15 pieces of advice from fixer-upper homeowners

Renovating a fixer-upper home comes with countless challenges that even experienced homeowners struggle to anticipate. This comprehensive guide shares practical wisdom from seasoned homeowners who have successfully transformed problematic properties into dream homes. Drawing on expert advice from contractors, inspectors, and renovation veterans, these essential lessons will help prospective buyers avoid costly mistakes and make informed decisions throughout their renovation journey.

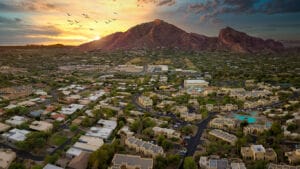

LOCAL NEWS: Phoenix housing market outpaces national trends again in 2025

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

- Complete Major Projects Before Moving In

- Balance Vision with Practical Calculations

- Request Detailed Estimates Before Emotional Commitment

- Sewer Inspection Essential for Pre-1984 Homes

- Always Budget for Hidden Surprises

- Get Professional Foundation Assessment First

- Fix Essentials First, Tackle Aesthetics Later

- Bring Contractors Before Making an Offer

- Know Your Numbers Before You Buy

- Budget Extra for Unexpected Renovation Expenses

- Match Project Scope to Your Skills

- Prioritize Structural Issues Over Cosmetic Updates

- Walk Property with Qualified Contractor First

- Replace Water Heaters Older Than Ten Years

- Multiple Inspections Reveal Hidden Problems

Complete Major Projects Before Moving In

Over the years I’ve done a bunch of flips and bought a few fixer-uppers to live in myself. So I’ve been on both sides — as an investor and as a homeowner living through renovations.

The biggest piece of advice I’d give someone buying a fixer-upper is to really know what you’re getting into before you close. Don’t skip the inspection. Hire a good inspector and go through everything with them — foundation, roof, sewer lines, water lines, and electrical. Those are the big-ticket items that can drain your budget fast. Cosmetic stuff like flooring or paint is easy to handle later, but if you’ve got foundation issues or need to replace old plumbing, that can easily turn your “great deal” into a money pit.

What I learned from experience is that living in a fixer-upper while you’re fixing it up sounds better than it actually is. It’s doable, but it can be a real headache — especially if you’re dealing with bathrooms or kitchens. If the only bathroom in the house needs work, just know you’re probably going to be without it for a while. Same goes for kitchens — it’s not fun living on takeout for weeks.

So my advice is: if you can, knock out the major livability projects before you move in. Get the plumbing, kitchen, and bathroom work done first, before you’re actually living in the middle of it. If you have to move in right away, make backup plans — know where you can shower, cook, or stay if things take longer than expected (and they usually do).

Buying a fixer-upper can be a great move — you can build a ton of equity and create something that’s truly your own — but the key is going in with eyes wide open. Understand what needs to be done, budget extra for surprises, and plan ahead for how you’re going to live through it.

Balance Vision with Practical Calculations

My best advice is to see the house for what it can be, not just what it is. It’s easy to get caught up in the excitement of potential, but every repair and renovation comes with layers you can’t always see until you start pulling things apart. I’ve learned that patience, not impulse, makes or breaks these projects. You want to walk through the property with both creative vision and a calculator. Understand where the true value lies and where it doesn’t. I’ve seen buyers overspend on finishes that don’t add to resale value or underestimate structural issues that drain their budget. When I bought my first fixer-upper, I thought I could do it all fast and cheap. I was wrong. It taught me that every house has its rhythm, and you can’t rush quality work. If you treat the process like a partnership between you and the property, you’ll make smarter decisions and end up with a home that feels earned, not just owned. That mindset has shaped how I look at every property since, both as an investor and as someone who helps others navigate those same walls and foundations.

Request Detailed Estimates Before Emotional Commitment

Get a contractor’s estimate on the full scope of work before you make your offer, not after you’re emotionally invested. Buyers fall in love with potential and underestimate costs by 50% or more. What looks like cosmetic updates — paint, floors, kitchen refresh — often reveals structural problems, outdated systems, or code violations once walls open. I’ve walked clients through “easy flips” where the $40K budget became $120K because of hidden foundation issues, knob-and-tube wiring throughout, or an HVAC system that failed inspection. Get line-item pricing on everything you plan to do, add 25% contingency for surprises, then see if the numbers still work.

