Introduction

The environment of stock analysis has really transformed from a boring tool evaluating highs/lows and MACD acting as a selection filter to an exceptional field that’s filled with so many new and innovative tools designed for the way we invest. With so many potential choices available right in your hand, it can feel overwhelming trying to separate the wheat from the chaff on apps that do what you want them to. All platforms promise you the world, but which are really worth your time?

To help you with that, we have taken the liberty to research and test out the most popular choices, before finally creating a list of the 9 best stock analysis service in the market right now! Through the in-depth comparison review, we will not only check core specs and features differences but also plans so that you can decide which one is worthy. Whether you are an experienced investor or a beginner in the world of trading, this guide will give you important tips that will help to improve your trading strategy and increase your success.

LOCAL NEWS: Phoenix housing market outpaces national trends again in 2025

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

Website List

1. BestStock AI

What is BestStock AI

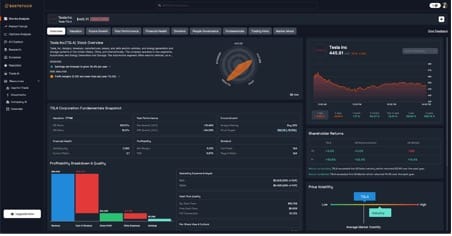

BestStock AI is the World’s 1st AI empowered stock utility designed to be clean, fast and reliable for all traders online. Investing analysis can be automated and actionable recommendations offered, by leveraging smart investment decisions that professionals and long term investors could not garner without the ability to analyze data. Providing complete financial intelligence on each company, and daily AI trading predictions to help its users read and search the stock market effortlessly. It also features an options calculator which calculates implied volatility, fair value price as well as Greeks on-the-fly to help you achieve the best possible options strategy.

Features

- Intelligent financial analysis provided by AI which does all the data processing that leads to actionable insight without manual labor

- Complete market coverage with full US stock financials and earnings transcripts

- Sophisticated statistical and business analysis tools to make smarter investment decisions

- Interactive data visualization features to easily gain insight into market trends

- Handpicked research and AI-powered insights for a smarter investing strategy every day

Pros and Cons

Pros:

- financial analysis that is AI-driven, which automates processing and makes actionable insight possible

- Full access to US stock financials, Earnings conference calls and daily market insights

- Intuitive research workflow for both professional & reatil investors

- Sophisticated data-visualization tools which aid decisions making process

Cons:

- Full access to all features may require a subscription

- Not much on-the-go analysis available in the mobile app

- A learning curve for users who may be new to financial analysis tools

2. Robinhood

What is Robinhood

Robinhood is a simple and affordable online brokerage platform that allows users to trade stocks, options, and cryptocurrency with zero commission fees. Its primary goal is to demystify the world of finance through easy to understand trading tools and resources, all without breaking the bank. With its easy-to-use mobile app and accessibility to new investors, Robinhood seems like the best option for a beginner to start investing beside Stash.

Features

- Easy-to-use tools that enable you to generate your own investment strategies and monitor the market.

- Ability to trade various trading instruments such as stocks, options or cryptocurrencies

- 24/7 trading for cryptocurrencies: Make crypto deposits and withdrawals, buy, sell or transfer assets at any time of the day!

- Managed portfolios by professionals who keep your investments in good hands

- Special promotions, for example bonus transfers on specific stocks that improve your trading experience

Pros and Cons

Pros:

- Easy to use tools and trading features for building your strategy or tracking the markets.

- Offers a wide range of trading options with stocks, options and cryptocurrencies

- Buy and sell Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies 24/7 and commission-free with Robinhood Crypto (where available).

- Incentivizing transfers with promotional bonuses, adding value for new customers

Cons:

- No exchange for CME, limited to OTC market only

- Limited offline trading and managing capabilities

- More expensive for some transactions than some competitors

- Limited functionality of the app compared to desktop counterparts

3. Webull

What is Webull

Webull is an online investment platform that has delivered an advanced level of trading data right to mobile for a more simpler and effective trading experience. With advanced trading tools and real time market data, Webull can help you shape your financial future. With an easy-to-use interface and a wide range of trade spreads to offer, it’s great for both beginners and experts.

Features

- An array of investable products including stocks, ETFs and options as well as access to breaking news, trending finance topics, market sense submissions and also has integrated trading.

- Professional trading information, including live quotes, charts and paper trading to help you refine your investment strategy

- Safe and secure environment: dedicated to security of your financial transactions

- New feature: we are introducing overnight trading and the ability to invest in recurring buys to help you maximize your investment potential

- Intuitive mobile and desktop applications optimised for flawless navigation & trading even while on the move

Pros and Cons

Pros:

- Large selection of investments including stocks, crypto and ETFs

- Enhanced apps with new desktop and mobile interfaces easy to use platform

- Advanced trading capabilities: Overnight trading and margin prediction markets

- Live quotes with mind-boggling trading tools to make quick decisions

Cons:

- New investors may find the array of features overwhelming

- Limited offline functionality for quotes, trades, account positions and balances

- Possible increased costs related to some trade options and features

4. AAII

What is AAII

American Association of Individual Investors (AAII) The AAII is a nonprofit organization that provides investor education and research for individual investors. The website provides a variety of tools, education and support in order to assist you in becoming an informed investor, who can achieve the goal of financial independence. It was designed to improve the investment acumen and capability of retail investors, so they will be equipped to better understand financial markets.

