In the years since the pandemic unsettled the office market, many have been anticipating an increase in distressed offices. While distressed activity has been muted to this point, weak demand, falling prices and a potential recession could lead to an increase in distressed office sales in 2023, as well as one of the smallest sales volumes since the Great Recession, the CommercialEdge U.S. office market report reveals.

DEEPER DIVE: Demand for Scottsdale Airpark commercial space far exceeds supply

Higher interest rates have already put pressure on owners with floating-rate debt and will provide a substantial challenge for loans that need to be refinanced this year. Remote and hybrid work have become entrenched and the tech industry — which drove much of the leasing of office space in recent years — is now contracting and laying off workers, thus further decreasing demand for office spaces.

“We know distress activity will increase this year. We are closely monitoring the loans that are coming due and how they are being handled on both the owner and lender side,” sats Peter Kolaczynski, CommercialEdge Senior Manager.

Metros with high quality office products might be better positioned to weather the storm when it comes to 2023 office sales, as tenants continue to look for well-amenitized, Class A office space in premium locations. This trend is expected to put downward pressure on older assets, especially those that are not well-located and well-kept, positioning these at a higher risk of distress as well.

Additionally, with demand for office space continuing to be lower, we expect that many of the distressed properties that are sold may be targeted for redevelopment and conversion into life sciences or multifamily properties.

Listing Rates and Vacancy: Vacancy Increases Accelerate in Tech-Heavy Metros

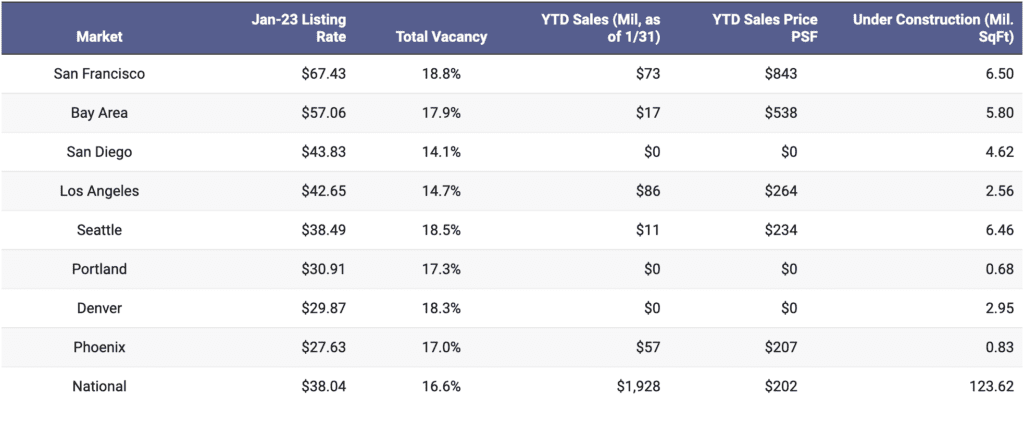

Across the top 50 U.S. office markets, the average full-service equivalent listing rate was $38.04 in January, an increase of 1.1% over the past 12 months. At the same time, the U.S. office vacancy rate continued to rise, reaching 16.6%, up 80 basis points over January 2022.

Although office vacancy rates continued to climb in most markets, some places have seen rates rise more rapidly than others since the pandemic upended the office market. Metros that owe their rapid growth to the tech sector have particularly felt the pressure of the remote work culture and recent tech layoffs.

Despite the steady rise in vacancy rates over the last couple of years, listing rates are still holding steady, thanks to tenants’ flight to quality. In January, the average listing rate for Class A and A+ office space was $46.70 per square foot, marking a 2.0% increase year-over-year. At the same time, Class B rates fell 0.7% to $30.11 per square foot.

In terms of location, office assets in CBDs claimed the highest listing rates at $51.43, up 3% over the past 12 months, while suburban assets stood at $30.47, also up 3.1% year-over-year. Urban office spaces, however, continued to depreciate, with rents falling 4.3% below the figures recorded at the beginning of 2022.

Supply: Five Markets Account for One Quarter of National Construction Pipeline

As of January, there was 123.6 million square feet of office space under construction nationally, accounting for 1.9% of total inventory. The top five markets by total square footage — Boston, Manhattan, Dallas, Austin and San Francisco — accounted for more than a quarter of all new supply being built.

The influx of people into Texas in recent years has helped prop up office markets that have been hit by remote work. Dallas has let developers remain active in the market, with 4.1 million square feet started last year and more soon on the way. The Fields — a 180-acre, $2 billion mixed-use project in Frisco — will eventually include four million square feet of office space alongside retail, restaurants, apartments and hotels.

Although offices in urban locations experienced the sharpest decline in asking rents, developers were most active in these areas. As of January, there were more than 66.5 million square feet of office space under construction in urban locations, representing 4.9% of total stock. Meanwhile, offices in CBDs and suburban areas are set to increase the national stock by 1.4% and 1.2%, respectively.

