Providing pay stubs for employees is one of the best things you can do as a business owner.

Pay stubs are documents that show how much an employee earns over a pay period. This is useful because they can use them for recordkeeping and as a form of proof of income.

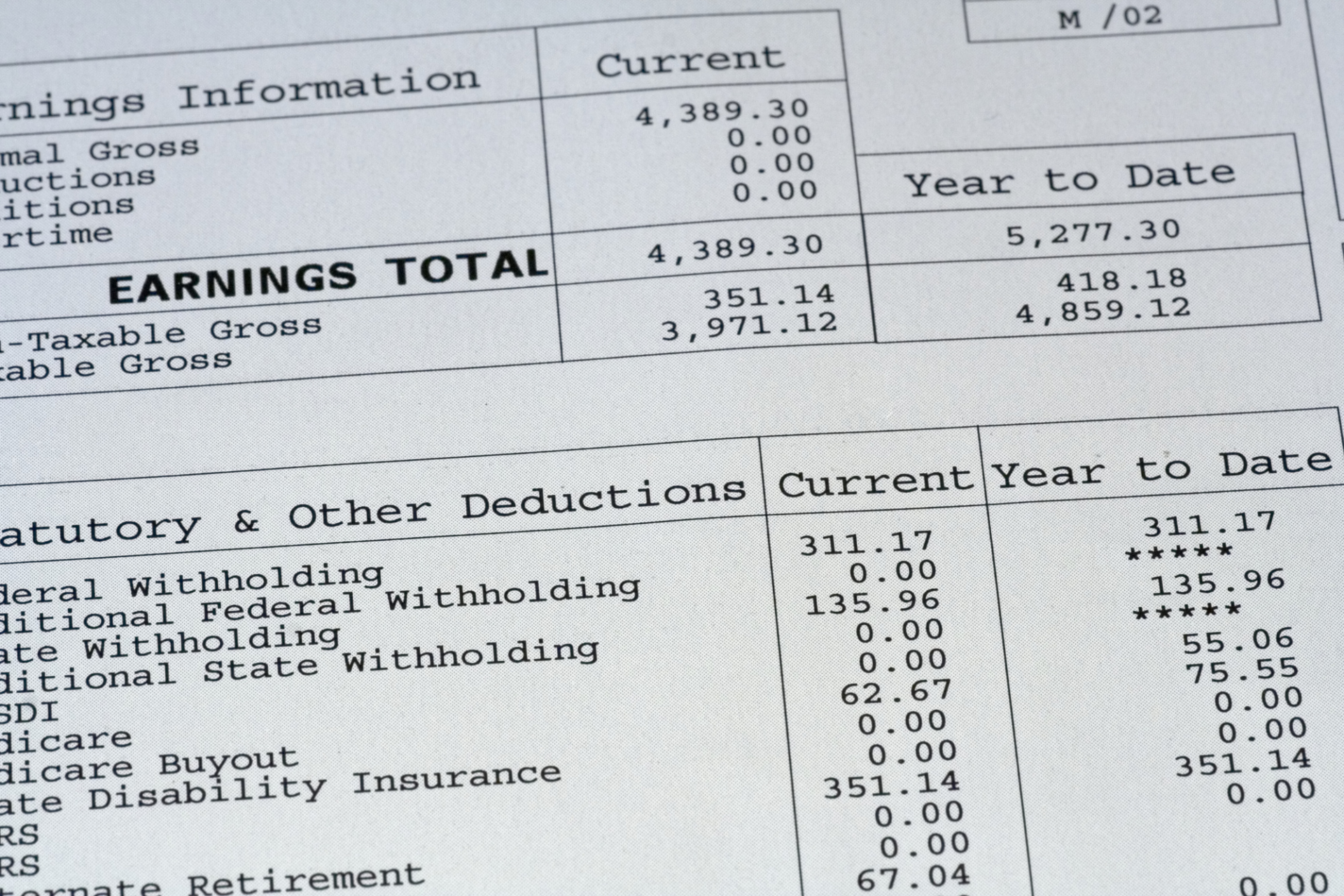

You’ll find several pieces of important information on a pay stub, including how much an employee’s earned, where they work, and who the employer is. Every time you pay your employees, you should give them pay stubs. But where do you start?

