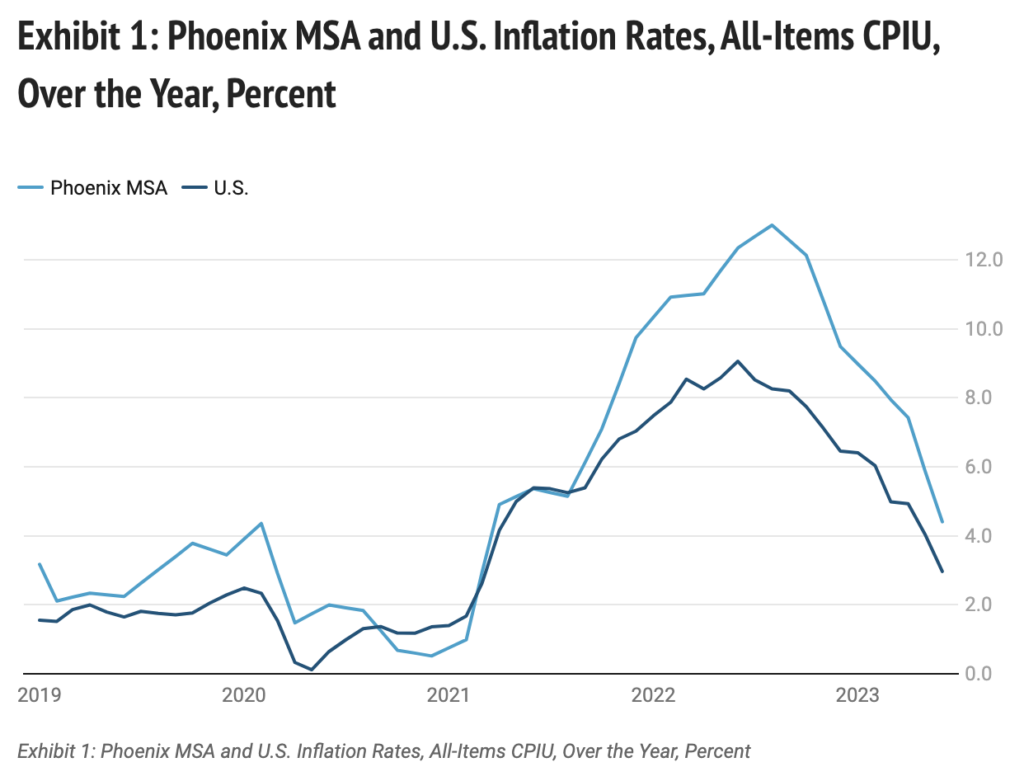

Inflation, measured by the all-items Consumer Price Index for All Urban Consumers (CPIU), in the Phoenix MSA decelerated in June to 4.4% over the year. That was down from a peak of 13.0% in August 2022 but still above the nation at 3.0% (Exhibit 1). The national rate peaked at 9.1% in June 2022.

LEARN MORE: Here’s how captive insurance can boost your bottom line and control costs

Keep in mind that the all-items inflation rate is a weighted average of price changes for goods and services purchased by U.S. urban residents. It includes sales and excise taxes. The importance of a given good or service in a price index is determined by its share of an average household’s budget.