Features

- Improved browser compatibility making it easy for you to connect using whatever device, web browser and operating system.

- Easy-to-use interface enables you to move swiftly across content.

- Strong Security Features protect your data from unauthorized access and security threats

- Full range of support resources to help with trouble shooting and user questions

- Maximum speeds thanks to the optimized performance of high speed screaming power users

Pros and Cons

Pros:

- Improves security to ensure unbiased, bot-free throws, great for kids and adults!

- Makes it easy for users to troubleshoot access challenges

- Promotes best practices through the use of JavaScript and cookies

Cons:

- Can annoy legitimate users who run into access barricades

- Workarounds technical issues related to browser settings

- Could alienate users who appreciate privacy-oriented browsing choices

5. Stockpulse

What is Stockpulse

Stockpulse operates an intelligent big data analytics platform based on artificial intelligence to analyse the pulse emanating from the stock markets and social media. Its main mission is to Enable financial institutions track all the conversations taking place in social space and extract valuable information from the discussion helping them better perform market analysis, risk evaluation and regulatory governance. But by providing summaries and sentiment analyses generated by A.I., Stockpulse enables clients, including Deutsche Börse AG and Moody’s, to make better decisions while keeping the markets honest.

Features

- Real-time monitoring of social media that improves market integrity and aids in regulatory compliance

- Actionable insights generated by AI which enhance market analysis and risk evaluation

- Extensive coverage with thousands of succinct summaries daily to help you make sense of the world.AppendLine

- Advanced sentiment analysis capabilities which enable financial organisations to identify market manipulation and anomalies

- Integration with existing systems for seamless trading surveillance and operational efficiency.

Pros and Cons

Pros:

- Offers on the fly social media insights for better decision making by financial institutions

- Advanced AI for efficient market surveillance and regulatory compliance

- Provides thousands of briefings each day to support market analysis and assuage risk

- Easily integrates with existing financial systems, streamlining operations

Cons:

- May take a while to fully grasp and make the most of advanced AI features

- Limited flexibility to tailor for financial use case or customer specific requirements

- Reliance on social sentiment data could result in the volatility of the accuracy of sentiments for periods with turbulent markets

6. RockFlow

What is RockFlow

RockFlow: The world’s first AI powered fintech platform for a more intuitive and simple, Bobby. Built to make investing smarter and more fun, RockFlow helps users create AI portfolios in seconds, trade stock and manage their investments smoothly with the help of cutting-edge data analytics and social media insights that identify trends and opportunities as they unfold. RockFlow aspires to make efficient & productive traders out of new and experienced traders alike, with its easy-to-use app.

Features

- AI-based portfolio management which automatically adapts your investment decisions with real time data analysis

- Advanced social media monitoring to detect trends and alert you for potential risks in your positions

- Intelligent trade execution whereby you can preset and let Bobby take over and make sure that you never miss an opportunity

- Personalized trader matching that connects you with top investors according to your trading style and preferences

- 24/7 AI support to keep you up-to-date and prepared to act on market opportunities anytime

Pros and Cons

Pros:

- Automated, AI-enabled portfolio management that takes seconds to make trades and optimize strategies

- Investment decisions are improved with full data analysis in 1000 streams

- A user-friendly interface makes it easy to communicate with the AI assistant.

- Networking with the top traders for better trading opportunities

Cons:

- Relying on AI could turn off people who like more traditional ways of investing

- Limited capabilities offline may affect accessibility do to connectivity limitations

- Learning curve for those not already familiar with AI-based investment platforms

7. Transparently

What is Transparently

Transparently.AI is a pioneering AI-based application that uncovers accounting fraud and manipulation in financial statements of organizations. Its goal is to aid in building transparent and trustworthy global markets that are free from financial vulnerabilities, while at the same time keeping users informed about risk everywhere. Leveraging its AI-driven Risk Engine and GenAI forensic accounting assistant, users can accurately identify potential issues and protect their investments.

Features

- Leading artificial intelligence for accounting manipulation and fraud detection which brings transparency and trust to financial statements

- AI-driven Risk Engine that gives instant snapshot of a company’s financial risks, to assist you in making informed decisions

- Hugenerd GenAI innovation Luca to analyse and find insights about financial exposures.

