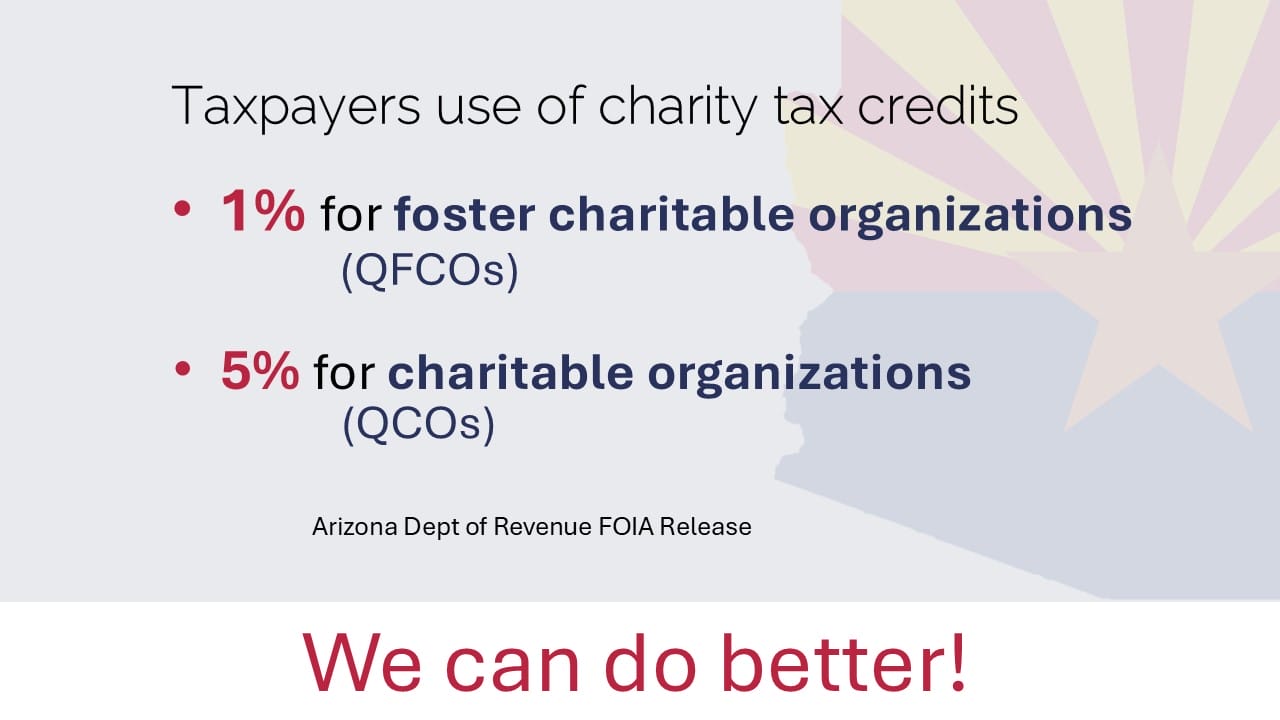

Did you know that only about 1% of Arizona taxpayers take advantage of the Foster Charity tax credit?

This tax credit allows for a dollar-for-dollar deduction from the Arizona income taxes you owe. Surprisingly, only around 1% of taxpayers utilize this benefit. Additionally, only about 5% take advantage of the Charity tax credit. Both credits can be used in conjunction with the well-known school tax credits.

LEARN MORE: How Arizona’s charitable tax credits can benefit you and your community

For those unfamiliar with Arizona’s charity tax credits, click here for brief overview. In a nutshell, Arizona is one of the few states that allows taxpayers to redirect a portion of the taxes they owe to qualified charities. It’s a no-brainer, giving you full control on how a portion of your taxes are spent! Who doesn’t want that?

As a retired entrepreneur from Arizona, I found myself with time on my hands. I decided to apply my talents to assisting non-profits in Arizona. From that experience, I quickly realized the significance of tax credit donations to these organizations. It is an essential part of their planned funding. They bank on it.

Upon investigating how many taxpayers utilize these credits, and with the cooperation of the Arizona Department of Revenue (FOIA response), I discovered that only 1% take advantage of the Foster Kids credit, and just 5% for other Qualified Charities. We can do better.

If an additional 1% of taxpayers used these credits (both charity types), it could result in approximately $30M or more for Arizona charities, enhancing their ability to make a positive impact.

There is an opportunity here for you to make a meaningful difference. Please inform your employees, family members, and friends about these tax credits. While I am not a CPA or an enrolled tax agent, it sure looks like a “no brainer really good thing” to do! The deadline for 2024 filing is April 15, 2025, so there is still time.

Over 1,300 qualified charity organizations eligible for tax credit donations all doing great work. If you don’t know where to start, we’ve created a handy web resource: www.AZTaxCreditList.com that makes it a lot easier to find the charities that speak to you. This resource is free for everyone, including charities. All donations are handle directly within that charity’s website. Our goal is to facilitate a greater use of these tax credits, getting more money for Arizona organizations that will greatly appreciate your kindness and support.

Thank you!

![Slide2[44]](https://azbigmedia.com/wp-content/uploads/2025/01/Slide244.jpg)