If you’re getting a paycheck and you’re a cautious employee then you know it has a dedicated section called ‘deductions’. Being an employee, you should know your deductions just as curiously as your gross pay. This will help you better understand the net pay.

What are payroll deductions?

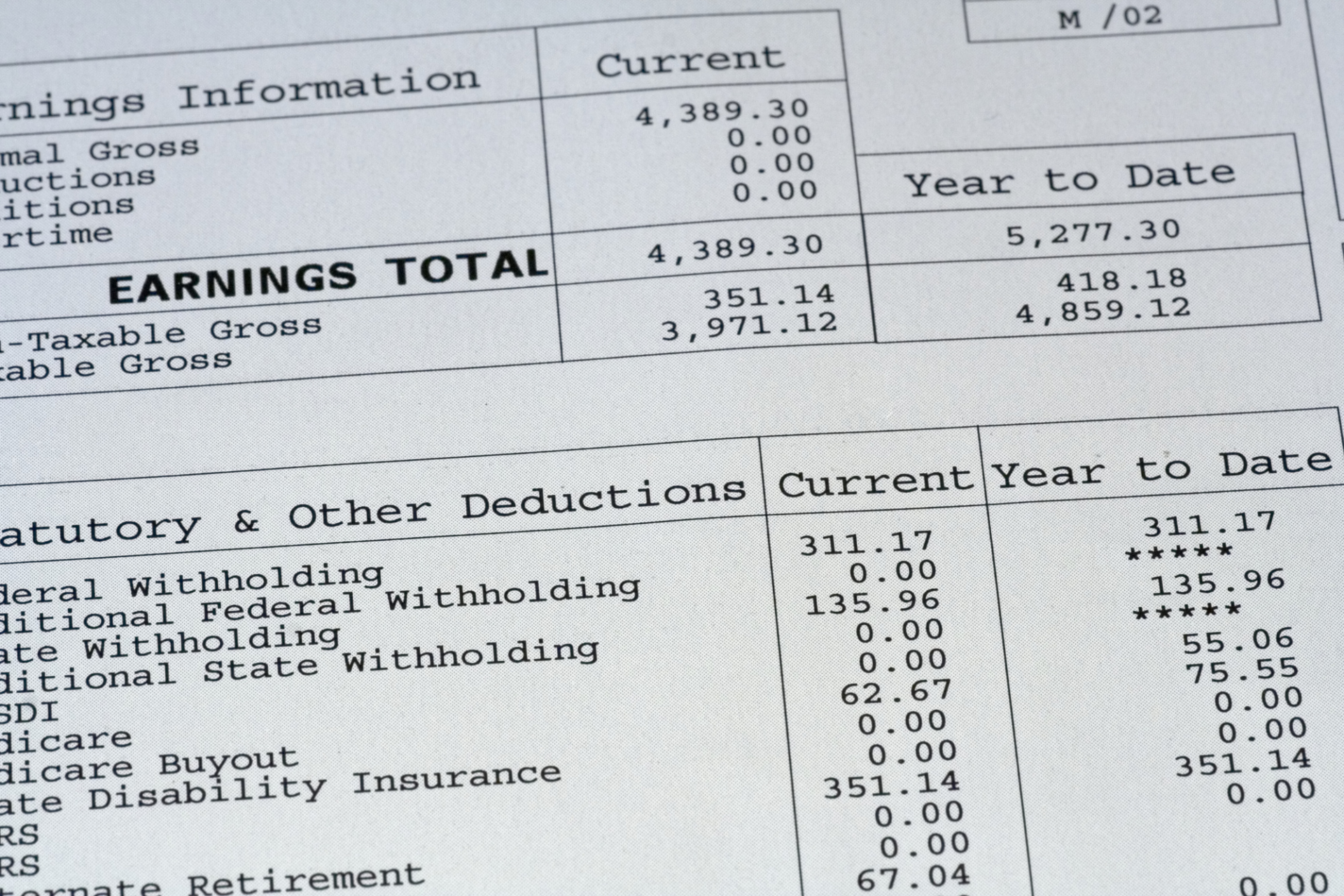

Payroll deductions are nothing but the wages withheld from the employee’s gross earnings for benefits, garnishments, and tax payments. For instance, your employer may deduct FICA-Medicare, FICA Social Security, Federal Tax, and State Tax. Generally, these deductions are displayed on the right side as you create a paystub.

Meanwhile, you should know that only employees are liable for these deductions and not independent workers. Moreover, the deduction amounts for the respective purpose could differ according to the state you’re working in.

Are all payroll deductions mandatory?

Surprisingly, not all payroll deductions are mandatory. You may opt-out if you’re not interested in some deductions. The latter ones are known as voluntary deductions.

So, which are mandatory deductions & which are voluntary? It’s your responsibility to learn about them both so you know what’s going on with your paystub.

Do you know? If your employer fails to follow the law mandatory deduction can be imposed with fines. Employees have the right to file lawsuits and they’re at the risk of going out of business if they do injustice with your deductions.

Mandatory Payroll Deductions

Here are the taxes mandatorily deducted from your paycheck:

• State tax

• Federal income tax

• Social security tax

• Medicare tax

Learning about these mandatory deductions isn’t enough. You should keep up with the changing guidelines by IRS so that you know if the right percentage is being deducted from your pay. In case you want to figure out yours then try the paystub generator.

Voluntary Payroll Deductions

No law permits employers to deduct amounts from your payroll voluntarily. But, many employers deduct amounts as per the convenience of the employee. No wonder these voluntary deductions are for the employee’s benefit only.

The voluntary deductions are also reflected on the paycheck just like mandatory ones. For example, if your employer deducts health insurance, vision or dental insurance, or retirement contributions then the respective amounts will be visible. Also, these deductions don’t benefit the employer but the employee. It’s like the employer deducts this on your behalf for your benefit only.

Some employers pay the basic insurance coverage for the employee. However, if the employee is willing to extend the benefits with more coverage for their family then they have to pay for it. So, make sure that you know what amount is deducted for what purpose.

When to reach out to your employer?

If your employer uses a paystub maker then be assured that your bonus and deductions will be reflected accurately. You can see what amounts are being deducted and for what through the ‘deductions’ section in your paycheck. In case your employer is making deductions you didn’t sign-up for then contact your HR department for help. You can ask them not to deduct the respective amount in the future.