Arizona job growth numbers have been revised down significantly in 2024, according to an analysis.

Arizona added 7,400 seasonally adjusted jobs over the month in January 2025, up from a revised increase of 6,500 in December 2024. The state seasonally adjusted unemployment rate ticked up from 3.8% in December to 3.9% in January. That was just below the national average of 4.0% in January.

FOOD NEWS: Arizona economy keeps rolling: Here are the numbers

THINGS TO DO: Want more news like this? Get our free newsletter here

Over the year in January, Arizona jobs were down 0.2% (non-seasonally adjusted). Nationally, jobs were up 1.4% over the year.

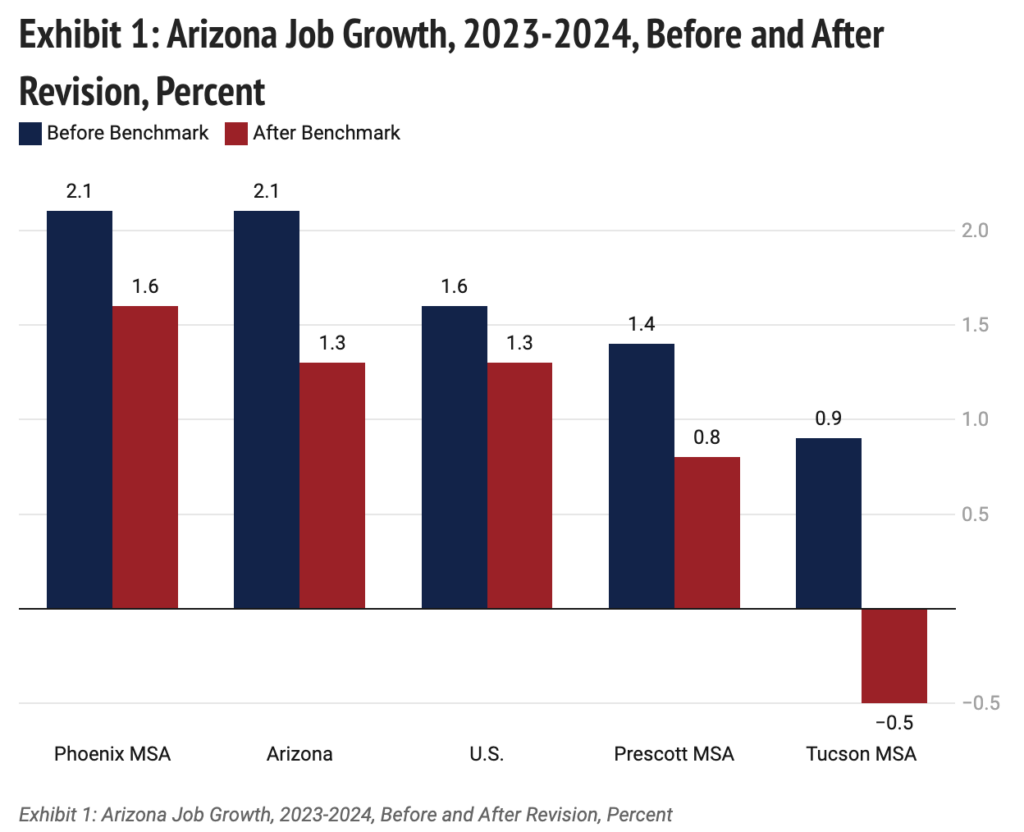

The big news in the January release was the substantial downward revision to Arizona job growth last year, combined with an upward revision to 2023. The preliminary data suggested that the state added 66,800 jobs in 2024 (annual average basis). The revised (benchmarked) estimate put growth at just 40,500. That pulled the statewide growth rate down from 2.1% in the preliminary data to just 1.3% (Exhibit 1). That was equal to the national average in 2024 and well below the 2.8% rate in 2023.

