At all times, people have asked themselves, “How do I get rich?” If in the Middle Ages many people became victims of the tulip crisis in the Netherlands, now there are enough vague offers on the Internet that promise quick wealth, but in the end leave the investor with nothing. Despite the level of financial literacy in society, it should be noted that for a long time there have been stable forms of investment in the world that have passed the test of time. In this article, we will tell you about some of them.[1]

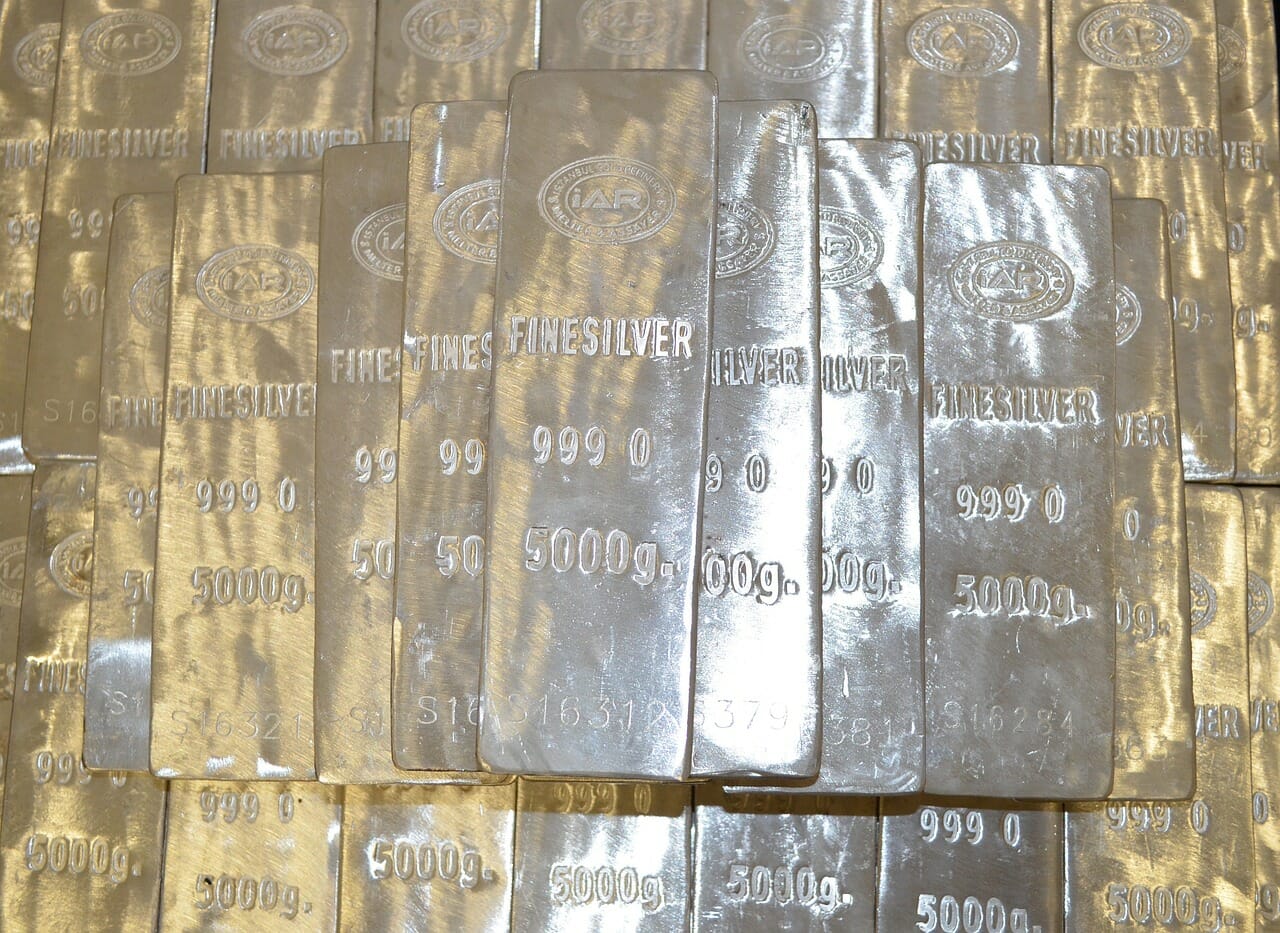

Precious metals

We also know from children’s fairy tales how valuable gold, silver and other natural resources that people use as money are. Even with the advent of the Internet and the progress of the virtual world, the way of investing in precious metals has not lost its relevance. Now you don’t have to keep gold under lock and key, but rather buy shares on stock exchanges. In any case, you will become richer from this. For example, over the past 20 years, according to some sources, the price of gold has increased 4 times.

What is the advantage of this way of investing? Precious metals have gone through many social and natural disasters throughout the history of mankind. But they have never depreciated to zero. By purchasing items from Copper State Coin and Bullion, you can be sure that even in conditions of political and economic instability, your investment will not lose value. Precious metals are a stable way of passive income for the long term. If you have the time and money to invest in precious metals, don’t miss your chance!

Of the latest examples, it is worth recalling the financial events of the beginning of 2022. When the stock market collapsed, gold and silver only gained in value. This proves that even with modern competitors in the world of investments, precious metals remain a stable unit.

Real Estate Investment

One of the most popular ways to invest safely is to buy commercial and residential real estate. Perhaps you yourself have thought about this way of investing when faced with the issue of renting or buying a home. Of course, this is not the fastest way to get rich, but in this case, money and time work for you. Buying real estate is a game for a long time. There are examples when investors take out a mortgage or loan and immediately rent out a property. So the owners eventually buy out the premises.

How to understand where it is better to buy real estate? Residential apartments are needed where infrastructure and the potential for high occupancy are developing. Commercial facilities can be in demand both in the central districts and on the periphery of the city. Parking and a large flow of people into the building are important for offices.

If over time you realize that this investment option is not suitable for you, then you can always sell all the objects with an increased margin. They are always in demand in fast-growing cities.

Bonds and stocks

Buying government or corporate bonds provides stable income and a relatively low level of risk compared to stocks.

Many investors in the modern world use a simple and understandable way to enrich their account. Conglomerates such as Apple, Coca Cola, Tesla or state-owned enterprises of any country have long been placed on stock exchanges with an offer to buy bonds and shares. Of course, one of the world-famous companies may go bankrupt in a month, but such a risk is almost equal to 0. Behind these companies there are big investors who will not let this happen. The benefits here are pretty clear. Every top player in the business world produces some kind of product or scales every year. This is reflected in the prices of its shares and bonds. You should not see only private companies in this way of investing. State structures are also quite reliable, because they are provided with the financial security of her country (the level of debt).

Of course, for some, even such actions look hard to feel, but today it is important to be an active and trend-aware person. Thanks to these skills, you will be able to quickly increase your investment portfolio.