Third-party vendors keep modern business running—but they also widen your attack surface. According to Verizon’s 2024 Data Breach Investigations Report, a partner or supplier was the most common entry point for external attacks, with 68% of breaches involving a non-malicious human element also involving a third party. This highlights that third parties are a significant factor in the security landscape, often being involved in breaches even when their actions aren’t malicious. Yet many teams still wrangle spreadsheets and signatures for weeks before a new partner can send the first invoice.

Workflow automation changes the calculus. A guided portal gathers vendor data once, routes approvals in parallel, and runs risk checks from the very first click. In the pages ahead, you’ll see five automation tactics that can slash onboarding time by half while hardening compliance and supplier trust.

LOCAL NEWS: Phoenix housing market outpaces national trends again in 2025

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

The hidden costs of manual vendor onboarding

Manual onboarding looks simple: a spreadsheet here, a few emails there. Manual vendor onboarding processes can be notoriously slow and costly. A 2023 study by the Levvel Research (now part of PayStream Advisors) found that for organizations with mostly manual processes, it takes an average of 25.6 days to onboard a new supplier. Furthermore, PayStream Advisors estimates that the internal cost to onboard and manage a single supplier can be as high as $250, a figure that automation can significantly reduce.

Why does it hurt? Every relay creates idle time. Your finance team re-keys a tax ID, legal hunts for an insurance certificate, and IT waits for a security questionnaire. A single transposed digit can bounce payments for days, and critical checks (sanctions, cyber insurance) disappear when documents sit in inboxes.

Regulators now expect proof that you vetted vendor identity, financial health, and security posture before paying the first dollar. If evidence hides in scattered email threads, showing diligence turns into a scavenger hunt that can end with five- or six-figure fines.

Agility slips away, too. Stalled approvals delay product launches and campaign kick-offs. In fast markets, waiting “a quarter of the quarter” to activate a partner costs competitive edge. Vendors feel the friction and may redeploy their A-team or walk away if onboarding drags.

Bottom line: manual onboarding isn’t simple paperwork; it quietly drains money, compliance headroom, and supplier goodwill every idle day.

Why workflow automation is the new benchmark

Automation is more than a time saver: it turns vendor onboarding into a built-in control system.

Speed with proof. Switching from email threads to a guided portal trims cycle time by about 60 percent, cutting the typical onboarding window from 60 days to 24, according to Zapro’s mid-market study. Tasks run in parallel, and the platform automatically pings the next reviewer, so no file waits in limbo.

Accuracy that enforces policy. The workflow pauses until the tax ID checks out, the insurance certificate is current, and the security questionnaire is complete. Automation is a key factor in reducing payment errors. The Association for Financial Professionals (AFP) found in its 2023 Payments Fraud and Control Survey that 71% of organizations have adopted automated controls such as bank account validation services to mitigate payment fraud risks. This shift towards automation helps ensure accuracy from the start, minimizing the need for costly and time-consuming rework.

Risk checks from the start. Every supplier record is screened against sanctions and watch-list feeds. Zapro data shows that automated bank-account validation can shrink fraud exposure by 80 percent. High-risk hits trigger extra scrutiny, while low-risk vendors glide through.

One shared view. Finance, legal, security, and sourcing all work from the same real-time dashboard, so bottlenecks surface instantly instead of sparking “who owns this?” email chains.

A vendor-friendly lift. Clear status updates reassure suppliers and let them start delivering value weeks sooner, momentum that compounds with every new project.

When speed, accuracy, risk control, and supplier goodwill rise together, automation shifts from a nice extra to the baseline your team will expect.

Strategy 1: Centralize and digitize the vendor onboarding process

Everything good in automation starts with a single source of truth.

When your vendor data lives in one portal, every stakeholder sees the same record in real time. You avoid “latest version” scavenger hunts and six-thread email chains just to confirm a routing number.

