What Are Futures in Trading?

Futures are financial contracts that allow traders to speculate on the price of an asset at a later date. A future is an agreement to buy or sell an asset at a specified date in the future, making it a standardized contract used for both risk management and speculation. These contracts play an important role in global markets by facilitating speculation and risk management, used by hedgers to lock in prices and by speculators to profit from volatility. Understanding what are futures in trading is essential for navigating a wide range of financial instruments, including commodities, equity indices, and now crypto assets.

In 2025, futures contracts are at the heart of leveraged trading strategies, giving traders exposure to price movements without owning the underlying asset.

What Is Trading Futures & How Does It Work?

Futures trading involves agreeing to buy or sell an underlying asset at a specified price and date. Both businesses and individual investors trade futures to hedge risk, speculate on price movements, and control large positions with relatively small capital. These contracts are standardized and traded on regulated exchanges or digital platforms. Key components include:

- Underlying Asset: Can be commodities (oil, wheat), indices (S&P 500), or digital currencies (Bitcoin, ETH).

- Margin Requirements: Traders only post a fraction of the contract value, making leverage possible.

- Leverage: Allows amplified gains or losses based on small price movements.

- Settlement: Contracts may be physically delivered or cash-settled, depending on the asset and platform.

- Contract Rollover: Traders often close or extend positions before expiration to maintain exposure.

- Future Date: Each futures contract specifies a future date for settlement or delivery.

- Tick Size: The minimum price increment by which a futures contract can fluctuate.

- Purchase: Entering a futures contract begins with the purchase, or initial transaction, to assume a market position.

- Current Price: Trades are executed at the current price in the market.

- Exchange: The exchange is the platform where futures contracts are traded and standardized.

- Delivery Date: The delivery date is when the contract is settled, either by delivery or cash settlement.

- Physical Delivery: Some contracts require physical delivery of the underlying asset at expiration.

Each action of buying or selling a futures contract is called a trade, and one contract represents a standardized quantity of the underlying asset. Traders must open and manage accounts to participate in futures trading.

Futures contracts are managed through clearinghouses, ensuring both parties meet margin obligations, and reducing counterparty risk.

To trade futures, traders must have sufficient funds in their accounts to meet initial and maintenance margin requirements. The movement of money within futures accounts includes deposits, withdrawals, and margin calls. The potential to earn a significant amount of money exists due to leverage, but so does the risk of large losses.

Futures Trading Charts and Tools

Technical analysis is central to futures trading. Futures trading charts allow traders to visualize price action and apply indicators for more informed decisions. Traders often seek trading insights from expert analysis and real-time data to better understand market conditions and make timely moves. Common chart types include:

- Candlestick Charts: Provide information on open, high, low, and close prices within a time frame.

- Line Charts: Useful for identifying broader trends.

- Tick Charts: Represent each transaction, helpful for scalpers and high-frequency traders.

Traders use tools such as:

- Moving Averages: To confirm trend direction.

- Relative Strength Index (RSI): To assess momentum and potential reversals.

- ATR (Average True Range): For setting stop-loss levels and managing volatility.

- Volume Indicators: To confirm breakouts and entry points.

Effective trading strategies also rely on sound trading advice and psychological principles, which help traders remain disciplined and adapt to changing market conditions. When using these tools, traders closely monitor price moves to identify optimal entry and exit points. Understanding price movement is crucial for managing risk and capitalizing on emerging trends.

Platforms like Bitunix, Bybit, and KuCoin provide real-time data, custom technical indicators, and multi-chart layouts for precise decision-making.

Trading Futures vs Options: Key Differences

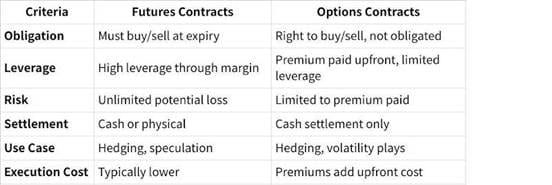

Both futures and options offer ways to speculate or hedge, but they work differently. Futures are binding obligations, while options provide the right—but not the obligation—to transact.

