As the calendar turns from business management planning to implementation and execution for 2014, global technology distributor Avnet, Inc. offers insights into trends that will influence the global supply chain in the new year and beyond. With a supply chain ecosystem spanning more than 300 franchised suppliers and 80 countries, Avnet helps its global customers navigate the changing global supply chain landscape to decrease lead times and improve time to market.

According to Capgemini Consulting’s 2013 study,1 55 percent of companies surveyed recognize that supply chain management can be a source of competitive advantage. Further, collaboration with supply chain partners results in a supply chain that allows companies to outperform the competition.

“As our global customers examined their financial performance last year, many experienced the positive value that a fully integrated and globally coordinated supply chain has on their business,” said Lynn Torrel, senior vice president global supply chain and strategic accounts at Avnet. “Collaboration is one of the most critical elements in an effective supply chain, and we expect to continue to see more companies fully integrate their supply chains throughout their extended network of suppliers and customers. Although we anticipate several factors to influence supply chain management this year, we also expect that those who employ a systematic approach to orchestrating their business ecosystem will continue to achieve the maximum financial impact.”

Avnet’s supply chain experts have identified several factors to consider when implementing a fully integrated supply chain this year. These include:

- Risk Management – Despite a growing awareness of supply chain risks and the importance of mitigating them, few organizations employ a comprehensive risk management strategy. As margins for error in the supply chain become slimmer, more organizations will realize they have the power to mitigate the impact of many supply chain disruptions. Proactively assessing potential risk and developing a risk management strategy is critical to a company’s ability to continue to manage supply to meet demand, as well as the expectations of business stakeholders, regardless of the economic or environmental challenges.

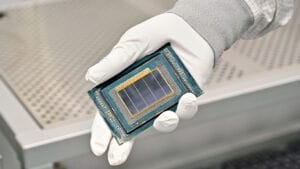

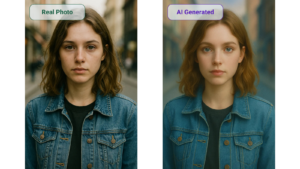

- Counterfeiting – Members of the electronics supply chain have become more proactive in their efforts to ensure part authenticity and guard against counterfeiting, and industry initiatives and certifications have helped crack down on counterfeits. While the war on counterfeits will continue, technology manufacturers will be better equipped to combat these issues as tools to help identify parts that could cause disruption to the electronics supply chain become more pervasive.

- Big Data – Business applications of big data analytics will continue to expand from demand-related sales, marketing and customer service and manufacturing, into more supply side areas such as procurement, inventory management, and supply risk management. Implementation and the impact on supply chains will be slow, yet steady this year.

- Manufacturing Strategies – While many companies are considering reshoring and near shoring strategies, few have relocated their manufacturing operations. As labor rates normalize around the globe, and more powerful tools in network design and analytics become available to better manage supply chains across multiple regions and product segments, reshoring and near shoring will become more actionable. As organizations focus more on the customer experience, regional markets, value density of goods, and risk mitigation strategies, the benefits of reshoring and near shoring become more evident.

- Segmentation – As customers continue to diversify their manufacturing strategies, so does the need for segmenting their supply chains based on multiple end-to-end metrics such as cost, expected service levels and both manufacturing and final delivery locations. Segmentation is key to customer satisfaction, yet it is not yet ingrained into the end-to-end view of most organizations’ supply chains. This often overlooked strategy can help manufacturers develop a greater understanding of the costs associated with delivering products to different customer sets around the globe.