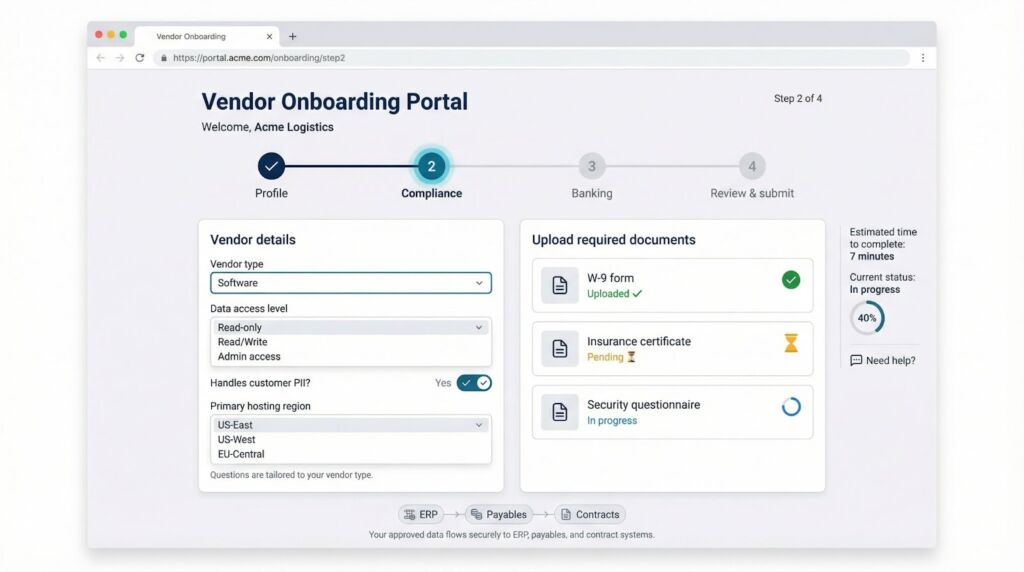

Give suppliers a secure, self-service landing zone. They answer adaptive questions—software vendors see security prompts, freight carriers see insurance fields—then upload documents once while a progress bar moves forward.

On the back end, integrations push approved data straight into ERP, payables, and contract tools. Teams often rely on vendor risk management software to standardize these processes, enforce policies, and keep risk reviews from falling through the cracks.

Centralization lifts accountability, too. A shared dashboard shows who owns the next task and how long it has been idle. If legal review stalls, leadership can spot the timer and shift resources before deadlines slip.

Vendors notice. One Zapro client saw supplier satisfaction scores jump 22 points after replacing PDFs with a portal. A smooth first impression builds goodwill, and it often delivers sharper pricing before the first purchase order is signed.

Digitize the foundation, and every other automation benefit stacks neatly on top. AI now reads vendor documents, flags risks, and syncs findings to procurement automatically.

Strategy 2: Embed risk assessment and due-diligence checks early

Speed means little if you let a risky vendor slip through. Modern workflows push diligence to the first click.

The moment a supplier opens the portal, an adaptive questionnaire sizes them up across data access, geography, and financial health. Answers trigger follow-ups: a SaaS vendor fields security questions, while a janitorial firm moves straight to insurance proof.

Behind the scenes, compliance-automation platforms connect those external databases at the field level. SOC 2 platform Vanta, for example, pipes tax-ID validation, sanctions screening, and cyber-rating feeds directly into the questionnaire; its user data shows this setup trims evidence-collection time by 62 percent and cuts the hours spent on vendor-security reviews roughly in half.

Risk tiering keeps effort proportional.

- Low-risk suppliers glide through with basic approval.

- Medium-risk vendors land in a security analyst’s queue.

- High-risk partners trigger executive sign-off or a SOC 2 review; the system enforces those guardrails, so no one has to memorize the policy manual.

Every action writes to an audit trail. If regulators ask how you vetted a cloud provider, one click exports a time-stamped log of checks and approvals, so there is no inbox scavenger hunt.

Early diligence also preserves relationships. Catching a compliance gap before the contract avoids the far uglier scramble after a breach or payment freeze. Vendors appreciate the clarity, and you can sleep better knowing the drawbridge stayed up until the visitor proved friendly.

Strategy 3: Automate approval workflows and cross-team collaboration

Manual onboarding forces reviews to run in series: legal, IT, then finance. Automating approval workflows dramatically reduces idle time. In a Total Economic Impact™ study conducted by Forrester, it was found that the composite organization, based on Ivalua customers, reduced supplier onboarding and management time by 80%, shortening the cycle time to as little as one to five days for most vendors. This allows legal, IT, and finance to conduct their reviews in parallel, eliminating bottlenecks.

Automation cuts the relay. As soon as a vendor submits a complete packet, the system launches parallel tasks: legal reviews the contract, IT vets the security questionnaire, and finance checks banking details. Nobody waits for a baton pass because everyone starts at the same time.

Conditional logic keeps the flow safe.

- Low-risk office-supply vendors follow a fast lane that skips executive sign-off.

- High-risk cloud providers trigger a checkpoint with the CISO.

Rules live on the platform, so they fire the same way every time.

Visibility completes the loop. Real-time dashboards show who owns each task and how long it has been idle; red flags prompt nudges or resource shifts before deadlines slip. Ivalua customers told Forrester that a central dashboard cut onboarding effort per supplier from 72 hours to about 24 and reduced cycle time to one to five days for most vendors.

When your teams can act in parallel, you erase idle time without trimming critical review. You get both speed and safety in a single move.

