Running a Shopify store in Canada is like juggling flaming torches in a windstorm—taxes make it even wilder. Picture selling to a nonprofit or wholesaler, only to botch their Shopify tax exemption and face an upset customer or a CRA audit. I’ve been there, helping a friend untangle a $3,000 tax mess on her Shopify store after she overcharged a charity. With guidance from a Shopify tax accountant at SAL Accounting, you can nail Shopify sales tax exemptions and keep everyone happy. This guide is your go-to for small business and e-commerce owners, packed with tips on Shopify accounting services, cross-border accounting, and small business tax accounting to save money and stay compliant in 2025.

What Are Shopify Tax Exemptions?

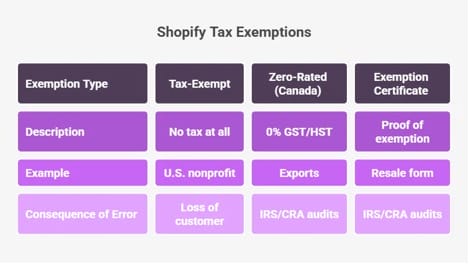

Shopify tax exemptions let you skip charging Shopify sales tax or GST/HST for certain buyers, like nonprofits, resellers, or exporters. It’s a game-changer for keeping customers loyal and avoiding legal headaches. Here’s the breakdown:

- Tax-Exempt: No tax at all, like for a U.S. nonprofit with an IRS certificate.

- Zero-Rated (Canada): 0% GST/HST for exports, but you still track it.

- Exemption Certificate: Proof, like a resale form, that says a customer skips tax.

Get this wrong, and it stings. Overcharge a Canadian nonprofit $600 on a $5,000 order, and they might shop elsewhere. Worse, missing tax-free forms can spark IRS or CRA audits. Shopify tax services from SAL Accounting can ensure your Shopify accounting services keep you compliant.

LOCAL NEWS: 100 best places to work and live in Arizona for 2025

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

Who Qualifies for Shopify Tax-Exempt Customers?

Not every buyer gets to dodge Shopify sales tax. Only specific U.S. and Canadian customers qualify as tax-exempt customers. Here’s who makes the list:

U.S. Buyers

- Resellers: Stores buying your products to resell, like a boutique grabbing your soaps. They need a state resale certificate.

- Nonprofits: Charities or schools with an IRS 501(c)(3) letter.

- Government Buyers: Federal or state agencies with exemption forms.

Example: A California reseller buys $2,500 of your candles. Their state tax form lets you skip $200 in Shopify sales tax. A Shopify accountant from SAL Accounting can verify these forms.

Canadian Buyers

- Exporters: Businesses shipping abroad, like a wholesaler sending hats overseas. They get 0% GST/HST.

- Nonprofits/Charities: Groups with a CRA GST/HST number.

- Indigenous Buyers: First Nations with status cards.

Example: A Vancouver charity orders $3,000 of event supplies. Their CRA number saves $390 in GST/HST. A cross border tax accountant can keep this straight.

How to Set Up Shopify Tax Exemptions

Setting up Shopify tax exemptions is easy if you know the steps. Here’s how to skip Shopify sales tax for products, collections, or customers like nonprofits or wholesalers, with help from Shopify accounting services.

- Log Into Shopify: Jump into your Shopify dashboard (yourstore.myshopify.com/admin). You need admin access to tweak tax settings. I save mine as a bookmark for quick access.

- Navigate to Tax Settings: Go to Settings > Taxes and duties in the bottom left. This is your hub for Shopify sales tax settings. Ensure your tax regions (U.S. states or Canadian provinces) are correct.

- Access Exemption Settings: Click “Manage tax exemptions” in Taxes and duties. This is where you set up tax-free rules. A Shopify tax accountant can guide you here.

- Set Products as Tax-Free: Create a collection like “Tax-Free Exports” for items like Canadian exports. Go to Products > Collections, add items, and set a 0% tax rate in tax settings. Use clear names like “ZeroTax-2025.”

