Does the upcoming election matter when it comes to your financial plan? The answer is clear: Yes and no

Market turmoil has been elevated in recent months, and the impending presidential election has many investors asking about the impact the election results will have on their finances, and also what they should do in preparation for the potential outcomes. One broad question has haunted market participants for decades – do elections really matter? Elections certainly have meaning and can matter in a number of ways – but the data also clearly indicates that they may not have nearly as much meaning with regard to the long-term outlook for our financial plans.

MORE NEWS: Discussing politics at work: Tips to manage hot topics

Do elections matter? Yes, elections matter in many ways.

Elections are critical to the proper functioning of any democracy, and elections definitely matter to citizens in a number of ways.

- Supreme Court nominations

- Perhaps the largest social and philosophical area influenced by presidential elections is the subject of Supreme Court nominations. Supreme Court justices are first nominated by the President of the United States and are then ratified by the Senate via simple majority. Therefore, if a particular party has control of the Executive Office and the Senate, upcoming nominations could be influenced in the direction of one partisan view. Given that justices are appointed for life, nominations for empty seats are relatively rare, this is typically not an issue that has serious consequences within the relative short election cycles.

- International trade

- The president can enact many forms of trade tariffs without Congressional approval. Some must eventually pass Congressional approval and others do not have that requirement. Trade tariffs can undoubtedly influence overall economic activity and could cause inflationary pressure throughout the system. However, econometric models suggest that these negative impacts tend be heavily front-loaded, and likely dissipate after roughly one year.

- Immigration policies

- Immigration controls are heavily influenced by the president, and often tend to fall along partisan party lines. Tightening of policies is assumed to increase inflationary pressure (restricting lower wage workers), although the long-term effects on the economy are hard to estimate reliably. The potential negative impacts may be offset by domestic job creation and wage growth.

- Tax policy

- There are long-term historical biases within the two parties regarding their approach towards taxation, with Democrat regimes typically pushing tax rates higher and Republican regimes pushing tax rates lower. Taxes are a very emotional topic for most voters, driving a fair amount of “single-issue” voter behavior.

- Regulation

- Appetite for federal regulation falls quite clearly along partisan party lines. A Republican sweep in the elections is presumed to be associated with lower regulation in coming years, which many believe to be a “pro-growth/ pro-business” environment.

- Social programs

- The Democratic party has a clear history of favoring larger and more social programs, and a Democratic sweep would almost certainly be associated with increased federal spending on such programs.

- Fiscal policy and the deficit

- At this time, neither party appears to be proposing policies that will result in anything other than larger budget deficits and rising debt burdens for the U.S. in coming years. A Democratic sweep would likely result in rapid expansion of spending programs, and a Republican sweep would likely entail lower taxes – both situations that will increase deficits. Neither party is proposing the types of austerity required to achieve budget surpluses (or even balanced budgets), so deficits seem to be a foregone conclusion for the foreseeable future. A clean sweep of both the White House and Congress by either party would likely lead to a more dramatic increase in the deficit and our debt burden. Split election results will lower the impact, but deficits are expected to grow regardless of the balance of power in Washington.

Do elections matter for my financial plan and investment strategy?

Despite the numerous ways in which elections matter for voters, the preponderance of evidence suggests that election outcomes should not weigh on our long-term financial planning strategies. In the short-term, election cycles can impact how the financial markets behave. Long-term data clearly indicates that election years tend to be associated with elevated volatility in the financial markets, due to heightened levels of uncertainty and polarizing volatility in the news cycle. During most cycles, the markets tend to stabilize and move higher after the election results are known, regardless of election outcomes. In 2024, the market cycle could be more volatile than normal, as vote-by-mail and mandatory recounts could delay the elections results for several weeks.

Some investors are tempted to consider timing the markets by pulling money out of the market prior to the election and re-entering after the election has ended. However, market timing is always a highly speculative undertaking, and timing around elections is even more precarious. The markets are not at all guaranteed to follow historical patterns, and sometimes the markets’ assumptions about election results point in precisely the wrong direction.

Take the 2016 election as an example, market forecasters were nearly unanimous in estimating that a Trump victory would be severely negative for the markets because of the high level of uncertainty he would bring. On election day the stock markets were plummeting as results came in (due to the surprisingly strong performance of President Trump). But, within 24 hours the markets had rallied powerfully upward and continued to push higher for many months thereafter. Even if we had magically known the 2016 election results ahead of time, we would have been on the wrong side of the markets if we had tried to game the outcome – all the top forecasters were wrong about what the 2016 election outcome would mean for the markets.