Strategy 4: Continuous monitoring and ongoing vendor management

Onboarding is not a finish line; risk shifts daily as your vendors change ownership, software stacks, or financial standing. SecurityScorecard found that 98 percent of organizations have a relationship with at least one third party that was breached in the past two years. Ignoring suppliers after the welcome email trades early diligence for long-term blind spots.

Automation widens your sightline. The same platform that screened a vendor on day one can ping threat-intelligence feeds every night. If a supplier’s domain appears in a new breach report or its cyber rating drops a letter grade, the workflow reopens the profile and alerts the right owner, often within minutes rather than days.

Scheduled “health checks” catch quiet drift. Insurance policies expire, certifications lapse, and credit scores wobble. Automated reminders prompt vendors to refresh documents and route overdue items to internal owners. The importance of continuous monitoring is a widely held view among risk professionals. A 2023 report by the Ponemon Institute, sponsored by Bitsight, revealed that 68% of leaders agree that their organization’s third-party risk management program is ineffective. To address this, organizations are increasingly turning to continuous monitoring to gain real-time visibility into their vendors’ security posture, moving away from point-in-time assessments that quickly become outdated.

When risk crosses a red line, the platform runs a playbook: pause new purchases, convene stakeholders, and activate contingency suppliers. These pre-mapped steps cut response time from days to minutes.

Strategy 5: Track Metrics and Continuously Improve

You cannot improve what you do not measure, and vendor onboarding is no exception.

First, pick the numbers that matter. Cycle time from application to approval. First-pass accuracy. Cost per vendor. Compliance adherence. Keep the list short so every metric earns attention.

Next, surface those numbers where people make decisions. Real-time dashboards beat end-of-quarter slide decks. When a graph shows average onboarding creeping past thirty days, teams feel the urgency to fix the choke point instead of explaining it away.

Data also fuels honest retrospectives. If security reviews cause seventy percent of delays, maybe the questionnaire needs a trim or the team needs another analyst. If low-risk vendors sail through while high-risk cases stall—and that’s by design—celebrate the policy working as intended.

Benchmark externally when you can. Industry surveys show top performers onboarding routine vendors in two weeks or less. Stack your trend line against that mark. Falling short builds the case for more automation budget; beating it becomes a bragging right in sales pitches and investor decks.

Finally, let insights loop back into the workflow. Patterns in breach alerts might inspire stricter password policies for new vendors. A spike in document rejections could prompt clearer instructions or template updates. The process evolves instead of ossifying.

Numbers give us clarity, but action turns clarity into progress. Measure, adjust, repeat—until onboarding is not just faster, but smarter every cycle.

Conclusion

Modern vendor onboarding can be more than an administrative hurdle. With centralized data, early risk checks, and parallel approvals, it becomes a reliable control system that protects both speed and security. Continuous monitoring and clear metrics ensure the process keeps improving instead of drifting back into manual chaos.

The payoff reaches every corner of the business. Vendors start delivering value sooner, teams avoid rework, and auditors see a clean trail of evidence. When you treat onboarding as a measurable workflow rather than a stack of forms, each cycle becomes faster, safer, and easier to defend.

Start by automating a single segment, learn from the data, and expand step by step. Over time, you build a program that strengthens trust, reduces exposure, and sets a new benchmark for how your organization manages third parties.

FAQs

What is workflow automation in vendor onboarding? Workflow automation uses rules based, digital processes to move vendor information through identity checks, risk reviews, and approvals without manual chasing. Instead of emailing spreadsheets and PDFs, vendors submit data through a portal that routes tasks to finance, legal, security, and procurement in a consistent, trackable way.

How does automation reduce vendor onboarding time? Automation eliminates idle time between hand offs. Tasks run in parallel, reminders trigger automatically, and approvers work from a single shared view. This typically cuts cycle time by 50 percent or more, especially for routine vendors that can move through a fast lane with predefined rules.

What risks does automated onboarding help control? An automated workflow enforces checks that are easy to skip in a manual process. Sanctions screening, bank account validation, cyber and financial risk scoring, and insurance and certification review all happen in a consistent way. High risk vendors are routed to deeper review, while low risk vendors follow a lighter but still compliant path.

How does continuous monitoring fit into vendor onboarding? Onboarding is the starting point for a longer life cycle. The same platform that runs checks on day one can keep watching vendors for changes in breach exposure, expired documents, or downgraded security ratings. When a threshold is crossed, the system reopens the vendor record, alerts owners, and triggers predefined playbooks.

Where should teams start if their current process is mostly manual? A practical starting point is to map the current onboarding steps, identify the biggest bottlenecks, then digitize a single vendor segment, such as low risk or low spend suppliers. From there, you can integrate with ERP and payables systems, add risk data sources, and gradually expand automation to more complex vendor types.