The other reality buyers miss is time. Fixer-uppers take twice as long as you think, and you’re either paying rent elsewhere or living in construction chaos. Permitting alone can eat 6-8 weeks before work starts. Then every opened wall reveals something — asbestos insulation, improper framing, plumbing that’s not to code. That “6-month project” becomes 14 months. BE HONEST about whether you can handle extended timelines and budget overruns, because both are guaranteed. Most fixer-uppers make financial sense only if you’re getting the property significantly below market and have real construction knowledge to manage the work.

Sewer Inspection Essential for Pre-1984 Homes

In Texas, getting a sewer-line scope for fixer-uppers is not optional…it is mandatory.

Homes built before 1984 commonly used cast-iron pipes that have long exceeded their lifespan. They corrode, collapse (from tree roots or foundation shifts), and create costly problems that no standard flip-n-fix budget can handle.

Our team has seen replacements approach $40,000, completely changing the economics of a deal. Every buyer, especially first-time real estate investors, should add a sewer inspection to their checklist before purchasing any older property.

It is a small investment of $200 that can prevent a very big mistake.

Always Budget for Hidden Surprises

Throughout my career, I have flipped many properties for profit. The best piece of advice I would give is to always expect the unexpected. When you buy a “fixer-upper,” there will inevitably be issues hidden, literally, in the walls. One of the homes I purchased once had actual mold growing in many of the walls due to rain gutters that weren’t draining properly. I had no idea the mold was there until we cut into a wall as part of the renovation. Fortunately, when I budget for a project like this, I always build in a 10% margin for “surprises.” That way, when the unexpected happens, the budget is ready for it and the project won’t suffer in other areas.

Get Professional Foundation Assessment First

Our team learned the hard way that a foundation can make or break a fixer-upper.

In Texas, the clay soil moves constantly with weather changes, and older homes are especially vulnerable. On one renovation, the property looked solid during the walkthrough, but the engineering report told a different story.

The foundation needed 15 piers, and once the repairs began, we had to replace all the flooring. That oversight added $33,000 to the budget and wiped out the project’s profit margin.

Since then, we never close on a home without a third-party engineer’s report. It is a simple step that protects both your finances and your peace of mind.

Fix Essentials First, Tackle Aesthetics Later

When you’re buying a fixer-upper, the smartest thing you can do is break everything you see into two lists — what’s a must-have and what’s a nice-to-have. Working heat and AC, a solid roof, no water damage, a dry basement — those are non-negotiable. Everything else, from ugly paint to creaky floors to the world’s smallest kitchen, you can live with for a while. People burn out because they think everything has to be fixed right away. It doesn’t.

When my wife and I bought our first older home, it was built in the 1950s and hadn’t been touched in decades. It was small and dated, but it was solid. We spent years fixing it up one project at a time — new floors one year, the kitchen the next. What started as a long to-do list turned into something we actually loved doing.

That’s what I tell buyers now: go slow, get every inspection you can, and expect surprises. Old homes always have them. But if you plan for the essentials and give yourself room to breathe, a fixer-upper can be one of the best experiences you’ll ever have.

Bring Contractors Before Making an Offer

For me, buying a fixer-upper can be one of the smartest moves in real estate, but only if you go in with clear eyes and realistic expectations. The biggest mistake buyers make is focusing too much on potential aesthetic upgrades and not enough on structural or system issues. Paint, flooring, and cabinets are easy to fix; foundation cracks, plumbing, or electrical problems are not.

When I work with clients looking at fixer-uppers, I always suggest bringing in a licensed contractor or inspector early, even before making an offer. They can help estimate renovation costs and uncover hidden issues that might not be obvious during a walkthrough. For me, that upfront evaluation often saves buyers from costly surprises later on, or helps them negotiate a better deal if the home still makes sense financially.

What I’ve learned through years of helping buyers is that a successful fixer-upper purchase comes down to budgeting with a cushion and knowing your threshold for renovations. Always assume that whatever your repair estimate is, you’ll spend at least 10-20% more. That buffer keeps you from feeling overwhelmed when the unexpected happens (and it almost always does).

In the end, a fixer-upper can be a fantastic opportunity to build equity and personalize your home. But in my opinion, the key is treating it like a business decision first, and a passion project second. If the numbers make sense and the foundation is solid, literally and financially, it can absolutely be worth it.

Know Your Numbers Before You Buy

My biggest piece of advice for anyone buying a fixer-upper is to know your numbers really well. Understand the ARV (after-repair value) before you buy. If you’re not confident in running comps, ask a few experienced real estate agents to pull CMAs for you so you aren’t surprised later when it’s time to sell. Then, get a firm handle on your rehab costs. Underestimating rehab costs can put you in a serious bind if you didn’t properly budget for what the property truly needs. It’s always good to get multiple bids before committing to any major work. Prices can vary drastically, and having a few quotes helps you get a true sense of fair costs and prevents expensive surprises.

