late fees never reappear, protecting both wallet and credit score from avoidable hits.

- Fight local fines by contesting minor violations or requesting community service; investigative reporting on Gretna’s ticket practices (ProPublica) shows how fast costs multiply.

- Ask banks to reverse the occasional overdraft; long-standing customers often receive courtesy refunds if they call promptly and politely.

Removing these financial leeches yields instant relief and ensures future payments target principal rather than unnecessary penalties.

Sell House Fast

If housing payments dominate your budget, a quick cash sale can wipe out multiple debts at once and leave surplus funds for a fresh start.

Understand local demand

Investors actively buying in Gretna appreciate convenient Westbank access, so competitive offers usually land within 24 hours of inquiry.

Skip traditional listings

No agent commissions or appraisals means the price you accept equals the check you collect, often within one business week.

Factor in moving costs

Set aside part of the proceeds for deposits and relocation expenses, guaranteeing the transition remains smooth rather than another stressful bill.

No Repairs Needed

Worried that cracked drywall or an aging roof will scare buyers away? Cash investors gladly purchase as-is properties, absorbing renovation headaches themselves.

Benefit from convenience

You avoid weekend hammer swings, contractor delays, and surprise permits, freeing precious mental energy for rebuilding financial stability instead.

Leave unwanted items

Old appliances or inherited furniture can stay behind; buyers factor disposal into their offer, turning a messy burden into effortless freedom.

Reduce closing uncertainty

Because sales aren’t contingent on lender inspections, deals rarely fall through, ensuring your debt payoff timeline stays on schedule.

Close On Your Timeline

Flexibility is power. Whether foreclosure looms next month or schooling starts next spring, choose a date that aligns perfectly with your personal calendar.

Pick seven days or seventy

Cash buyers accommodate tight emergencies or longer transitions, allowing you to line up rentals, movers, and school transfers without panic.

Avoid double housing costs

Coordinated closings prevent overlapping mortgage and rent payments, so your fresh budget launches clean instead of freighted with duplicate expenses.

Control viewing schedule

No parade of strangers means life continues normally until keys change hands, minimizing disruption for kids, pets, and remote-work routines.

Simple Three-Step Sale

You’ll appreciate how streamlined the process feels compared to traditional listings packed with showings, offers, and contingencies that drag on for months.

- Request an offer via a web form or quick phone call; provide basic property details and preferred closing window.

- Review transparent numbers after a brief walk-through; there are no hidden fees, and you decide whether the figure meets your goals.

- Sign and schedule the closing at a local title company, then collect your cashier’s check or wire transfer the same day.

This straightforward path converts bricks and mortar into immediate liquidity that erases debt and boosts your emergency fund in a single motion.

Debt-Free Horizon

You’ve mapped obligations, trimmed costs, and unlocked cash channels; the next action is simply execution. Keep momentum by prioritizing every dollar toward balances before lifestyle upgrades. If selling property accelerates the plan, explore a Fast Cash Sale in New Orleans model as a reference point, then apply comparable terms locally.