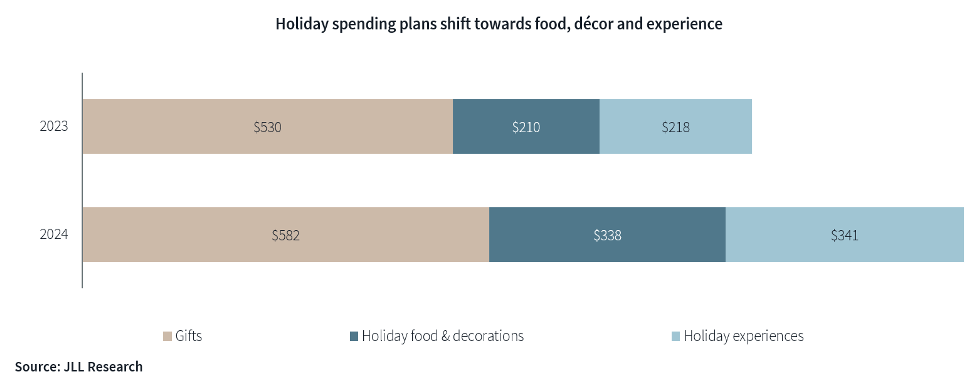

Driven by cooling inflation and the revival of physical storefronts, consumer holiday spending habits will see significant shifts this holiday season compared to 2023, according to JLL’s 2024 Holiday Shopping Survey. After surveying over 1,000 consumers to understand how, when, and where shoppers plan to spend their dollars this holiday season, JLL reveals an expected 31.7% uptick in holiday budgets in 2024, totaling $1,261 per shopper for gifts, holiday food and décor, and experiences.

LEARN MORE: Read the latest consumer and lifestyle news here

How much are you budgeting for holiday gifts, food and décor, and experiences in 2024?

“We’re not only seeing a shift in the amount that shoppers are spending but also what they spend their budgets on, including a focus less on giving and more on living,” said Naveen Jaggi, President of Retail Advisory Services, Americas, at JLL. “With consumers expected to increase their holiday shopping budgets by over $300 from last year, this increase is, in part, due to a 56% uptick in spending on holiday-related experiences, such as dining out or attending a live performance, signaling that shoppers are embracing more than just physical goods this season.”

“Phoenix is the perfect market for this year’s dynamic shopper demand to unfold,” said Ryan Tanner, Senior Associate, JLL. “Our retail and restaurant vacancy rates are near historic lows, below 5% for the Phoenix MSA, and tenants are excited for the holidays. They are ready to capture the Valley’s established – and expanding – base of consumers of all ages.”

Among physical gifts, clothing, electronics and accessories will top the list of items shoppers plan to give others this holiday season. However, gift-giving won’t stop with family and friends this year, as 83% of holiday shoppers plan to also buy a gift for themselves. This is up from 76.2% in 2023, with apparel and electronics topping consumers’ self-indulgent lists.

Stores increase relevance for holiday shopping

Most consumers will interact with physical retail storefronts this year, even more than in 2023, either by shopping in a mall; in an open-air center; picking up curbside or in-store, or a combination thereof. Consumers will also turn to multiple channels to shop, including an increasing reliance on social platforms for holiday gift ideas. Over eight in ten respondents will use social media platforms like Facebook, Instagram, and TikTok to inform 2024 holiday shopping decisions, with TikTok’s e-commerce platform nearly doubling in popularity relative to 2023. While shoppers continue to turn to their digital devices to check gifts off holiday shopping lists, only 12% of holiday shoppers will exclusively order online this season as consumers increasingly prioritize in-store holiday experiences.

“Phoenix’s retail and restaurant atmosphere feeds into these shopping patterns, giving customers a host of environments in which to shop – from high-end lifestyle centers to malls, power centers and historic downtown districts. All of these have popular retailers and restaurants, holiday attractions and decorations to enhance the experience,” said Tanner. “Many of these also have retailers with both an online presence and a physical storefront, creating a plethora of ‘clicks and bricks’ shopping opportunities.”

According to the JLL report, malls have emerged as the top brick-and-mortar destination for 2024, with a forecasted 18% uptick in visits. And for the first time, department stores topped the list of store types where consumers plan to visit for holiday shopping. With over half of consumers (57.9%) planning to visit department stores, this increase correlates with the rise in mall visits overall, where mall shoppers will increase by 18.7% this year.

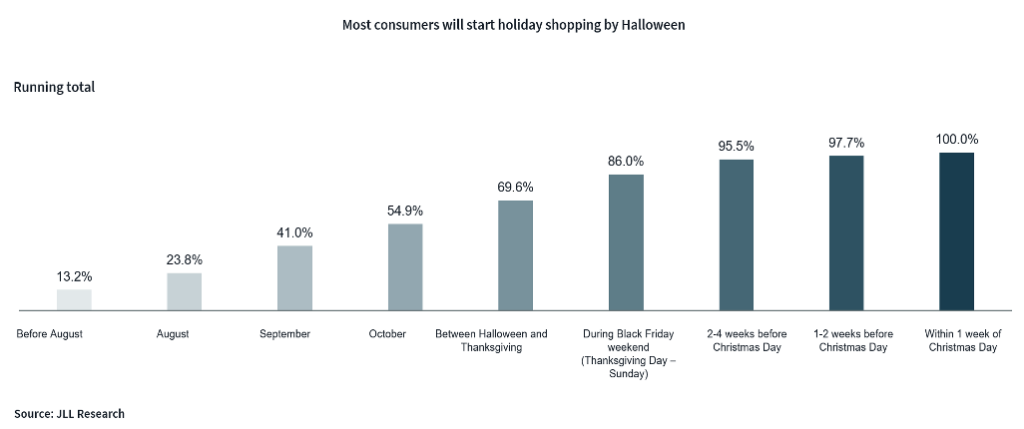

Holiday shopping begins early, but deal seekers will wait for Black Friday

Early bird shoppers have already begun sourcing their holiday gifts, with over 40% of consumers reporting that they started checking items off their lists in September. By the week after Thanksgiving, JLL predicts that the number of consumers that have started shopping will more than double (86%), as consumers open their wallets to take advantage of deal days like Black Friday and Cyber Monday.

When will you start holiday spending on gifts?

Deal days will be particularly of interest to younger shoppers, primarily Gen Z, who are expected to start shopping during Black Friday weekend, while the big spender Millennial cohort (aged 30-44 years) said they would start shopping notably earlier, with 65.5% starting by Halloween. Consistent with the escalated trend of consumers seeking in-store experiences, more shoppers will head to stores on deal days in 2024 than last year, with over 50% of consumers planning to shop Black Friday deals in-store, compared to 39.5% in 2023.