Cushman & Wakefield today released new research on the challenges and factors driving onshoring and nearshoring, finding that while nearshoring and reshoring activities have increased from both businesses and governments, the manufacturing resurgence is facing significant headwinds in achieving meaningful impact.

LEARN MORE: How Pinal County became a magnet for manufacturing development

“Disruptions to supply chains across the world have been the norm over the past three years, bringing the impacts of globalization and the importance of well-functioning supply chains into sharper focus. Not just an operational or financial headache for businesses to contend with, the disruptions grew so deep that consumers also felt them acutely,” said David Smith, Head of Americas Insights.

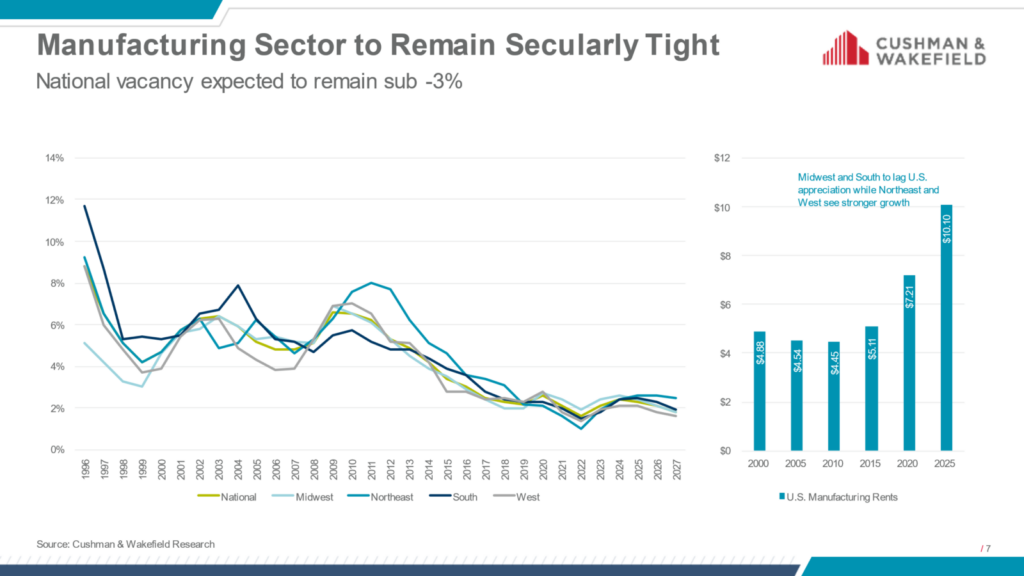

With the revived effort to begin reshoring and nearshoring manufacturing to and toward the U.S., the composition of real estate will need to change. Currently, manufacturing vacancy makes up 10.3% of the country’s total available space. With only 80 msf of space currently under construction, of which half will be owner-occupied and 25% is non-owner-occupied build-to-suit, this is not likely to improve anytime soon. Tight leasing market conditions will be an issue for occupiers who have not already secured their facilities.

“Both governments and the private sector became more aware of the economic, financial and social impacts that disruption to supply chains can have — along with increases in protectionism that predated the pandemic — and the increased emphasis placed on sustainable energy supply chains, nearshoring and reshoring considerations have intensified for businesses and governments alike,” said Ben Harris, Senior Managing Director, Logistics & Industrial Services – Americas.

Alongside the real estate component, other parts of the U.S. infrastructure will need to change. Manufacturing requires a lot of power, and many greenfield land sites lack sufficient power to host the manufacturing sites needed. Limited land options for commercial real estate make selecting a new site difficult, but it will be more challenging for manufacturing users. In addition to struggles with power, the American Society of Civil Engineers (ASCE) gave the nation’s infrastructure a grade of C-minus on its 2021 quadrennial infrastructure report card.

In the first quarter of 2023, S&P 500 companies that mentioned “reshoring” during earnings calls were up 128% year-over-year (YoY). Reshoring and foreign direct investment manufacturing job announcements exceeded 360,000 in 2022, a record-breaking 53% increase from 2021. Since 2020, private companies have announced $470 billion in manufacturing and clean energy investments — in addition to the $220 billion already announced by the federal government. These projects and investments are creating new job opportunities, helping to lift manufacturing employment to 13 million as of midyear 2023, its highest level since 2008. That represents only a 1.3% increase from the same period in 2019, compared to a 3.5% increase in employment across all sectors.

Job demand on an absolute basis is strongest in California and Texas, with unique job postings at 24,000 and 17,000, respectively. The Midwest is the region with the largest number of job postings at 66,000, which is up an impressive 28% YoY. This growth rate is only behind the Southeast, which increased 31% YoY. The Midwest continues to be a pillar of U.S. manufacturing employment, but the center of gravity is shifting southward toward the Sun Belt, particularly the Southeast. Much of this is tied to the strong growth in auto-related manufacturing; the 50 metro areas with the highest concentration of employment in auto-related manufacturing are all located in either Southern or Midwest states.

“The U.S. has a long way to go before larger reshoring and nearshoring trends take hold. Manufacturers need to decide if it makes sense to relocate parts or the entirety of an operation and if the U.S. is the right place. As it becomes more possible to diversify supply chains and bring manufacturing back to the U.S., it will be important to consider the state of manufacturing real estate. Working strategically on location, understanding labor needs and the cost of operations and materials will be more important than ever, and the planning should start now,” said Smith.