- Tag Tax-Exempt Customers: Head to Customers, select a customer, click Edit, and add a “Tax-Free” tag. Link this tag to a 0% tax rate in tax settings. Their orders skip Shopify sales tax. For example, a U.S. nonprofit buying $1,500 of books skips $120 in tax.

- Collect Tax-Free Forms: Always get proof, like an IRS 501(c)(3) letter or CRA GST/HST number. Ask customers to email it or use an app like Avalara. E-commerce bookkeeping services from SAL Accounting keep these organized.

- Skip Tax for One Order: For a single tax-free order, go to Orders > Draft Orders, create the order, set tax to 0%, and note the reason (e.g., “Nonprofit Form #789”). Store the form safely.

Essential Tax-Free Forms for Shopify Sales Tax

You can’t skip Shopify sales tax without proper tax-free forms. Here’s what you need:

- U.S. Resellers: State resale certificate (e.g., California’s CDTFA-230).

- U.S. Nonprofits: IRS 501(c)(3) letter.

- U.S. Government Buyers: Government exemption form.

- Canadian Exporters/Nonprofits: CRA GST/HST number.

- Canadian Indigenous Buyers: Indigenous status card.

Example: A Montreal exporter orders $7,000 of goods. Their CRA number saves $910 in GST/HST, but you need to verify it. Small business bookkeeping in Canada keeps these forms in check.

Stay Compliant with Shopify Tax Exemptions in 2025

Setting up Shopify tax exemptions is only half the battle—staying legal is key. Here’s how to avoid fines and keep your Shopify sales tax setup clean:

- Collect Forms Every Time: No tax-free forms, no exemption. Get that IRS letter or CRA number before skipping taxes.

- Verify Forms: Ensure forms are legit. Use CRA’s online tool for GST/HST numbers or check U.S. forms with state/IRS databases. Some expire yearly, so stay vigilant.

- Store Forms Securely: Keep forms for 3-7 years for audits. Use Shopify’s customer notes, a cloud folder, or apps like Avalara.

Example: A Florida nonprofit buys $4,000 of supplies. Their valid IRS form skips $320 in Shopify sales tax, and you’re audit-safe with proper storage.

Top Tips for Shopify Tax Exemptions with a Shopify Accountant

Here’s how to ace Shopify tax exemptions in 2025:

- Use Apps: Apps like Avalara or TaxImmune collect and store tax-free forms automatically. E-commerce bookkeeping services integrate these tools for efficiency.

- Smart Tagging: Use tags like “Tax-Free-US” or “Zero-Tax-CA” to organize customers. It keeps your Shopify tidy.

- Track Tax Changes: U.S. states made 408 tax rate changes in 2025. Stay updated with a US Canada tax expert.

- Train Your Team: Teach staff to spot valid tax-free forms to avoid errors with resellers or nonprofits.

- Backup Forms: Store forms in a cloud folder or app for IRS/CRA audits. Bookkeeping services for small business ensure you’re covered.

Case Study: Emma, a Vancouver Shopify seller, sold $50,000 to a Canadian exporter but overcharged $6,500 in GST/HST. The exporter complained, and an audit loomed. A Shopify tax accountant verified the CRA number, tagged the customer “Zero-Tax-CA,” and refunded the tax. Emma dodged a fine and kept her client.

Trust SAL Accounting for Shopify Accounting Services

At SAL Accounting, we’re passionate about helping Canadian Shopify sellers and e-commerce owners master tax exemptions. Our Shopify tax accountants deliver tailored ecommerce accounting and services to keep your store compliant and profitable.

Visit salaccounting.ca to explore our bookkeeping packages for small businesses and start saving today!

Email: tax@salaccounting.ca

Phone Number: (416) 848-8470

Location: 55 Village Centre Pl, Suite 734, Toronto, ON L4Z 1V9 | 330 Bay St, Unit 1401, Toronto, ON M5J 0B6