Computer and aerospace manufacturing plays a significant role in Arizona’s financial future.

The economic storm that has wreaked havoc for most businesses was barely a breeze for Michael McPhie.

“We were really not affected negatively,” says the CEO of Curis Resources, a mineral exploration and development company in Florence. “The economic downturn really did not affect the demand for some commodities, so copper mining continues to be a significant economic engine for the state.”

With 10 percent of the world’s copper supply coming from Arizona, a combination of continued high demand from China and innovative and cost-effective methods of extraction allowed the copper industry — one of Arizona’s oldest professions — to weather the economic storm with little damage.

While Arizona’s Top 10 manufacturing companies added about 3,200 jobs in 2011, some of the state’s other manufacturing companies were not so lucky.

“It certainly wasn’t easy, especially for our smaller manufacturers, who make up 79 percent of Arizona’s manufacturing sector and employ four or fewer people,” says Mark Dobbins, senior vice president and secretary for SUMCO Phoenix Corporation, which manufactures silicon wafers for the semiconductor industry. “Although companies of all sizes were affected by the recession, they were probably hit the hardest.”

While the state’s manufacturing sector is holding steady, the uncertainty coming out of Washington and in the financial markets has not helped its economic recovery, according to Glenn Hamer, president and CEO of the Arizona Chamber of Commerce and Industry.

“The federal health care law, EPA regulations and a National Labor Relations Board that has taken positions hostile to manufacturing has likely done more to slow recovery than spur it on,” Hamer says. “The governor and the Legislature, however, have responded decisively, passing in 2011 a once-in-a-generation economic competitiveness package that makes Arizona more attractive than ever to manufacturers.”

The Arizona Competitiveness Package includes a mix of tax reforms and business incentives designed to encourage expansion among existing Arizona companies, while establishing Arizona as an attractive location for businesses worldwide.

“Arizona manufacturers have underperformed in the export arena as compared to other states in the last several years,” Hamer says. “Economic competitiveness legislation passed by the Legislature and signed by the governor last year goes far in attracting manufacturers, especially those who sell beyond Arizona borders.”

While the landmark 2011 legislation was a shot in the arm for manufacturing and business, the Arizona Manufacturers Council — which serves the state in conjunction with the Arizona Chamber of Commerce and Industry — has identified several legislative issues that are important to manufacturing in 2012, Hamer says. The Arizona Manufacturers Council is striving to:

- Streamline regulations and the issuance of permits.

- Eliminate barriers to economic development created by inadequate infrastructure for capital intensive manufacturing operations.

- Promote a friendlier legal environment through tort reform.

- Support policies that will strengthen the solvency of Arizona’s unemployment insurance system.

“We need a clearly defined economic goal and strong collaborative leadership for the next five, 10, 15 and 20 years for the state,” says Dobbins, who is also immediate past chairman of the Arizona Manufacturers Council. “We need a clear education pathway to support Arizonans’ having the job skills to meet the challenges of that goal. We have the infrastructure to become a major player in all of our primary industry sectors. Now we have to create the political will to set the state’s objective to become the international commercial and business hub of the Southwest.”

To get there, Dobbins says, “We need to rid ourselves of outdated policies that discourage businesses from relocating here and be aggressive at pursuing growth. We must invest in education and fund our schools and universities properly so they produce graduates who are vocationally skilled and/or STEM-skilled and job-ready.”

Even in the copper mining industry is transitioning into a knowledge-based workforce, McPhie says.

“We are working with local colleges so we can attract and educate the best and the brightest engineers, hydrologists and geologists,” McPhie says. “There are tremendous opportunities to make significant wages in the copper mining industry, particularly because there will be a significant numbers of retirees due to our industry’s aging workforce.”

It’s not just the mining industry that is looking for a new generation of workers. “We’ve also seen manufacturing (hiring) pick up substantially in the last month,” says Andy Ernst, regional vice president for Robert Half International, a staffing services firm.

While Dobbins says the computer and electronic product manufacturing is generally considered among the state’s strongest manufacturing areas, the production of transportation equipment — which includes the aerospace and defense industries — could be the most captivating, yet challenging, sector to watch in the next several years.

“The advent of Unmanned Aircraft Systems (UAS) in the defense sphere is extremely exciting for Arizona manufacturing,” Hamer says. “The AMC is working with the Arizona Aerospace and Defense Commission and other stakeholders to secure Arizona’s position as a leading location for research and development, manufacturing, and testing of UAS, and we are supporting Arizona’s proposal to be designated by the Federal Aviation Administration as a national UAS testing area.”

