States may tax income differently from the federal government, but workers are not insulated from rising burdens, as federal changes to withholding and deductions coincide with state-level tax reforms. As all this is now reshaping take-home pay and refund outcomes for millions of households in 2026, I am reaching out with a new report, highlighting the states where medium and high-income earners pay the highest personal income taxes. Thankfully, Arizona is among the states with the lowest personal income tax rates.

READ MORE: Here is the outlook for Phoenix’s 2026 housing market

LOCAL NEWS: TSMC Arizona preparing workers for a chips future

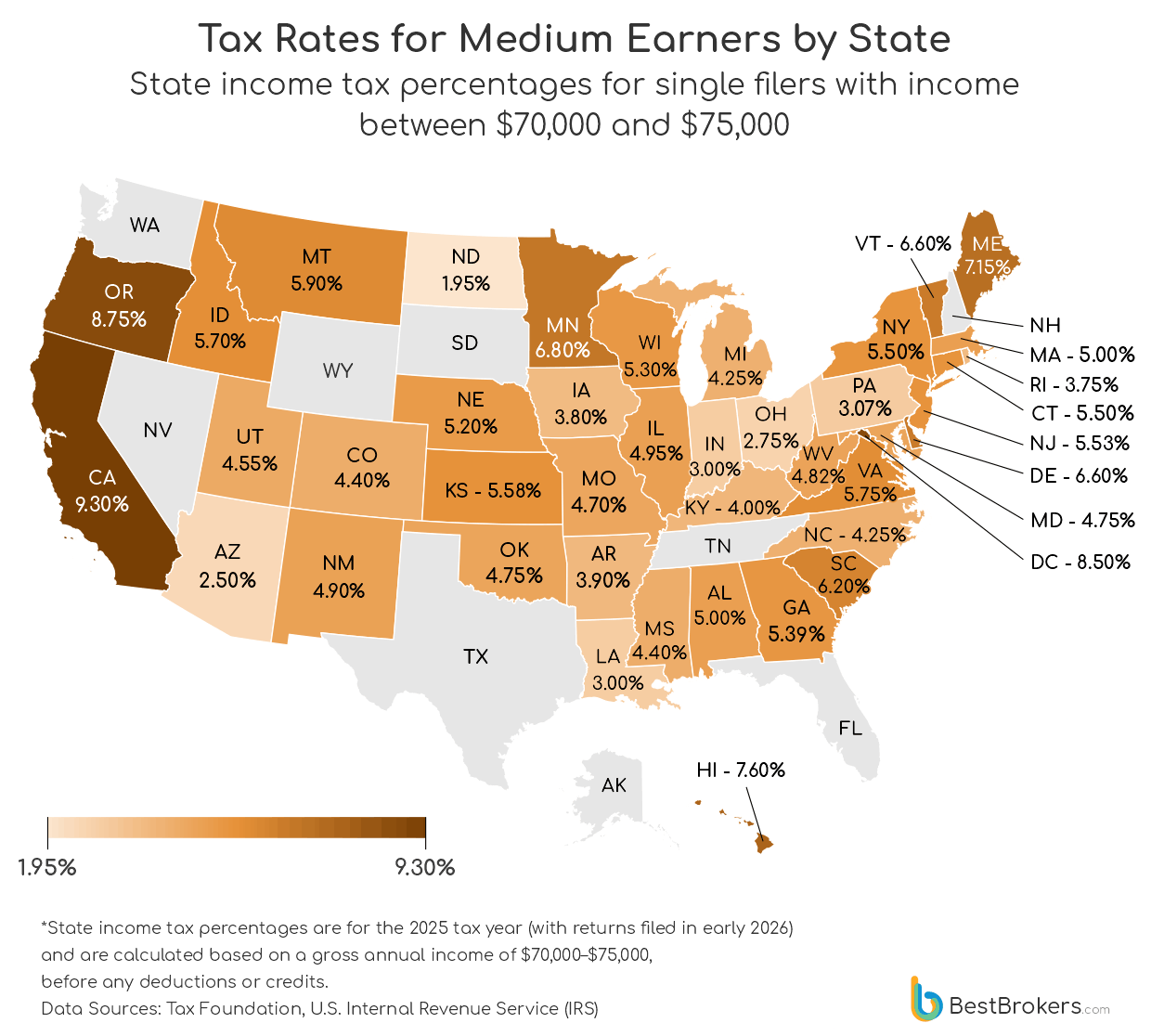

To identify which states place the heaviest personal income tax burden on earners, the team at BestBrokers analyzed 2025 state tax rates across all 50 states, focusing on individuals with income around the national average and the maximum marginal rates applied to top income brackets. We examined changes over the past year and five years to highlight where tax pressures have shifted most dramatically. The analysis also compares single filers with married couples earning the same income, revealing states that impose a marriage penalty or bonus. The full dataset behind the research is available on Google Drive via this link.

The data reveals that while nine U.S. states do not levy a personal income tax, workers in several states face exceptionally high taxes on their wages. Those earning roughly $70,000 to $75,000 in gross annual income face the highest state income tax burdens in California (9.3%), Oregon (8.75%), Washington, D.C. (8.5%), and Hawaii (7.6%), all of which use progressive, bracketed systems that apply different rates across income levels.

Here are a few key takeaways from the report:

• The lowest tax burdens on average income are in North Dakota, where the lowest rate of 1.95% applies to income up to $48,475, with higher rates above that; Arizona and Louisiana use flat rates of 2.5% and 3%, while Ohio starts at 2.75% over $26,050, rising to 3.5% above $100,000.

• California imposes the highest tax burden on workers earning between $70,000 and $75,000, with a 9.3% rate applied to income over $70,606. This rate remains relevant up to $360,659. The state also has one of the most complex bracket systems, featuring 10 rates ranging from 1% on income over $0 to 13.3% on earnings above $1 million.

• Oregon ranks second, taxing income over $11,050 at 8.75%, rising to 9.9% for earnings above $125,000. Washington, D.C., follows with 8.5% on income between $60,000 and $250,000. Hawaii (7.6%), Maine (7.15%), and Minnesota (6.8%) round out the list, with Hawaii’s system featuring 12 brackets, ranging from 1.4% on income over $0 to 11% on earnings above $325,000.

• Earners with an average gross income of $70-75K saw declines in 15 states, from -2% in Indiana, Idaho, and Georgia to -29% in Louisiana and -33% in Iowa. Over the past five years, larger drops were seen in Arizona (-40%), Arkansas (-34%), and West Virginia (-26%).

• Eighteen states charge a “marriage penalty” for dual-income couples filing jointly. On $75,000 each, the largest penalties hit Washington, D.C. ($8,173), Delaware ($7,008), and West Virginia ($5,724), while New York offers a tiny marriage bonus ($23). In most other states, joint or separate filing makes little difference.

• Nine U.S. states – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming – have no state income tax, allowing residents to keep more of their earnings. Still, this does not mean full take-home pay, as federal income taxes, Social Security and Medicare contributions, and in some cases local taxes or other mandatory deductions, still apply.