Silver is one of the world’s most fascinating precious metals, and one that is renowned for being far more versatile and malleable than gold.

In fact, industrial usage accounts for more than half of annual demand worldwide over the course of the last five years, from jewelery and battery production to its use in medical devices (thanks to its antibacterial qualities).

But what are the most prominent applications for silver across the globe, and what does the future hold for the price of this precious metal?

What are the Most Prominent Applications for Silver?

Interestingly, industrial fabrication drives much of the demand for silver, with 486.8 million ounces utilized for this purpose as recently as 2020.

Put simply, silver is the best electrical and thermal conductor of all metals, making it ideal for use within industrial fabrication applications such as switches, contacts and fuses.

In the fast growing world of electronics, industrial silver is used mainly in multi-layer ceramic capacitors, alongside the production of membrane switches and electrically heated automotive windshields.

In 2020, industrial demand for silver actually decreased as a result of coronavirus lockdowns and diminished demand, but this year is expected to see a significant rebound in this regard.

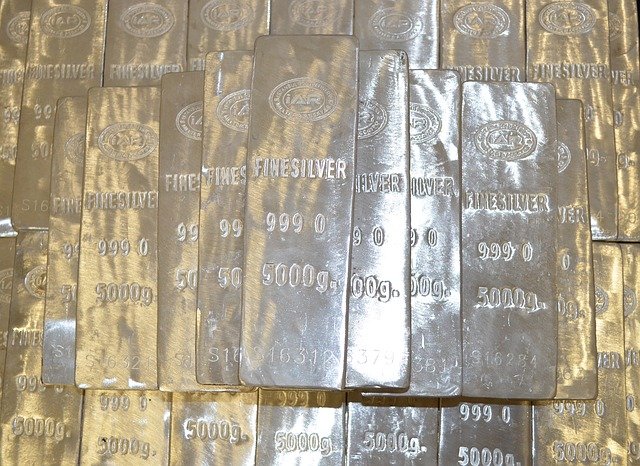

A further 148.6 million ounces of silver was used in the production of jewelry, while bullion coins and bars and silverware made up the rest of the top four global applications.

The Modern Uses of Silver and the Price of This Commodity

Silver is characterized by its immense versatility, with the modern age having seen it take a broad range of additional applications.

For example, solar panels rank as one of the top consumers of silver and have done so ever since the mid-noughties, while more recent developments in mobile technology have also seen the precious metal widely deployed in the production of batteries.

To put this into context, the demand from battery manufacturers is about 300,000 metric tons of lithium carbonate equivalent (LCE) per year, while there’s approximately 520,000 metric tons of existing mining capacity for battery markets at present.

Last year also saw a huge surge in demand for silver in the medical device industry, which boomed as a result of the coronavirus and remains in good stead as the pandemic continues to have an impact across the globe.

The Price of Silver the Most Influential Factors

With demand continuing to rise through 2020 against the backdrop of a consistent mining supply, it’s little wonder that silver was the best performing commodity through 2020.

In fact, it’s little wonder that investors continue to keep a close eye on the price of silver, with total returns in 2020 peaking at an impressive 47.9%. This built on a trend initially established in 2019, when the commodity delivered an average return of 15.2% to investors across the board.

This was nearly twice as generative as the next most performant commodity (copper with 26.0% returns), while gold’s average return of 25.1% was considerably lower.

This trend is unlikely to abate anytime soon, particularly with such a diverse array of high demand sectors in play and silver remaining a competitively-priced commodity.