Arizona’s largest aerospace and defense companies are investing in the future of UAS, which the military uses to track enemy movements, bomb targets and move supplies without putting soldiers in harm’s way. Boeing moved its unmanned division to Mesa, where it can manufacture the A160T Hummingbird, the company’s flagship unmanned aircraft, once every 12 days. Raytheon in Tucson is working on several UAS innovations, including an operating system that would make it easier to install various brands of sensors and communicate among multiple unmanned aircraft.

But aerospace and defense isn’t the only area expected to create new jobs.

“In addition to the potential growth of Unmanned Aircraft Systems in Arizona, Intel’s $5 billion investment in a new factory in Chandler will require 1,000 workers and is creating 14,000 jobs in the construction sector in anticipation of the facility’s completion in 2013,” Hamer says. “The investment has a tremendous downstream effect on other companies.”

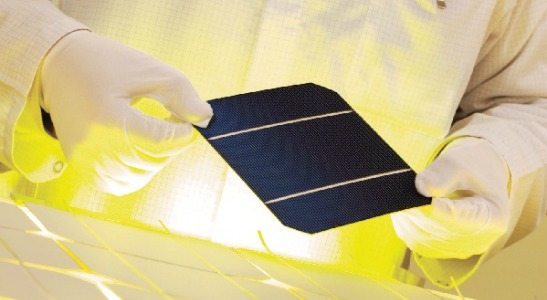

Renewable energy is another potential hotbed for growth.

“If it is able to overcome certain global market challenges, certainly the solar industry has big growth potential for the future of our state,” Dobbins says. “Also, as long as we, as a society, continue to be in love with personal electronics — computers, laptops, cell phones — and our cars, manufacturing in Arizona will continue to grow.”

To help that growth, the Arizona Chamber of Commerce and Industry is focused on two initiatives:

- Southwest<>Direct, which aims to make Arizona the international commercial and business hub of the Southwestern U.S.

- A collaboration between the education community and business to secure highly trained, vocational skills-certified and STEM-certified employees for today and tomorrow’s increasingly technical workplace.

“The Chamber and the AMC are (also) working together to promote a tax environment that attracts manufacturing, including reforms to the state’s treatment of income derived from capital gains, and lengthening the time businesses can carry losses forward against future profits as way of encouraging more startups and businesses that require large capital investments,” Hamer says.

Despite the increase in job creation and slight decrease in economic despair, the state’s manufacturing sector still faces some challenges.

“With looming federal budget cuts, Arizona’s defense and aerospace manufacturers stand to face some big changes,” Hamer says. “It is incumbent upon our leaders to continue to position our state as a leader in this field by aggressively pursuing Unmanned Aerial Systems flight testing, research and manufacturing in Arizona.”

Hamer says that it will be imperative for lawmakers and business leaders to have a unified vision for the future of manufacturing in Arizona.

“Arizona needs to be mindful of the growing creep of regulations and red tape that stifles business’ ability to focus on innovation and investment,” Hamer says. “Gov. Jan Brewer recognized this when her first act as governor was to institute a regulatory moratorium; the Legislature soon followed the governor’s action with a sweeping regulatory reform package of its own. Increased transparency in the regulatory sphere at all levels of government will help attract (new) manufacturing to Arizona.”

ARIZONA AEROSPACE

Here are four of the major players in Arizona’s defense and aerospace industry:

Boeing: The company’s 4,878-employee Defense, Space & Security facility in Mesa is best known for producing the AH-64 Apache attack helicopter for the U.S. Army. Additional work at the Mesa facility includes production of electrical subassemblies for the F/A-18, F-15, and C-17 aircraft.

General Dynamics: With more than 5,400 employees at its Scottsdale headquarters, General Dynamics C4 Systems specializes in command and control, communications networking, computing and information assurance for defense, government and select commercial customers in the U.S. and abroad.

Honeywell International: With more than 10,000 employees at 21 Arizona facilities, Honeywell International contracts with the Department of Defense through both their Aerospace and their Automation and Control Solutions business units. In particular, Honeywell Aerospace is headquartered in Phoenix, with major facilities in Tempe, Glendale, and Tucson.

Raytheon Missile Systems: Headquartered in Tucson with 12,000 Arizona employees, Raytheon Missile Systems designs, develops, and produces weapon systems for the U.S. military and the armed forces of more than 50 countries.