While Americans struggle with all forms of personal debt – from credit cards to student loans – an increasing number are keeping a monthly household budget, but is it helping?

LEARN MORE: Arizona has 3 of the Top 30 most sought-after cities for renters

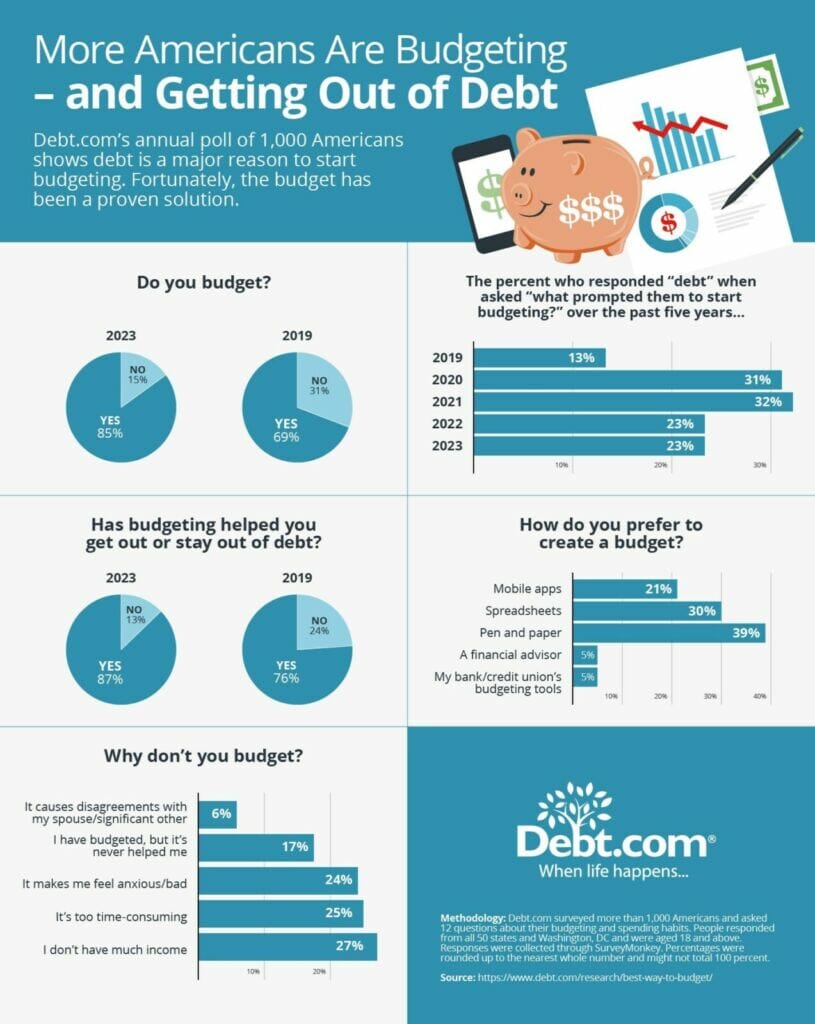

The 2023 Debt.com Budgeting Survey shows 85% of respondents are budgeting. That’s a statistical dead heat from last year’s 86% – but it’s a huge jump from five years ago, when 69% were reporting that they budgeted income and expenses in 2019.

The reason for that jump is in 2019, only 13% of respondents said, “Debt prompted me to start budgeting.” Since then, a global pandemic and historic inflation drove that number to 23% this year and last year.

That worries Debt.com president Don Silvestri, who wants Americans to budget in good times and bad.

“If you only create a household budget because you’re worried about debt, what happens when the worst is behind you, will you stop budgeting?” Silvestri wonders. “If that happens, you’ll stop budgeting, get back in financial trouble, then start budgeting again. Budgeting should be preventative medicine, not emergency surgery.”

In the second quarter of 2023, the Federal Reserve Bank of New York reported that household debt topped $17 trillion, and credit card balances rose by $45 billion – bringing outstanding debt to a record of more than $1 trillion. Those numbers have changed how Debt.com chairman Howard Dvorkin approaches budgeting.

“When I became a CPA three decades ago, budgeting was something I urged clients to do. Given the shocking stats, now I insist they do it,” Dvorkin says. “The truly scary part? With personal debt ballooning so much, budgeting alone won’t solve the money problems it once did. Budgeting is now a diagnostic tool. It can tell you when to consult a professional – before it’s too late.” People can learn how to create a budget for their lifestyle on Debt.com.

Other survey findings:

- 50% of respondents report living paycheck to paycheck

- 39% say they budget to increase their wealth

- 23% say they budget to help debt with their debt

- 16% say they budget to manage rising prices and inflation

- 15% say they budget to meet retirement goals

- 6% say they budget because of a divorce or loss of a spouse

- Out of those who say they don’t budget, the most common reason cited (25%) said it was too time-consuming.

Another interesting finding was that most respondents, 39.34%, say they prefer to budget the old fashion way using a pen and paper over digital tools. More survey findings can be found on Debt.com research hub.