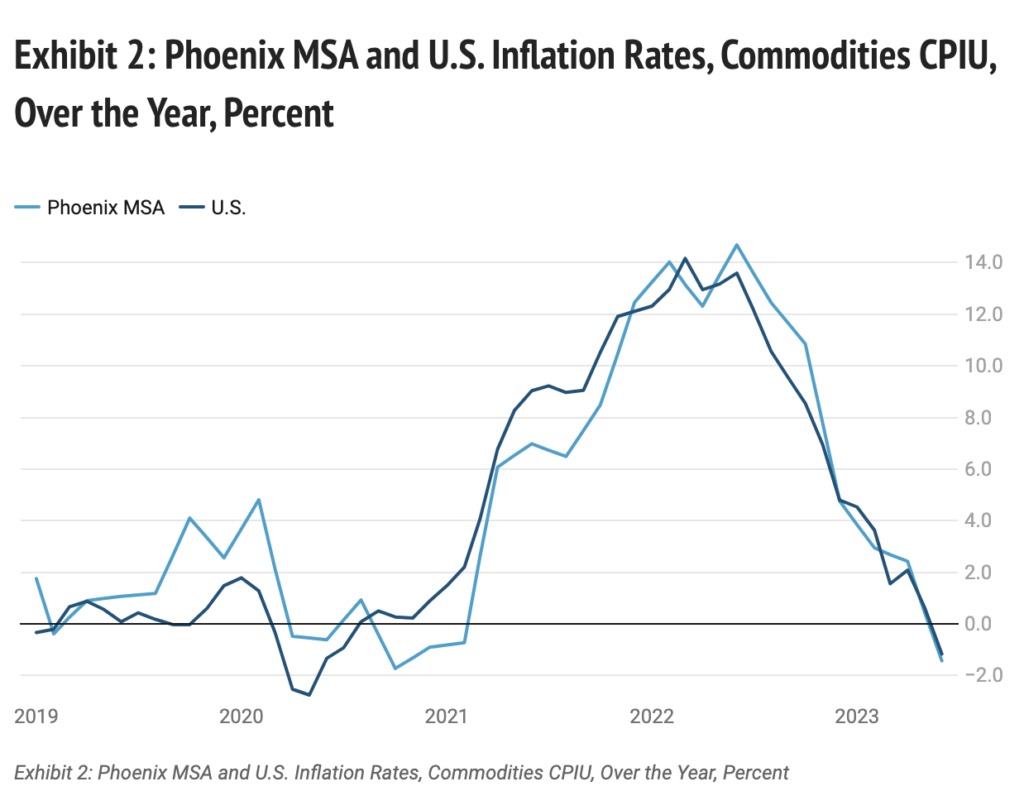

Part of the reason that all-items inflation has come down recently is because commodity inflation has softened significantly. The commodities CPIU for the Phoenix MSA declined by 1.4% over the year in June and the national average dropped by 1.2%. The Phoenix rate is down from a peak of 14.7% in June 2022. The national rate was down from a peak of 14.2%. As Exhibit 2 shows, commodities inflation in Phoenix has been fairly similar to the U.S. Commodities in the CPIU includes tangible products like gas, food, apparel, appliances, furniture, etc. Commodities make up a relatively small share of an average household’s budget.