Are there patterns to political regimes?

Several of the factors mentioned in the first section of this piece highlight ways that politics can influence the economy. However, most of these effects are shorter-term in nature, and pale in comparison to the impact of interest rates and other macro-economic factors in determining the direction of the markets.

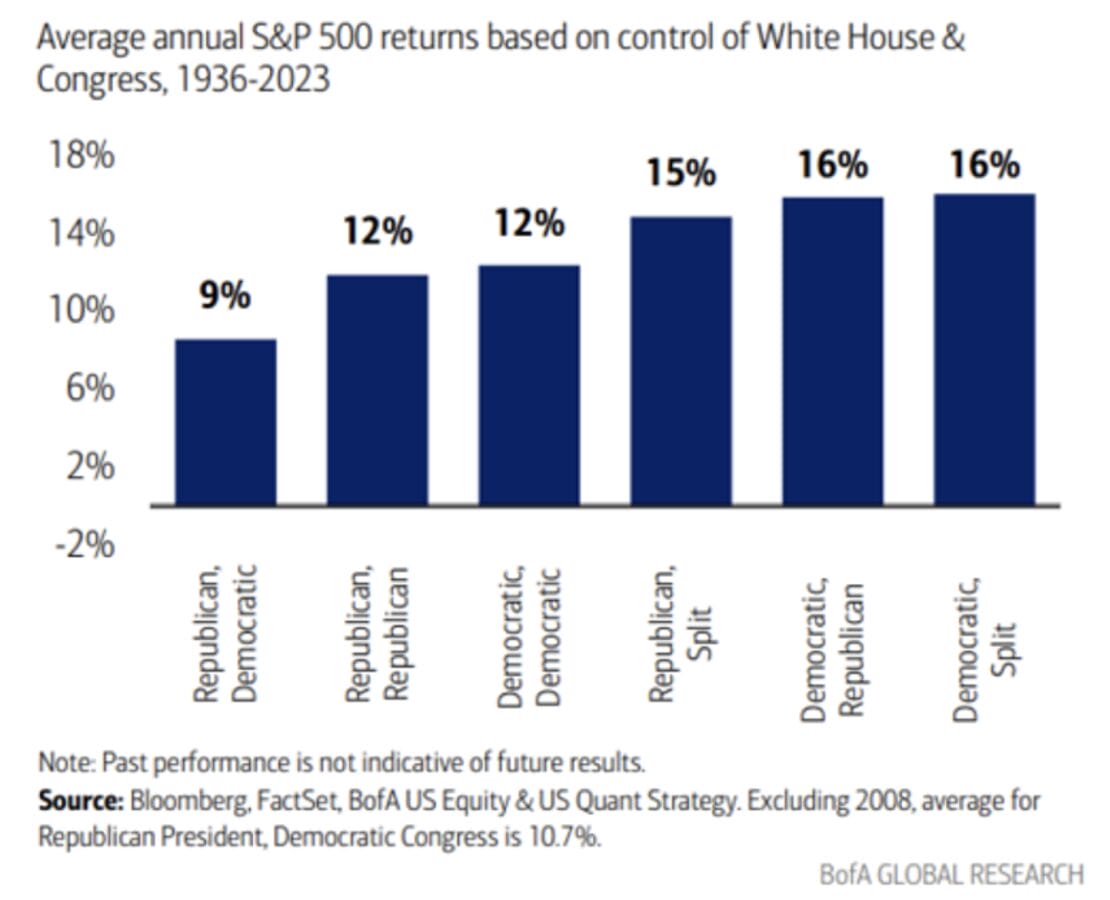

Many firms have studied elections and economic outcomes over the last century, and there are no discernable correlations showing that any combination of presidential election outcomes is better or worse for subsequent economic and market results. (There is some evidence that split governments correlate with better overall outcomes – because they are more gridlocked – see the section below).

