Ever since the Great Recession exposed the weaknesses of Arizona’s economy, leaders have made a concerted effort to diversify the types of businesses operating in the state. That endeavor has given Arizona a reputation as a growing industrial market, with tens of billions of dollars being spent by Intel and Taiwan Semiconductor Manufacturing Company (TSMC) — and attracting other supply-chain-related projects that will evolve into economic development success stories. During that same period, the technology sector has also grown, with nearly $2 billion in funding going to startups based in Greater Phoenix since 2015.

“We’re at a critical inflection point where success begets success,” explains Chris Camacho, president and CEO of GPEC. “Instead of companies scaling to that initial $5 million [annual recurring revenue] and moving out of market, we’re seeing them grow and scale here. About once a week, someone introduces me to an interesting, disruptive company with a founder who I’ve never heard of before. That’s what’s happening in this region.”

READ ALSO: Here are the Ranking Arizona Top 10 lists for 2022

With corporate giants such as Honeywell, Intel and General Dynamics having a presence in Greater Phoenix, the environment is ripe for entrepreneurs. Camacho says he’s spoken to a former Intel engineer who launched her own business, and at another meeting, three of the executives from new companies were former Honeywell executives.

“I hate to compare us to any other place, but when you have the capital, and you have the idea makers that are spun out of legacy sectors such as defense and semiconductors that birth new enterprises, we’re mirroring some of that activity that happened in Silicon Valley,” he says. “I bet that $2 billion in investment ends up climbing exponentially over the next several years, because this is a place where people want to launch and scale enterprises.”

Economic development success stories: Trainual

One of these homegrown entrepreneurs is Chris Ronzio, founder and CEO of Trainual. The Scottsdale-based software platform is a tool for businesses to onboard, train and scale teams. Ronzio started the business in January 2018 and has since raised $33.75 million across Series A and B funding rounds.

“This is my third company, but I had never raised outside capital before,” Ronzio says. “I had to learn what valuations were, and what Series A and Series B even mean. Going through the process for the first time in 2019 was really eye opening — a crash course in calls with investors, understanding what metrics matter and just trying to understand how outsiders would value the company.”

When Ronzio decided to raise outside capital at the Series A level, Trainual had been operating for about two years. The business was already at $3 million in revenue and had a few thousand customers.

“It wasn’t an idea, we already had traction,” he says. “But that first round of institutional investment was a growth investment. It was about building a stronger foundation because we had got to that point as fast as we could, and there were messes to clean up. It was all about customer support, running a more mature business and filling out our leadership team. That was the focus in late 2019 and through 2020, when we doubled in size.”

Then, in 2021, Ronzio did a temperature check with investors about another round of funding. He realized there’s an understanding in the investment community that when a company records around $8 to $10 million in revenue, it’s considered self-sustaining and doesn’t necessarily need to raise outside funding.

Doing so, however, can speed up the plans of the company. That could mean hiring more people, investing in research and development, making acquisitions or spending more on marketing to stimulate growth. Trainual closed a $27 million Series B investment in May 2021, which Ronzio says will be used to add specialized roles to better serve a bigger customer base.

“We already built a sustainable business, but we want to build a market leading, worldwide company, and that’s when it becomes attractive to take on outside investment to propel our progress,” he explains.

Ronzio credits Greater Phoenix as a prime location for entrepreneurs to build something novel, thanks in part to a vibrant community that includes PHX Startup Week, StartupAZ and the Arizona chapter of the Entrepreneurs’ Organization.

“It’s fertile soil, and there’s a lot of these seeds being spread. We’re going to hit a point where they start growing, and we’ll start to build the infrastructure not just to support the seeds, but the small plants — the companies — that start to expand to 15 employees, or raise a Series A round of funding,” Ronzio says. “In the next few years, you’ll see a big boom in jobs at these brand-new businesses that you might not know about today, but in five years, they’ll be employing hundreds of people.”