Read on to learn how to create pay stubs for employees!

What Pay Stubs Are Used For

Pay stubs are some of the most common documents used by those that are trying to prove their income or track their finances. A pay stub can be used as legal proof of income, providing that all of the information on it is correct.

Employees usually get pay stubs from their employers when they’re paid. However, independent contractors or those who don’t get them from their employer will need to make them manually.

With a pay stub, your employees can use it to help them get the following:

• Mortgage

• Auto loan

• Credit card

Almost all loans can be applied for by using pay stubs as your proof of income. When you start making them, you’ll want to bring several with you so that the lender can look deep into your financial history.

How to Make a Pay Stub

Understanding how to make your own check stubs will benefit you in several ways because it’ll be more personalized. If you get pay stubs from an employer but have a side gig, you’ll want to make pay stubs for the side gig to keep your finances organized.

Making a pay stub isn’t a difficult process, but you’ll need to be ready to make several calculations. Aside from that, you must choose a program that you’ll use to make them. You can use the likes of a paystub creator, as making a pay stub yourself lets you choose exactly how it looks.

Gross Pay

When someone says they make $50,000 a year, they’re most likely referring to their gross pay. Your gross pay is the money that you earn in a pay period. So if you earn $10 an hour and work 40 hours per week, your bi-weekly gross pay would be $800.

Coming up with your gross pay will be a lot easier if you have a certain salary because you’ll already know the number. Those who work hourly will have varying gross pay depending on how much they’ve worked in a pay period.

Keep in mind that things like taxes won’t be included in your gross pay, as this is the number you get before deductions.

Deductions

A deduction is anything that is taken out of your pay. Social Security taxes, state taxes, and local taxes are all deductions. If you have a retirement plan, the money that’s taken out for it will also count as a deduction.

Deductions can be tricky to calculate because some areas don’t charge local taxes. Take a look at the IRS Employer’s Tax Guide to find out if you have to pay local taxes where you live.

On the pay stub, you must list out each deduction and how much money is going into it. Ensure that you keep the deductions separate, so don’t combine state and local taxes.

Net Pay

Your net pay is the amount of money that you take home (after deductions are made). To come up with this, just subtract all of the deductions from your gross pay. If you work for an employer, this will be the number you see on your paychecks.

Choosing a Program to Make Them

Whether you’re trying to figure out how to create pay stubs for employees or yourself, you’ll need to choose a program that gives you the tools to make them. Those who aren’t tech-savvy can opt for a pay stub maker that will automatically generate templates for them.

Anyone who wants more control over how their pay stubs look can go with either Microsoft Excel or Google Sheets. Both of these offer similar features but have minor differences that make them unique.

Microsoft Excel is an entire program dedicated to creating spreadsheets, whereas Google Sheets is a part of Google Drive, which has several office tools. The main benefit of using Excel is that you get access to a plethora of tools, though most of them aren’t useful for making pay stubs.

With Google Sheets, you can use most of the tools that Excel provides. When it comes to making a pay stub, this option may be better because all of the documents are stored via the cloud. This lets you access your pay stubs from any device without having to store it on physical storage.

Start Making Pay Stubs for Employees Today

Now that you know how to make paycheck stubs for free, all you need to do is get started. Whenever you pay employees, ensure that you provide them pay stubs with each check. If you can, give them access to a computer in which they can print the stubs out themselves.

When you make pay stubs for employees, you’ll need all of the information to be correct so that they can legally use them. If the info isn’t correct, they’ll have problems when they try to apply for loans and other things.

Browse our articles to learn more about business and other topics.