How often do you take a good look at your paycheck stub? Aside from the amount you’ve been paid, there are several other important details included on your paycheck stub that are worth being familiar with.

Understanding your paycheck can help you make sure you’re being paid properly.

Here are 5 essential tips for reading your paycheck correctly so you can ensure you’re not missing out on important benefits.

1. Know the Basics

A paycheck stub includes a lot of information. This is both helpful and sometimes confusing. Don’t be intimidated by all the different sections and abbreviations.

Your paycheck stub will always include some standard pieces of information, including:

- Your full name spelled correctly

- Your address

- The start and end dates of the pay period

- Your tax filing status (whether you’re filing jointly, etc.)

- Your gross and net pay

If you can identify these aspects, you’ll understand the most important parts of your paystub.

2. Understand “Gross” vs. “Net”

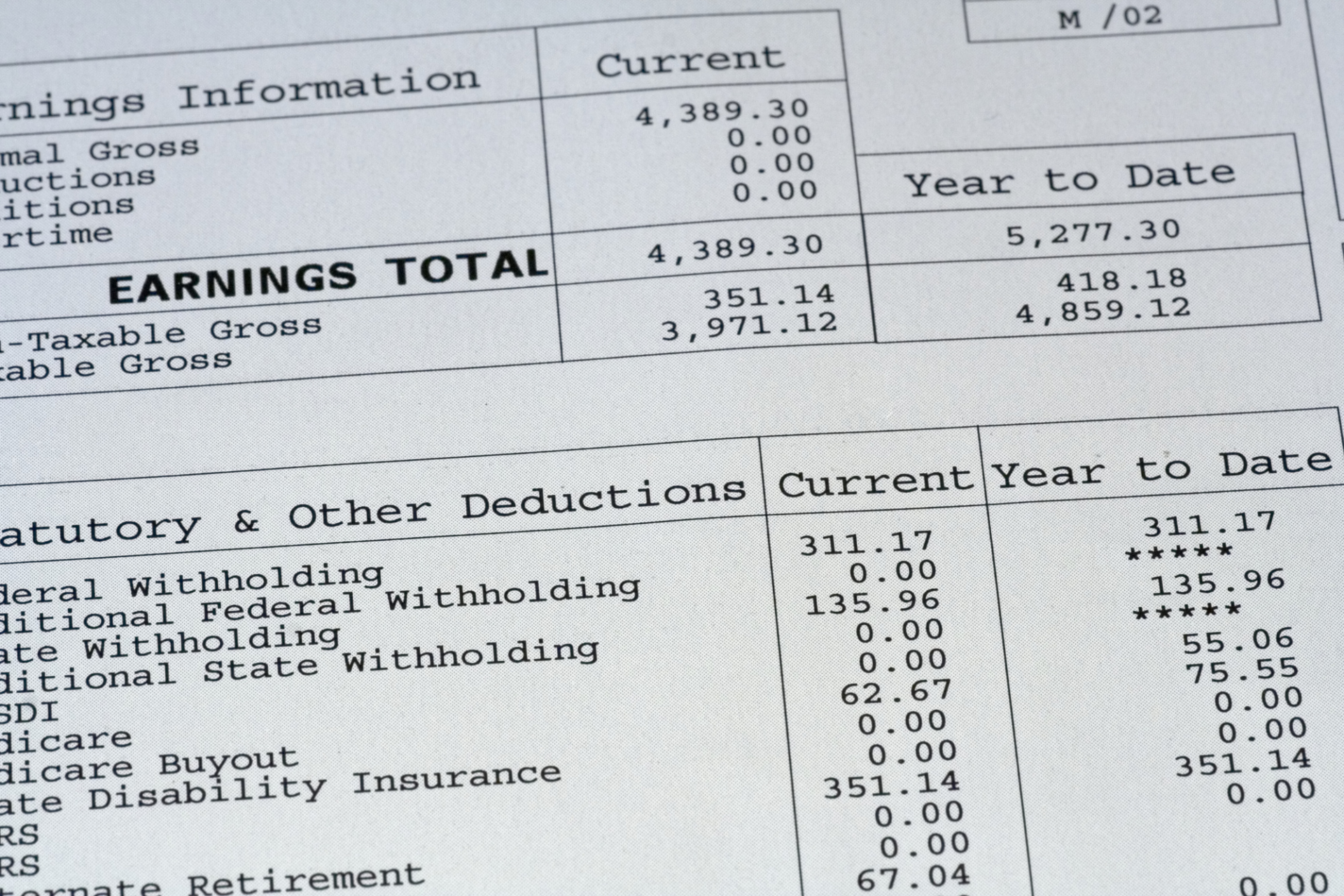

When you’re reading your paycheck, you will notice two terms regarding your payment: gross pay and net pay.

It’s important to know the difference between these two, as gross pay indicates how much you are paid before taxes or other deductions are removed.

Net pay is the amount you will actually take home.

On the left side of your paycheck, where gross pay is listed, you will also be shown a detailed breakdown of your gross pay for the entire tax year. This is to help you understand how much you owe and are paying in taxes based on your income.

3. Know Your Government Deductions

There are certain deductions from your gross pay that everyone pays. These are your Federal and State income taxes.

Both will vary depending on how much money you earn and what state you live in.

Social security deductions are another form of federal deduction that everyone pays regardless of where they live. This amount is 6.2% of your gross income and pays retirees or individuals who cannot work in the United States.

Your employer is also responsible for contributing 6.2% of each employee’s income, equaling 12.4% total per employee.

Another federal tax deduction from your gross pay is Medicare. This is 1.45% of your gross income that goes to providing medical care for older Americans.

4. Know Your Personal Deductions

Do you have a retirement or savings plan through your employer? If so, then their check stub maker will include information on how much money you contribute to those savings plans each time you are paid.

Your paycheck will also show you how much you contribute to any health plans you signed up for.

It’s important to know what types of savings or retirement plans you are signing up for as certain kinds will deduct the money before taxes–thus, saving you on how much money you owe in taxes.

5. Read Carefully

Most of the time, the person creating your pay stub has plenty of experience and knows what they’re doing.

However, human error can occur.

If you’re not aware of how much you should be receiving in net pay or how much you should be paying in taxes and other deductions, you may miss potential errors.

Know what amounts are correct for you, your state, and your position. Then, read your paycheck carefully.

Knowing Your Paycheck Stub

Most people receive their paycheck stub, look at the amount, and don’t give it another thought. But, understanding the information on your paycheck can empower you to make better financial decisions and be sure you’re taking home what you should.

For more helpful articles, browse the Business portion of our website.