- Customized tools on all risk areas (i.e., unusual inventory activity) to increase your financial scrutiny

- Independent news delivery to aid portfolio managers and investors in discerning corporate accounting challenges

Pros and Cons

Pros:

- Next generation of AI that adds transparency and trust to corporate financial statements

- Risk analytics tools that assess overall credit risk and potential financial vulnerabilities

- Groundbreaking GenAI forensics accountancy assistant delivering vital understanding

- Quick intuitive user friendly demo for exploring financial risks

Cons:

- Users who are not financially literate may find AI-generated insights hard to comprehend

- Some lack of customization involving specific industry requirements or unusual financial situation

- Relying on technology may be difficult when there are outages or technical difficulties

8. Moneycontrol

What is Moneycontrol

Moneycontrol is one of the best financial app that offers you access to real-time price quotes, stock and share trading news and live TV on NSE, BSE markets and within your percentage gain as well. Its primary mission is to give owners & traders of stocks, options, forex and futures a one stop site where they can obtain a wealth of in depth financial content as well as news that is vital whether they are the experienced individual trader or The new kid on the block. Packed with in-depth analysis, expert opinions, and research apparatus to help you take informed decision; Moneycontrol is one of the best financial portals in India that delivers everything related to business and economy simultaneously.

Features

- Expectation of good RBI rate cuts led growth in the markets anticipated

- Big stock price jump, with Biocon shares rising by 10 percent in just two days

- Market drivers and restraints including inflation trend analysis and their impact

- Strong long-term visibility through strong order books in strategic sectors

- Live coverage and expert analysis to help you make sense of market shifts

Pros and Cons

Pros:

- Market rally: Sensex gaining 550 points, showing positive trend in markets

- Rising optimism among investors that RBI will cut rates

- Outperformance from specific stocks like Biocon reflecting resilience of the market

- More attention to long-term growth opportunities in sectors such as infrastructure

Cons:

- Volatility in the market can trigger profit booking as was the case with Groww shares

- Depending upon factors outside of your control, such as an RBI decision, can lead to uncertainty

- Possibility of infrequent lapse in performance at the time of significant market activity

9. Earnings Whispers

What is Earnings Whispers

Earnings Whispers is the only provider of real, professional whisper numbers for professional traders and investors – the most reliable earnings expectation availabe – based on superior fundamental research that is combined with investor sentiment data, quantitative studies, and technical analysis to create a valuable indicator for favorable trading and investing. Its main product is the Whisper Report which receives earnings news and information from hundreds of stocks each quarter, based on pre-market and after stock market close, that give an indication of probable (rather than actual) earnings results for as yet unannounced sales. Being able to see features such as recent positive earnings and projected figures, Earnings Whispers will help those who are willing to wade through the muddy waters of headlines when it comes to reporting time.

Features

- Full earnings sentiment breakdown to assist in cutting through the noise and focusing on important factors.

- The latest breaking news on high profile stocks, large cap stock and the moment to ignite your new investment ideas.

- In-depth analysis related to earnings releases, or other material that may affect your investment decisions

- Visualization of sentiment and interest levels to get you started with your research

- Get informed with visual sentiment and interests.

- Easy to use app that helps you track & analyze Earnings News

Pros and Cons

Pros:

- Earnings sentiment insights in a convenient format for investor consideration

- Complete coverage of recent and anticipated earnings news

- Discussions that stimulate understanding of industry trends

- An easy-to-use interface enables intuitive access to information

Cons:

- Scarce information on negative earnings sentiment

- The prospect of too much information with frequent updates

- Made be less extensive for less popular earnings reports

Key Takeaways

- The right strategy to analyzing stocks is what works best for you and fits your investment objectives and tolerance for risk.

- Performance in the past is not the only criterion – know all about strategy of thecompany for what lies ahead.

- Ability to integrate with financial news and analytics can make decision making process much easier.

- So important the experience of users and learning curves of the analytic platforms.

- The fact that the tool was recently updated and offers an advanced analytics feature proves this is a strong, modern tool capable of adjusting to market conditions.

- Risk management and diversification are important to limit losses in volatile markets.

- Community help and availability of educational resources can make a big difference in your investing skill and confidence.

Conclusion

Conclusion The above research on the best 9 stock analysis service hopes to help making sexy decisions in fierce competition. Both have their own set of strengths and capabilities, so it’s important to consider your trading style, investing goals, and budget before choosing one.

The stock analysis world is changing faster than ever before and there are all sorts of new features coming to this scene. We advise beginning with the solutions that are most closely in line with what you need now while taking into account their scalability and flexibility as your market solutions evolve. Don’t forget, the highest cost product is not necessarily the best one and in additional to that most feature-rich platform might not be something you will be using depending how you trade.

Use free trials and demos to get hands-on experience with these tools, and feel free to ask various customer support teams if you have questions. The perfect stock analysis tool will make all of the difference in your trading success and enable you to become a far better trader, which is why it’s well worth the time to find the best stock market program for you when trading and making decisions. Get started looking for your options today and take it into your own hands to make better investment decisions!