Futures trading involves substantial risk due to leverage and price volatility, which can lead to significant losses if the market moves against your position. Both instruments can be used for speculating on price movements, but the mechanics and risk exposure differ. Traders must decide which instrument best fits their risk tolerance and trading objectives.

Futures vs Options Comparison

Futures are preferred when certainty and direct exposure are needed. Options suit traders seeking flexibility with limited risk.

Crypto Futures Trading: New Opportunities and Risks

Crypto futures trading has emerged as one of the fastest-growing areas in derivatives. These contracts allow traders to speculate on cryptocurrencies like Bitcoin or Ethereum, as well as on bitcoin futures—a specific type of crypto futures contract—without holding them.

Key features include:

- Perpetual Futures: No expiration date; price remains anchored via funding rates.

- 24/7 Trading: Unlike traditional markets, crypto futures run continuously.

- High Volatility: Greater potential for profit or loss compared to traditional markets.

- Collateral Flexibility: Some platforms allow multi-asset collateral including stablecoins.

- Crypto futures are similar to traditional futures contracts on assets like crude oil, market indices, and interest rates.

Traders use a variety of trading strategies and futures trading strategies to profit from price swings in the futures market. Understanding your risk tolerance is crucial before engaging in crypto futures trading.

While the mechanics mirror traditional futures, the risk profile is higher due to extreme price swings and liquidity variation. Most traders in futures markets do not intend to take physical delivery of the asset, focusing instead on speculation or hedging. Bitunix, for example, offers crypto-only futures with up to 125x leverage, advanced risk dashboards, and deep altcoin support.

There are many types of futures contracts, such as crude oil futures contracts and other particular futures contracts, which can be tailored to specific assets. On trading platforms, traders can diversify their portfolio by including crypto futures alongside other financial instruments.

The futures market and broader futures markets are dynamic environments, where the trader plays a key role in analyzing and acting on market opportunities. A futures contract is a standardized agreement to buy or sell an asset at a predetermined price and date, serving as a fundamental tool for risk management, speculation, and implementing various trading strategies.

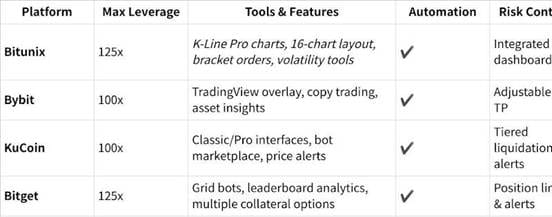

Choosing a Platform & Feature Comparison

Selecting a crypto futures platform requires assessing more than just fees. The best platforms offer comprehensive tools for risk management, analytics, and technical execution.

Crypto Futures Platform Feature Comparison

Click the image to view the sheet.

Platforms like Bitunix stand out for their high-performance charting infrastructure, custom indicator suite, and seamless automation tools, all optimized for crypto derivatives.

Frequently Asked Questions

Can I hedge spot crypto holdings with futures?

Yes. Selling crypto futures allows investors to offset potential spot losses, a common hedging strategy during market corrections.

What’s required to start trading futures?

A funded account, KYC verification, and platform training are typical prerequisites. Traders must also understand margin requirements and liquidation risks.

How is margin calculated in crypto futures?

Margin is the collateral needed to open a position, based on leverage and the notional value of the trade. Platforms auto-calculate this and monitor real-time exposure.

What is a contract rollover?

This refers to closing an expiring futures position and opening a new one with a later settlement date. Perpetual contracts eliminate this need but require funding rate awareness.

Conclusion: Understanding Futures in Modern Markets

Knowing what is trading futures provides traders with access to a diverse set of strategies, from hedging to leveraged speculation. Whether trading commodities, indices, or crypto, futures offer flexibility, liquidity, and risk exposure at scale.

Platforms like Bitunix, Bybit, and Bitget allow traders to harness these markets through advanced technical indicators, position sizing tools, and automation. Mastering futures trading involves understanding how contracts work, comparing platforms carefully, and applying sound risk management practices—especially in fast-evolving sectors like crypto.