I always tell people: inspect everything. A full inspection is worth every penny. We learned this firsthand when we tried to save on costs by skipping a full inspection. Come to find out, several things were half-done by the previous owner. We had to redo the floors, plumbing, and had to redo a couple of bathrooms, ultimately more than doubling our original rehab budget.

The people who succeed with fixer-uppers are the ones who treat it like a business from day one. They plan their exit, verify their numbers, and budget for the unexpected.

Budget Extra for Unexpected Renovation Expenses

One piece of advice, and arguably the most valuable piece of advice, for anyone buying a fixer-upper is: don’t buy it unless you have the ability to pay more than budgeted for repairs. I’ve been a full-time real estate investor since 2010 with over 2,000+ transactions closed. I’ve flipped countless homes in multiple states, and what I’m sharing with you today is a critical piece of information you need to make an informed decision.

You should add a minimum of an extra 15% to your budget when renovating a fixer-upper property, as there are so many variables and unexpected expenses that can come to light during the renovation. If you’re maxed out financially based on the contractor’s bid, I highly suggest that you modify the scope to allow for the surprise expenses you’ll encounter along the way!

This advice will, in many cases, prevent you from landing in a difficult financial position during the renovation process.

Match Project Scope to Your Skills

Buying a fixer-upper can be exciting because it gives you the freedom to shape a home into something that truly fits you. I have learned that excitement can quickly turn into stress if you take on more than you can realistically handle. It helps to be honest about your time, skill level, and how much patience you have for living through a renovation. Starting small and doing things right is always better than rushing through a big project that wears you down.

Many buyers underestimate how demanding a renovation can be. It is not just about paying for materials and labor. The process often takes longer than expected and can affect your daily routine. Planning ahead, setting a realistic budget, and allowing some flexibility for unexpected costs will save a lot of frustration later.

A fixer-upper can be a great investment and a source of pride if you approach it with the right mindset. Go in with clear expectations, make a plan that fits your lifestyle, and give yourself time to enjoy the process. The work is worth it when you see the home come together in a way that feels truly yours.

Prioritize Structural Issues Over Cosmetic Updates

If you’re considering a fixer-upper, my best advice is to approach it with a clear plan and realistic expectations. Renovations can be rewarding, but they often uncover more work than you expect. I’ve helped many buyers through this process, and the most successful ones take time to understand the scope before committing.

Start with a thorough inspection and prioritize structural and mechanical issues, as those are the areas that truly affect value. Cosmetic updates are the easy part. I always encourage clients to work with experienced contractors, get multiple estimates, and build a contingency into their budget for surprises. It’s much better to know your costs upfront than to be caught off guard halfway through.

The fixer-uppers that turn out best are the ones where buyers stay focused on the numbers and long-term potential. If the home’s location and foundation are solid, and you go in with a smart plan, it can be one of the best investments you ever make.

Walk Property with Qualified Contractor First

My number one piece of advice for anyone buying a fixer-upper is simple: anticipate higher numbers across the board. Whatever you’re planning for labor costs, material expenses, and project timelines — increase them. A home inspection, while valuable, won’t reveal the full story of what you’re getting into. Take the extra step of walking through the property with a qualified contractor who can provide realistic estimates on costs and timelines. This additional perspective will give you a much clearer picture of the investment required and help you make a more informed decision before committing to a property that might become a money pit. Getting those professional eyes on the project early can save you from nasty surprises down the road.

Replace Water Heaters Older Than Ten Years

Checking the age of the water heater is one of the simplest and most important steps before renovating.

We replace any unit that is 10 years or older.

The reason is simple: water heaters rust from the inside out. They may look fine on the exterior, but corrosion builds until it suddenly fails, flooding the area around it.

Many Plano homeowners try to save money by keeping what looks like a working unit, only to face a major leak after their remodel is complete. Imagine installing new hardwood floors only to have them ruined weeks later by an old water heater that gave out.

Spending a little now prevents a costly disaster later.

Multiple Inspections Reveal Hidden Problems

My top advice here would be to get a thorough inspection. This will really help identify what exactly you will need to fix, how much it’s likely to cost, and what your priorities should be as you begin addressing things. I have had the best luck with even having multiple inspections, since some inspectors will miss things others might pick up on.