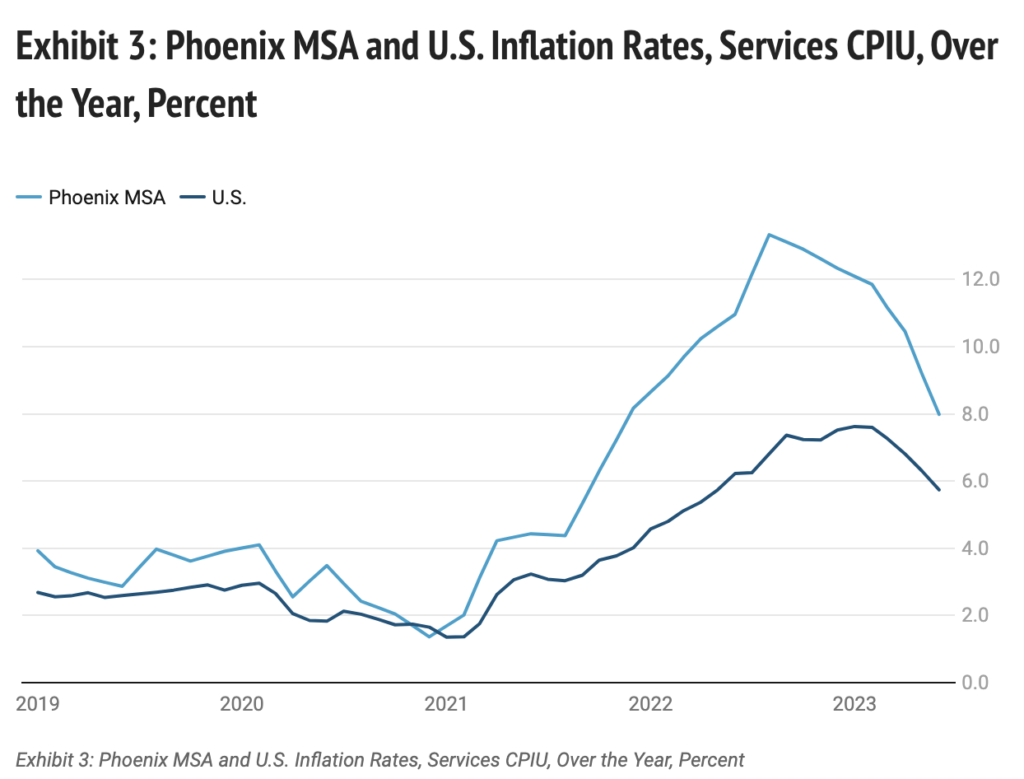

A more important driver of the deceleration in Phoenix inflation has been the services CPIU, which rose 8.0% over the year in June (Exhibit 3). That was down significantly from its peak in August 2022 of 13.3%. Nationally, the services CPIU was up 5.7% over the year in June. Services matter more for the overall CPIU because services make up a much larger share of an average household’s budget. Services include intangible goods like housing, health care, recreation, education, etc.