Transactions: Distressed Sales Likely to Increase in 2023

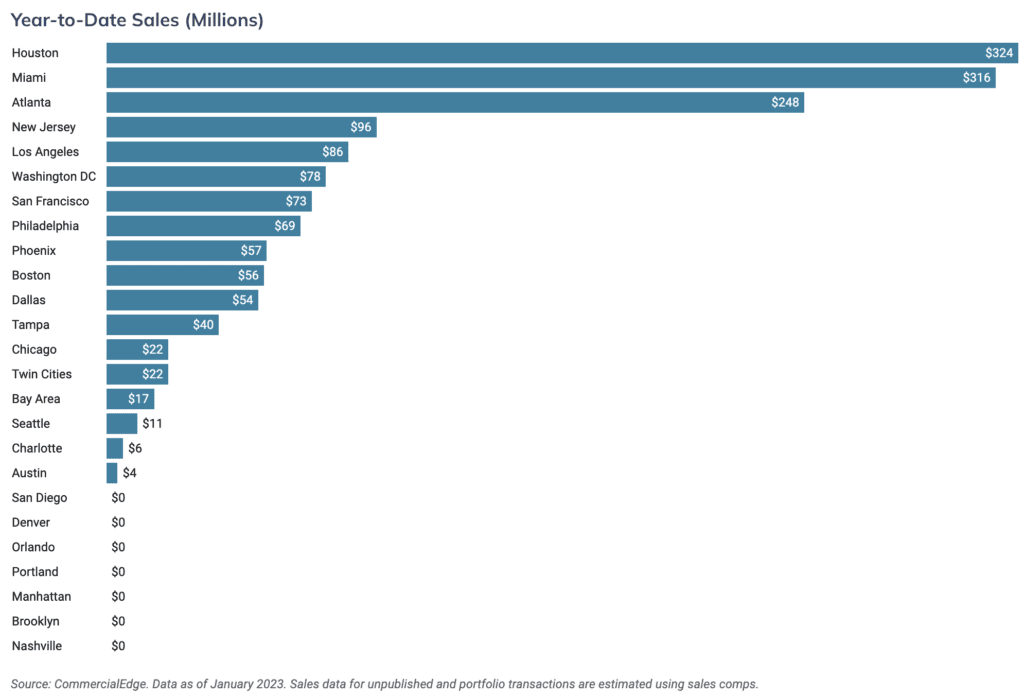

CommercialEdge recorded $1.9 billion in office transactions in January, with properties trading at $202 per square foot.

But taking into account the overall economic uncertainty, the entrenchment of remote work and the upheavals triggered by increased interest rates, office market outlooks anticipate that there will not be much capital for office transactions this year.

Investors may still be able to find loans for well-located buildings with strong occupancy and cash-flow, but for the most part, deals for office buildings will likely fail to materialize. It’s expected that office transaction volumes in 2023 will be at their lowest levels since the years following the Great Financial Crisis.

Higher interest rates have already put pressure on owners with floating rate debt and will provide a substantial challenge for loans that need to be refinanced in 2023. The national average sale price of an office property fell from $269 per square foot in the first quarter of 2022 to $214 per square foot in the fourth quarter. A flood of distressed 2023 office sales could trigger a downward price spiral for offices.

Distressed sales will most likely increase in frequency this year, but it is too early to say whether it will be a large wave. With demand for office space continuing to be soft, many of the distressed properties that are sold may be targeted for conversions into life sciences or multifamily, with some razed and entirely redeveloped.

Western Markets: Remote Work Drives Up Vacancies in Denver

With vacancy rates rising across the nation’s largest office markets, the West also followed suit. For instance, Denver’s vacancy rate in January stood at 18.3%, up 200 basis points (bps) over the last 12 months and 370 basis points over the last two years. Other leading tech markets, such as Seattle, San Francisco, and Portland also saw their office vacancy rates increase by 1.47%, 2.87 % and 3.20% year-over-year in January.

In fact, all leading western markets experienced continued increases in vacancies over the past 12 months. While Portland’s 3.2% rise was the most significant, even San Diego — with its thriving life sciences sector — saw a year-over-year uptick of 0.27%. This lifted the local vacancy rate to 14.09%, which is still the lowest among leading western office markets.

Circling back to Denver, the main cause of increasing office vacancy rates in the Mile High City is remote work. According to the Census Bureau’s American Community Survey, 28% of respondents in the market reported working from home, one of the highest shares in the country. Additionally, Denver has benefited from robust growth in the tech sector in recent years, and the layoffs currently hitting that industry will hamper the market. Denver’s sublease rate was 1.8%, a figure that could move upward in the future.

Despite a nearly 19% vacancy rate, San Francisco continued to lead the West in asking rents at $67.43 per square foot. Local trends show that listing rates were still growing at a healthy pace here, further widening the pricing gap between San Francisco and other West Coast markets. Those include the Bay Area which at $57.06 per square foot demanded the second highest asking rents.

Additionally, the West Coast’s top markets also led the region in terms of office development: San Francisco and Seattle both had 6.5 million square feet under construction in January, accounting for 4.2% and 4.7% of their existing stocks, respectively. And while the Bay Area’s office pipeline is set to increase the existing local stock by just 2.9%, that will still add 5.8 million square feet of new offices.

The three markets also had ample new stock in the planning stages, with San Francisco’s under construction and planned pipeline as high as 20%. However, considering the increasing headwinds faced by both the office and tech sectors, much of that planned pipeline may not materialize. In particular, there is growing nationwide concern regarding a potential spike in distressed 2023 office sales, due to low occupancy, expiring leases and maturing loans.