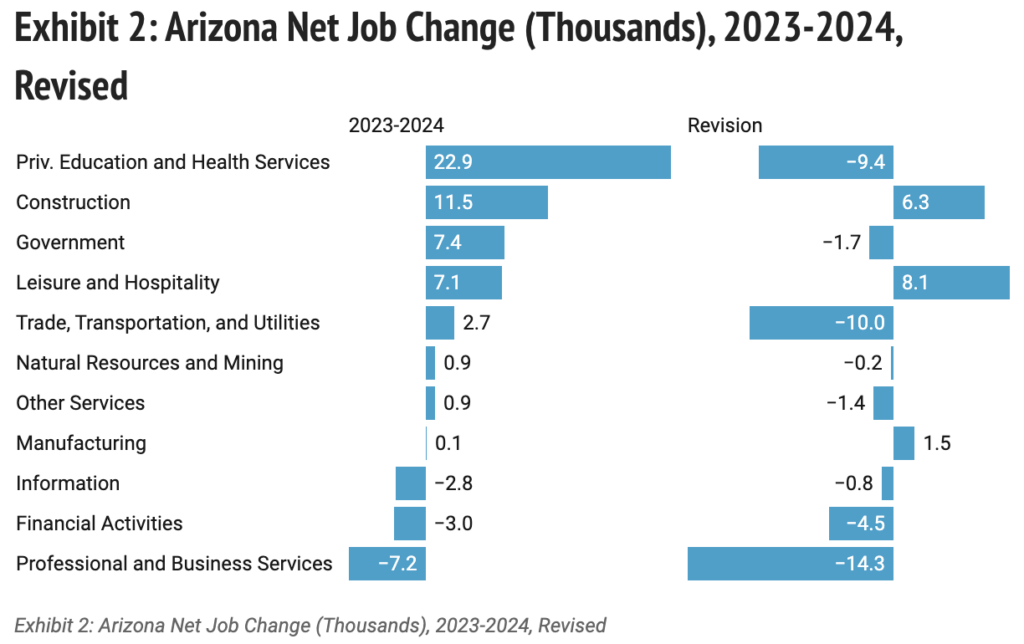

The downward revisions to Arizona job growth in 2024 were not evenly distributed across sectors (Exhibit 2). The largest downward revisions were in professional and business services; trade, transportation, and utilities; and private education and health services. The largest upward revisions were in leisure and hospitality and construction.

Based on the revised data, state job gains in 2024 were driven by private education and health services; construction, government; and leisure and hospitality. Professional and business services; financial activities; and information jobs were down. Manufacturing jobs were roughly stable.

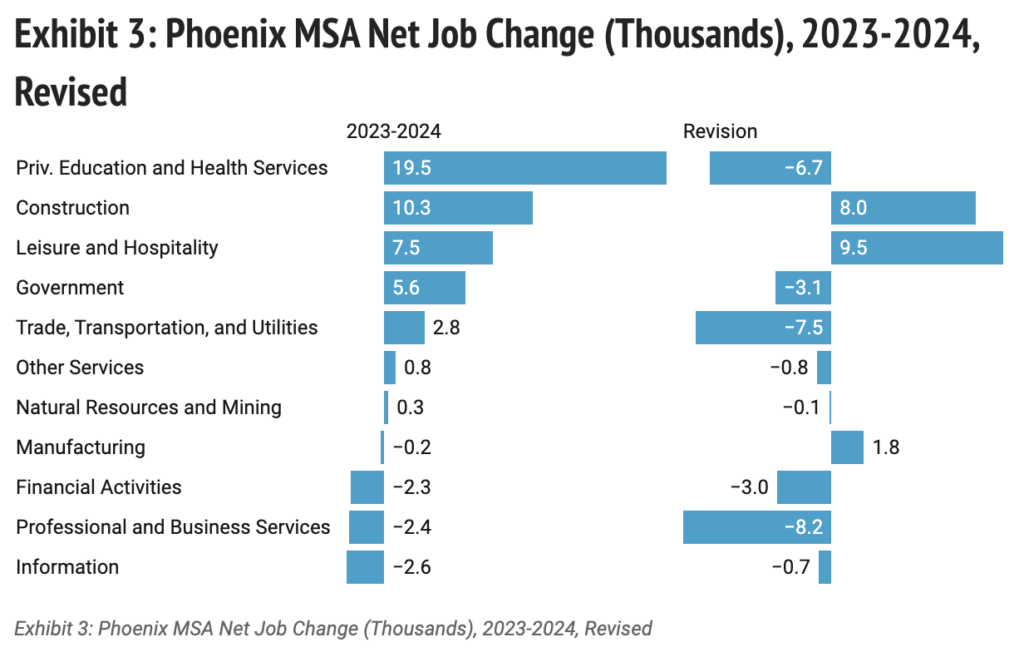

Phoenix MSA job gains were revised down from 49,900 in the preliminary data to 39,200 in the benchmark. That reduced the growth rate from 2.1% to 1.6%.

Exhibit 3 shows over the year job growth by industry in Phoenix and the revisions. As for the state, the largest downward revisions were in professional and business services; trade, transportation, and utilities; and private education and health services. Job gains were revised up significantly in leisure and hospitality and construction.

For the year, Phoenix job gains were driven by private education and health services; construction; leisure and hospitality; and government. Jobs were down in information, professional and business services; and financial activities. Manufacturing jobs were roughly stable.