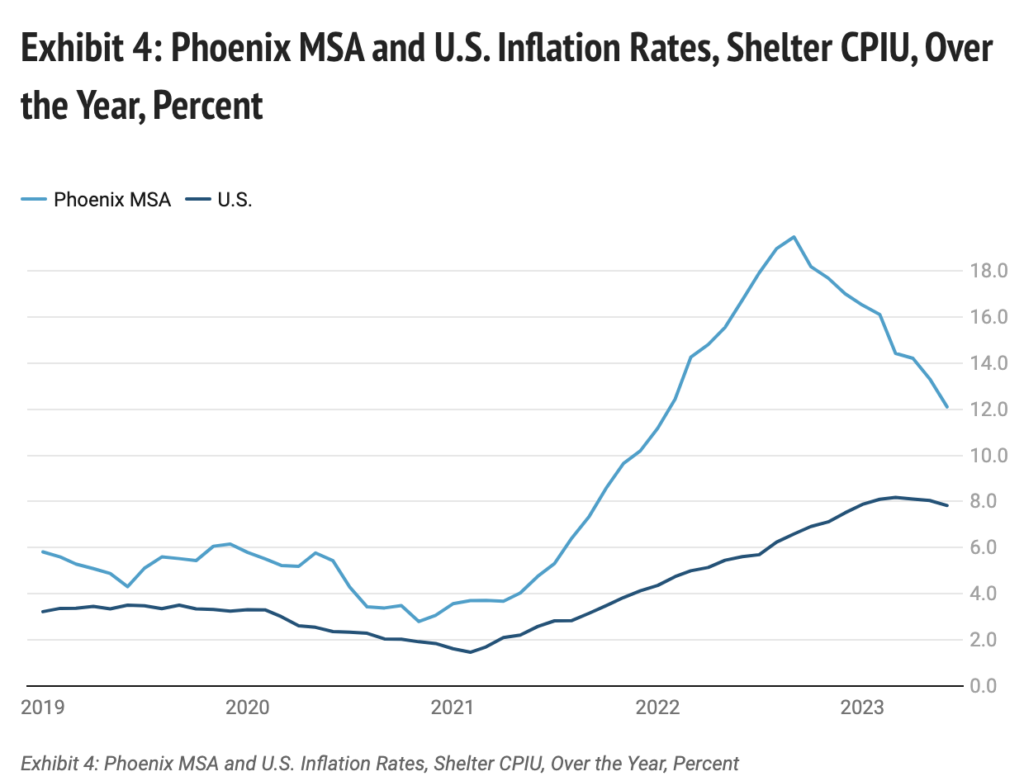

What is driving down services inflation? Shelter. Within the services CPIU, housing is by far the largest component and within housing shelter is the largest sector. Shelter includes both rent and imputed owner-occupied rent, as well as temporary shelter like hotel rooms. Owner-occupied rent is a concept estimated by the U.S. Bureau of Labor Statistics (which publishes the CPIU) to put the costs of home ownership on the same basis as rent.

In Phoenix, shelter inflation peaked at 19.5% in September 2022. In June it was down to 12.1%. That was still well above the U.S. at 7.8% (Exhibit 4). The recent deceleration in Phoenix shelter inflation reflects declining median home prices and slower gains in rent.

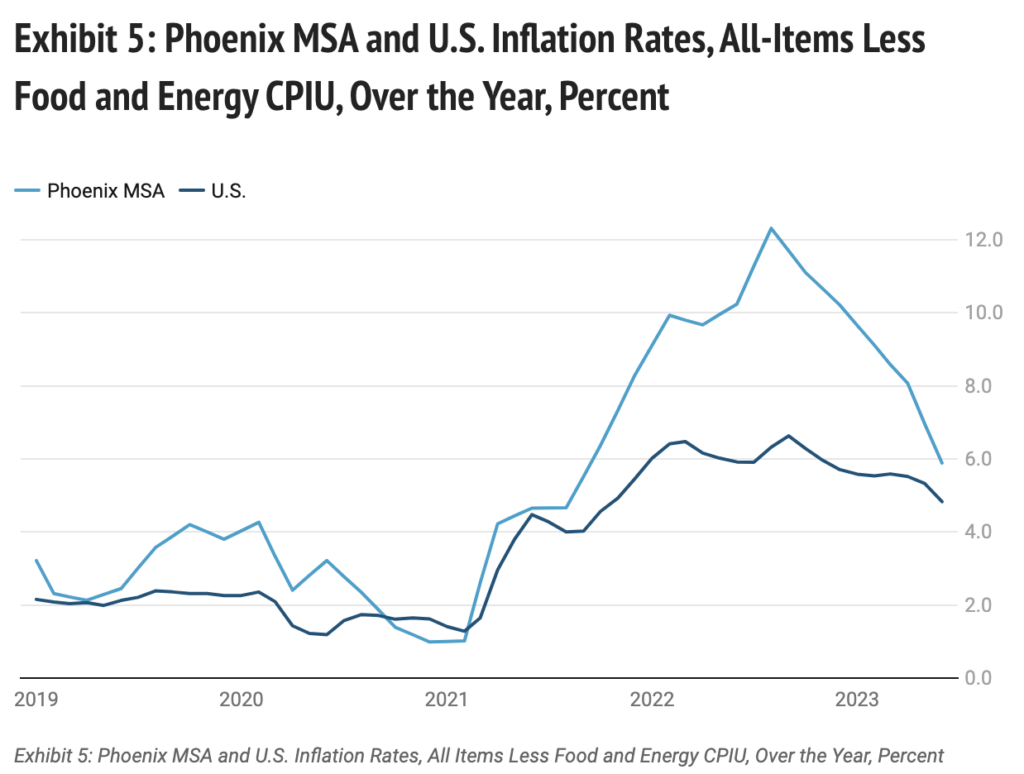

While inflation measured by the all-items CPIU in Phoenix has decelerated rapidly recently, the slowdown has been less rapid for the core index, which excludes food and energy. In June, the core CPIU in Phoenix rose 5.9% over the year, which was down from its peak of 12.3% in August of 2022 but above the nation at 4.8% (Exhibit 5).

Author:George W. Hammond, Ph.D., is the director and research professor at the Economic and Business Research Center (EBRC).