Moov

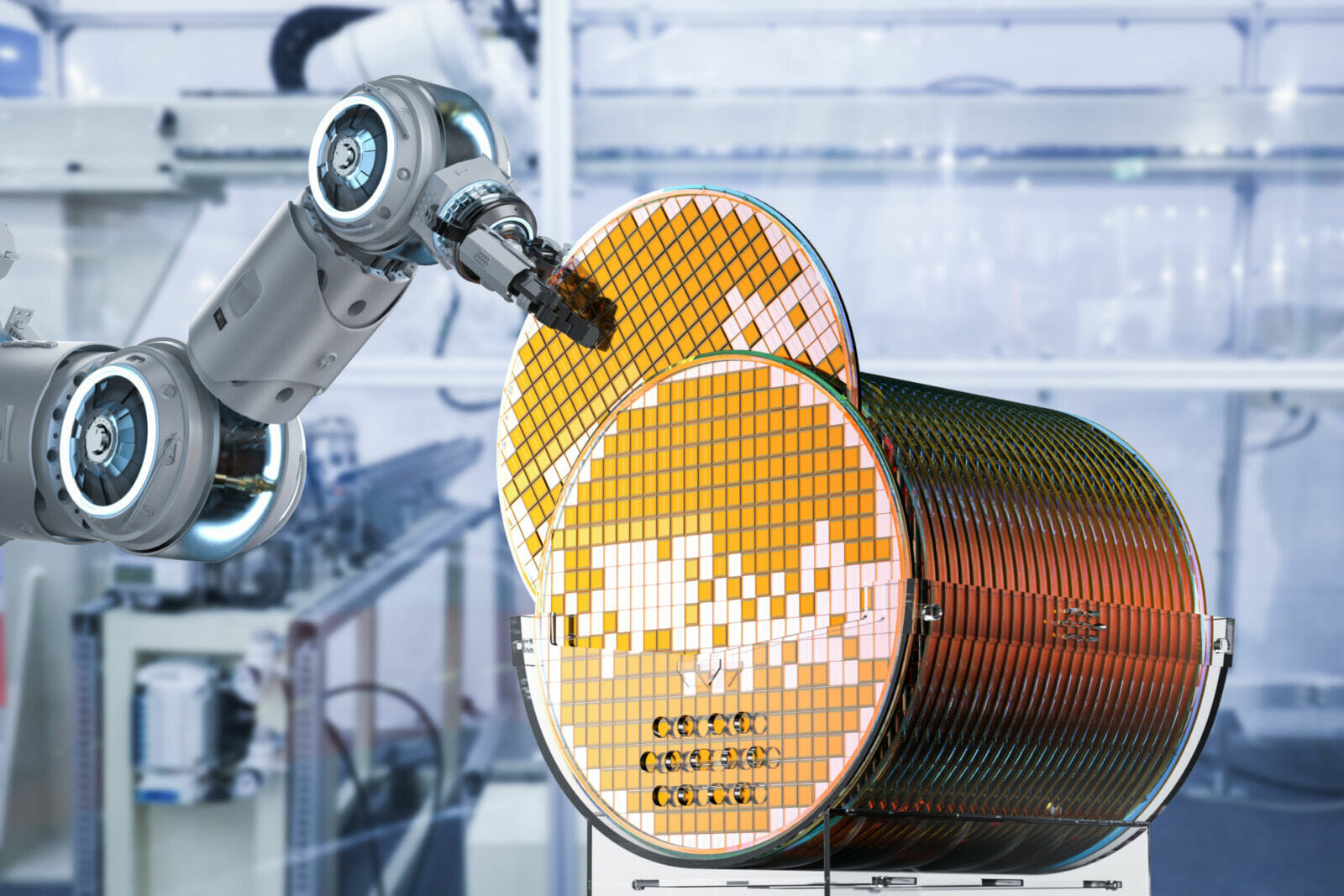

While Greater Phoenix is proving itself as an incubator for new companies and economic development success stories, it’s also a destination for those further along the development stages. In 2019, Steven Zhou, co-founder and CEO of Moov, opened a satellite office for his global online platform for buying and selling used semiconductor equipment in Chandler.

By March 2021, the company had moved to Tempe and announced that Greater Phoenix had become HQ1, taking the title from the San Fransico office. Later that year, Moov raised its fourth round of funding, becoming the second largest Series A in Arizona history at $41 million raised.

“The honest answer to ‘why Arizona?’ is that we’re following our customers,” Zhou explains. “We have relationships with the big names in the industry. We’ve done business with TSMC, Intel, Micron, Global Foundries, but also the small and medium sized players.”

That said, Zhou adds that Arizona also has a friendly business environment and attractive incentives. In the last decade, he has started two businesses and worked with multiple states, noting that there can be difficulties navigating different governments and municipalities — but working with the authorities in Arizona has been different.

“It’s been smooth like butter,” he concludes. “It seems like everyone is low ego and rowing in the same direction. People just want the best for the state. It feels like Silicon Valley 10 years ago — there’s opportunity for us to grow here. A cluster has developed, and other companies in our industry are building around it. As the U.S. doubles down in Arizona, so are we.”