Arizona is one of the most financially challenged states in the U.S., according to new research examining multiple factors relating to the personal finances of residents living in each state.

DEEPER DIVE: Having the money talk? Tips for discussing finances with your partner

DEEPER DIVE: Need to borrow money? Here are 5 alternatives to credit cards

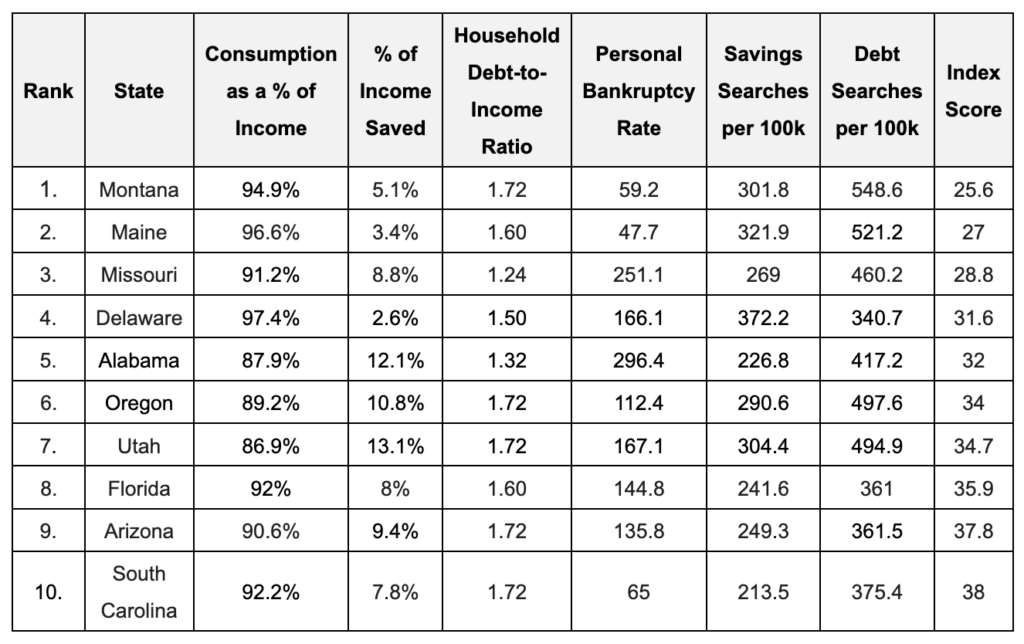

Financial experts at Uplift Legal Funding analyzed six factors relating to the personal finances of each state and scored each one out of 10 to create an Index score for all 50 states.

The factors analyzed within the index included: consumption of annual income as a percentage alongside the percentage of income saved; household debt-to-income ratios; annual personal bankruptcy rates, and the number of saving and debt-related Google searches per state.

Top 10 financially challenged US states

Montana was named the US state most in need of financial assistance, with a score of 25.6 out of 100. At 94.9%, Montana ranked third highest for annual average consumption of income, meaning that residents have less disposable income to save after financing essential living expenses. It appears, however, that residents in Montana are still Googling for ways to save money – at 308.1 searches per 100,000 residents, despite using 94.9% of their annual income on average. At 1.72, Montana also ranked joint third (alongside eight other states) for the highest for household debt-to-income ratio, meaning that residents’ debt is significantly higher than their annual earnings. This is reflected in the high number of debt-related searches on Google. At 548.6 searches per 100,000 residents, Montana ranked second highest for Google searches relating to debt.

The second state in need of financial assistance was Maine, with a score of 27 out of 100. At 96.6%, Maine ranked second highest for annual average consumption of income, leaving residents with only 3.4% of disposable income to save. Residents living in Maine were also more inclined to search for ways to save money (321.9 searches per 100,000 residents). Maine also ranked third highest for debt-related Google searches, at 521.2 searches per 100,000 residents. Interestingly, however, Maine had the third lowest personal bankruptcy rate of 47.7 per 100,000 residents.

Missouri came in third, with a score of 28.8 out of 100. Despite having a household debt-to-income ratio of 1.24, which was lower than most other states, it had the second highest personal bankruptcy rate of 251.1 per 100,000 residents. Apart from Alabama, which ranked first, residents in Missouri filed for bankruptcy more than any other state. At 91.2%, Missouri ranked ninth for annual average consumption of income, leaving residents with an average of 8.8% of income to save.

With a score of 31.6 out of 100, Delaware ranked fourth for the US states most in need of financial assistance. At a staggering 97.4%, Delaware ranked first for annual average consumption of income, leaving residents with a meagre 2.6% of disposable income to save. This likely explains the high volume of saving-related Google searches in Delaware, at 372.2 searches per 100,000 people.

Alabama is the fifth state in need of financial assistance according to the data, with a score of 32 out of 100. Despite residents consuming an average of 87.9% of their income, Alabama ranked first for personal bankruptcy rate. At 296.4 per 100,000 residents, there were more bankruptcies in Alabama than in any other state. It was also the fourth least likely state to Google ways to save money, at 226.8 searches per 100,000 residents.

Ranking sixth for the US states most in need of financial assistance was Oregon, with a score of 34 out of 100. Despite having a lower annual average consumption of income than other states, Oregon ranked joint third for household debt-to-income ratio. It was also the fourth most likely state to Google ways to alleviate debt, at 476.6 searches per 100,000 residents.

In seventh place was Utah, with a score of 34.7 out of 100. It had the twelfth highest personal bankruptcy rate of 167.1, and the third highest debt-to-income ratio of 1.72. This is reflected in its high number of debt-related Google searches, of which Utah ranked fifth, at 494.9 searches per 100,000 residents.

Florida ranked the eighth US state in need of financial assistance, with a score of 35.9 out of 100. At 92%, it ranked seventh highest for annual average consumption of income. Despite saving a mere average of 8% income, Florida was the tenth least likely state to search for ways to save money, at 241.6 searches per 100,000 residents. At 1.60, it also ranked fourth for household debt-to-income ratio.

Arizona came in ninth, with a score of 37.8 out of 100. At 90.6%, it ranked eleventh highest for annual average consumption of income, leaving residents with an average of 9.4% disposable income to save. Arizona had a household debt-to-income ratio of 1.72, placing it third.

In tenth place came South Carolina, with a score of 38 out of 100. It was the state with the least amount of Google searches for saving money, at 213.5 searches per 100,000 residents. At 92.2%, it ranked sixth for annual average consumption of income, leaving residents with 7.8% of disposable income to save.

The states with the highest debt-to-income ratios were Hawaii and Idaho at 2.06, followed by Maryland at 1.84. North Dakota was the state with the most Google searches for both saving-related terms, at 545 searches per 100,000 residents, and debt-related terms, at 550.5 searches per 100,000 residents.

A spokesperson for Uplift Legal Funding said: “Consumer debt levels saw an annual increase of 7% last year. The largest percentage increases were for personal loans, where total balances increased by 18.3%, and credit card balances, which increased by 16%.”

“In the current economic climate, it is to be expected that US citizens are turning to search engines like Google to better discover ways to alleviate debt and save money faster. With consumer debt levels rising in line with the cost-of-living and inflation, the research aims to highlight the importance of living within means and creating personal finance plans.”

“Debt can be overwhelming, but there are various steps individuals can take towards alleviating it including negotiating lower interest rates and applying for 0% balance transfer credit cards. It is important not to ignore it.”