Arizona’s historic mining industry is among the most abundant on the planet, producing copper, lead and zinc that make the world go round.

Freeport-McMoran, ASARCO, Newmont, Rio Tinto, Taseko, Hudbay, South32, these are the industry giants investing billions of dollars in state-of-the-art operations here. As the demand for metals rises along with the world’s population, Arizona is positioned to reap the economic benefits.

Arizona’s border state, Sonora, Mexico, is a large producer of silver, putting it in a similar position.

Tariff-free trade is essential to their continued viability, Harry “Red” Conger, president and chief operating officer-Americas for Freeport-McMoRan, Inc., told a large crowd of business leaders and policy makers at the 60th Anniversary Summit of the Arizona-Mexico Commission (AMC) in Phoenix.

Under the free trade agreement, the North American Free Trade Agreement (NAFTA), Arizona and Sonora have developed extensive supply chains across both borders that provide jobs and revenue for communities, he said.

“I’m a native son of Arizona, but I think of myself as a regional native. I’ve always been blind to the border,” said Conger, whose father was a mining engineer at a copper mine near Marana. “There’s a lot that goes on in mining in this part of the world that moves back and forth across the border.”

Supply chains support local economies

Conger was a speaker at the AMC Summit along with Arizona Gov. Doug Ducey and Sonora Gov. Claudia Pavlovich who spoke about “The Future of North American Trade.” Their primary message was to urge ratification of a new open trade agreement, the United States-Mexico-Canada Agreement (USMCA), that will replace the outdated NAFTA and bring it into the modern, digital age.

CEOs, trade officials and policymakers came together at the event to strategize and collaborate on cross border initiatives to promote economic development in 16 areas including mining. AMC’s mission is to improve the economic prosperity and quality of life for residents through public-private collaborations in advocacy, trade, networking and information.

Preserving free and open trade between the three countries is a primary goal of the commission this year. Expansion and modernization of border crossings to increase international commerce is another.

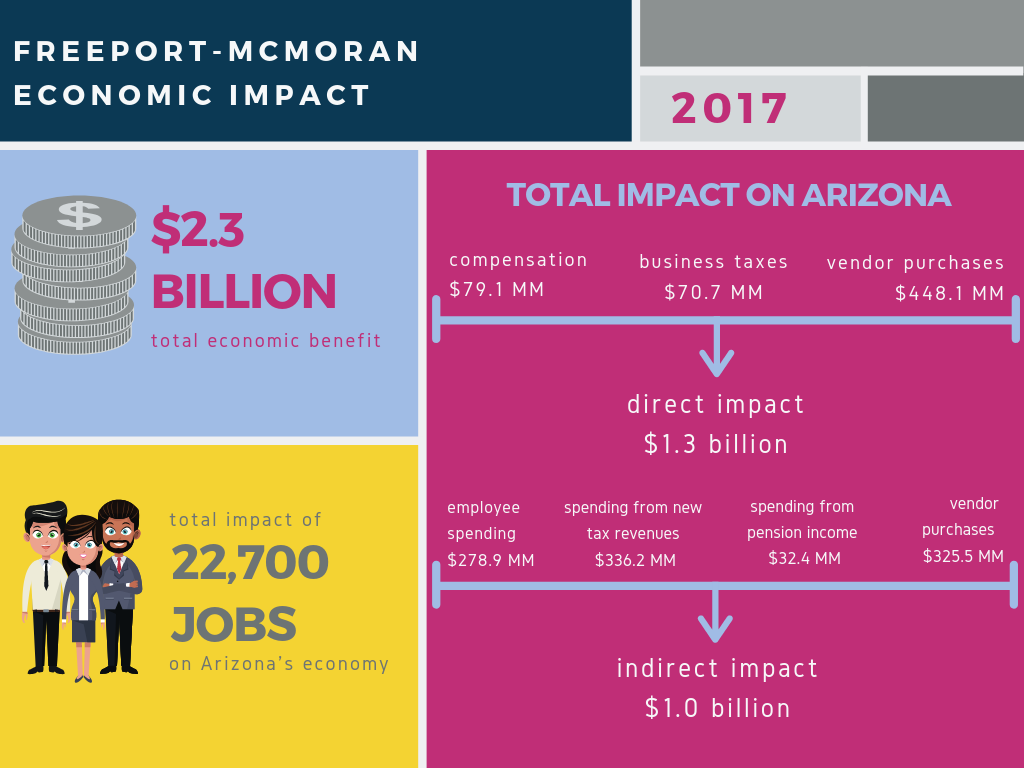

Freeport-McMoran, which generates $2.4 billion in direct and indirect revenues to the state and 22,700 direct and indirect jobs, benefits from NAFTA, and currently is exploring mining opportunities in both states.

“We’re very optimistic that we’ll have more mining operations in the region and we’d like for some of those to be on the other side of the border,” Conger said. “We are an international entity. We are a free trader and very much support everyone’s efforts for a new trade agreement.”

New mining projects in Arizona

Freeport is one of 27 major mines in Arizona that account for a $4.87 billion impact on the Arizona economy and 51,800 direct and indirect jobs, according to the Arizona Commerce Authority.

A number of new mining operations have announced new and planned projects including:

Hermosa-Taylor Project South32, an Australian Mining Company, purchased the $2.3 billion project to develop a state-of-the-art underground mine in the Patagonia Mountains near Nogales. It will mine lead, zinc, and silver. Once completed, the mine is expected to impact over 3,000 people in the state of Sonora and Arizona through employment opportunities, economic stimulus, and production.

Florence Copper Mine Parent company Taseko Mines commenced operations this year at its new in-situ copper recovery facility in Florence. The commercial life of the project is expected to be 25 years. Arizona would receive an economic uplift of $3.4 billion with $2.1 billion remaining in Pinal County.

ASARCO completed a $229-million modernization of the historic Hayden copper smelter. Owned by Grupo Mexico, the mine has restarted operations. The smelter employs 560 and contributes about $122 million annually to the economy.

Freeport McMoRan Inc. is completing a $250 million modernization of equipment at the historic Miami smelter near Globe. The Miami mining operation employs 760 and has an annual economic impact of about $267 million.

Resolution Copper has spent $40 million cleaning up a hundred-year old mining site before it starts construction on a mine that will be the largest in North America. Owners Rio TInto and BHP have invested over $2 billion in developing the project since 2004 and are entering the final permit stage.

Excelsior Mining Corp. announced that it has been issued the first new copper mine permit in Arizona in over a decade. The federal Environmental Protection Agency issued an operating permit for in-situ recovery mining for the Gunnison Copper Project between Benson and Willcox.

This story was originally published at Chamber Business News.