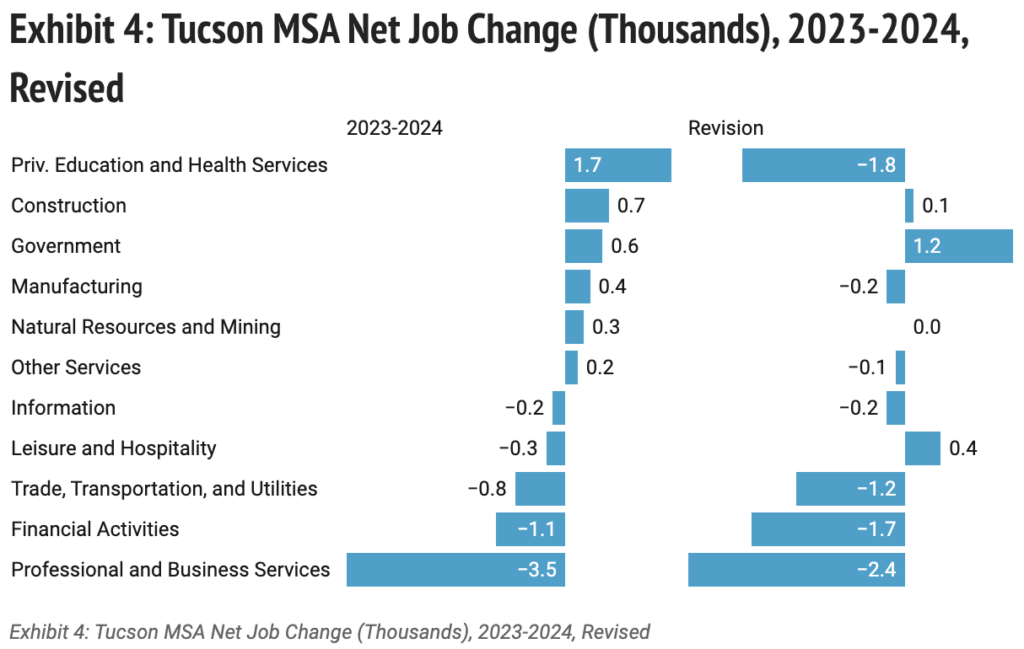

Job growth in the Tucson MSA was revised down as well. In fact, the data now suggest that Tucson lost jobs last year. In particular, the preliminary data suggested that Tucson added 3,600 jobs in 2024. The latest estimates suggest that Tucson lost 2,100. That pulled the growth rate down from 0.9% to -0.5%.

Exhibit 4 shows how Tucson job growth (and growth revisions) were distributed across industries in 2024. Again, the largest downward revisions were in professional and business services; private education and health services; financial activities; and trade, transportation and utilities. Jobs in government were revised up significantly.

The latest data suggest that private education and health services was the main driver of job growth in Tucson last year, with contributions from construction; government; manufacturing; natural resources and mining; and other services. Jobs were down significantly in professional and business services; financial activities; and trade, transportation and utilities.

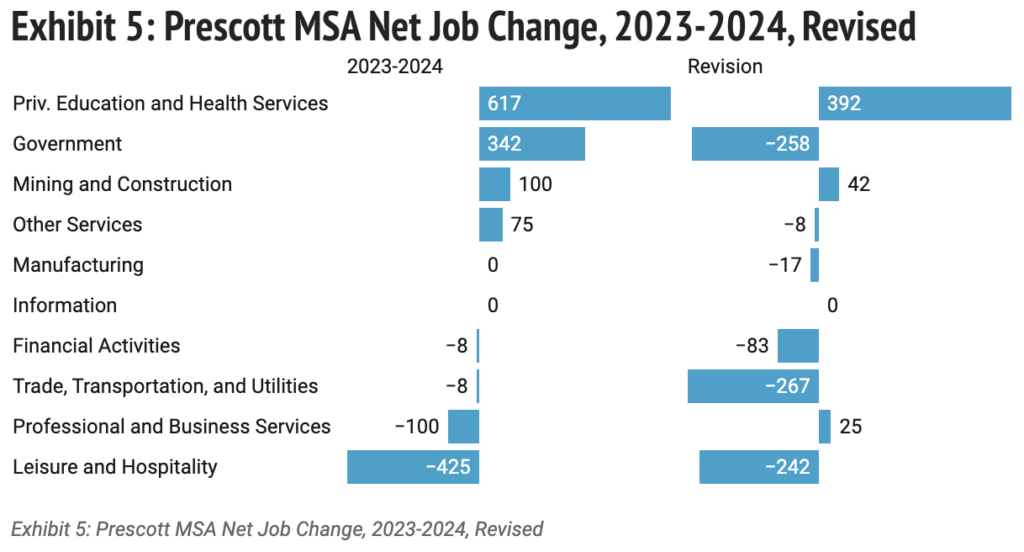

Prescott MSA job gains in 2024 were revised down from just over 1,000 in the preliminary data to about 600 in the revised estimates. That pulled the growth rate down from 1.4% to 0.8%.

As Exhibit 5 shows, job gains were revised up significantly in private education and health services. Job gains were revised down in trade, transportation, and utilities; government; and leisure and hospitality.

In 2024, Prescott job growth was driven by private education and health services; government; mining and construction; and other services. Jobs were down significantly in leisure and hospitality and professional and business services.

If your business or organization requires more timely and in-depth forecast data and analysis, find out about the benefits of joining EBRC’s Forecasting Project and email EBRC director George Hammond at ghammond@arizona.edu.

Author: George Hammond is director of the Eller Business Research Center. If your business or organization requires more timely and in-depth forecast data and analysis, find out about the benefits of joining EBRC’s Forecasting Project and email EBRC Hammond at ghammond@arizona.edu. Copyright 2025 Economic and Business Research Center, The University of Arizona, all rights reserved.