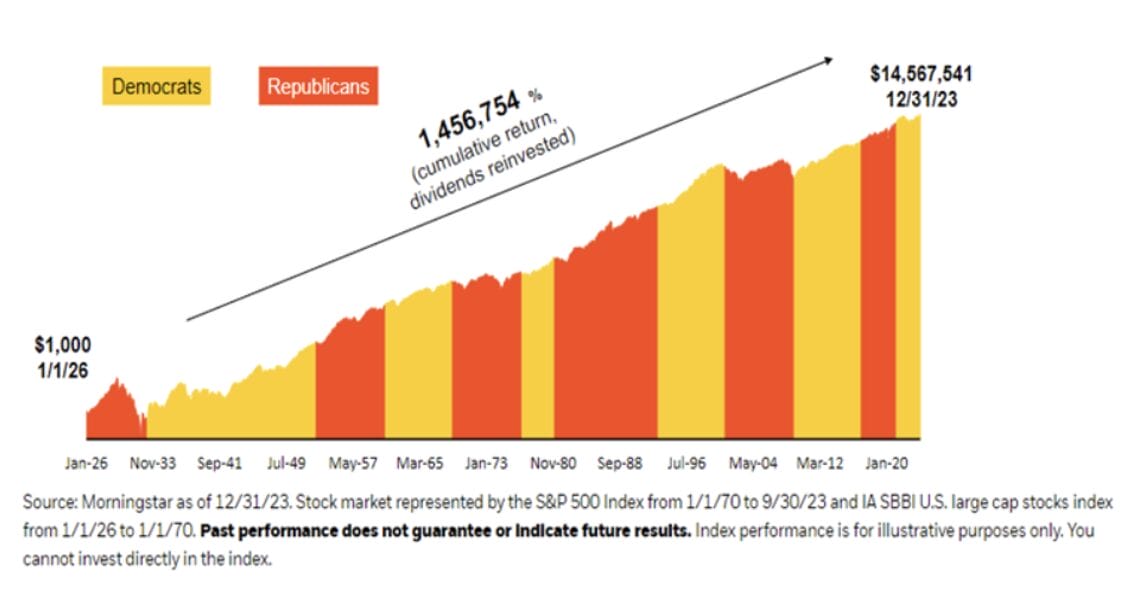

Our natural biases cause us to seek out confirmation that a Republican or Democrat regime is clearly better for the economy and markets over coming years. This is a natural compulsion that we all have – hoping that “our team” delivers better results. Voters consistently report that they feel better about the economy and markets when their party is in control in Washington – but market returns have been nearly identical under either party during most cycles in recent decades. When there have been large short-term differences in returns, it has been due to major macro-economic events, not the actions of the politicians in charge in Washington (i.e. The global financial crisis in 2008 and the COVID pandemic). The longer-term data illustrates this clearly – the economy and markets have generally expanded over the last century regardless of which party is in power.

Our economy is very large, diverse and dynamic – it tends to expand regardless of the back-and-forth changes that occur in Washington.

The equity market prefers gridlock

A complete sweep by either party (with the White House and Congress unified under one party) would most likely bring with it more abrupt policy changes and higher uncertainty. Historical evidence supports the notion that split governments tend to simply do less (gridlock), and therefore uncertainty is lower, allowing the economy to expand more organically. The market data supports this notion, with variants of split regimes associated with higher market returns over the long-term (versus sweep regimes). However, this does not mean that investors should alter long-term plans based on expectations of sweep or split election outcomes. Equity returns are healthy across all combinations – staying invested throughout all cycles is clearly the best approach. Perhaps we should all hope for a split government in D.C. – but stay invested no matter what happens.

Reflect politics at the polls – not portfolios

Over the longer-term, financial markets are influenced more by macro-economic conditions than political outcomes. Investors should never let their political opinions overrule their investment discipline. Broad macro-economic factors, such as the level and direction of interest rates, tend to have a greater influence over the economy and markets than the actual election results.

Stay anchored to your long-term financial goals, growth is more important than politics. Businesses and personal wealth strategies are long-term endeavors – generally focusing on 7 to 30-year time horizons (or longer), while political/election cycles run from 2-4 years. The political winds change direction frequently and it is ill-advised to alter your long-term saving and investment plans based on the gyrations of the short-term election cycle. During volatile times such as these, having a well-thought-out financial plan is critical for avoiding being swept up in the noise of the election cycle. Anchoring to a long-term wealth plan will help investors weather the storm without altering their course.

Author: Eric Kelley is chief investment officer at UMB Bank.