Greater Phoenix’s residential real estate market weathered unprecedented challenges in 2023, with factors such as a shortage of listings, record-high mortgage rates and hesitant sellers making it the toughest year for the market since 2009, according to the latest market data reports from Phoenix REALTORS. Yet despite the challenges, REALTORS are turning their gaze towards a more promising 2024, as they witness signs of improvement and new opportunities on the horizon. And five Metro Phoenix ZIP codes distinguished themselves for having the biggest home sale price increase in 2023 compared with 2022.

READ MORE: AZ Big 100: 50 real estate companies to watch in 2024

“Interest rates are down over a point from October, and we’re moving into the prime home sales season,” said Sheryl Bowden, new president of Phoenix REALTORS’ Board of Directors. “Experts predict that the worst is behind, with many opportunities ahead for both buyers and sellers.”

According to a recent American Community Survey from the Census Bureau, Phoenix virtually tied for first, and Maricopa County remains the top growing area in the United States. The uptick of new families moving into the Valley for career changes, business opportunities and quality of life, primarily from California and the central Midwest, is driving demand for quality housing.

“There are hundreds of new homes and apartments under construction, and we’re anticipating major interest in downsizing by current homeowners,” said Bowden. “The population growth, dropping mortgage rate and increasing housing stock is creating optimism that the market will turn in 2024.”

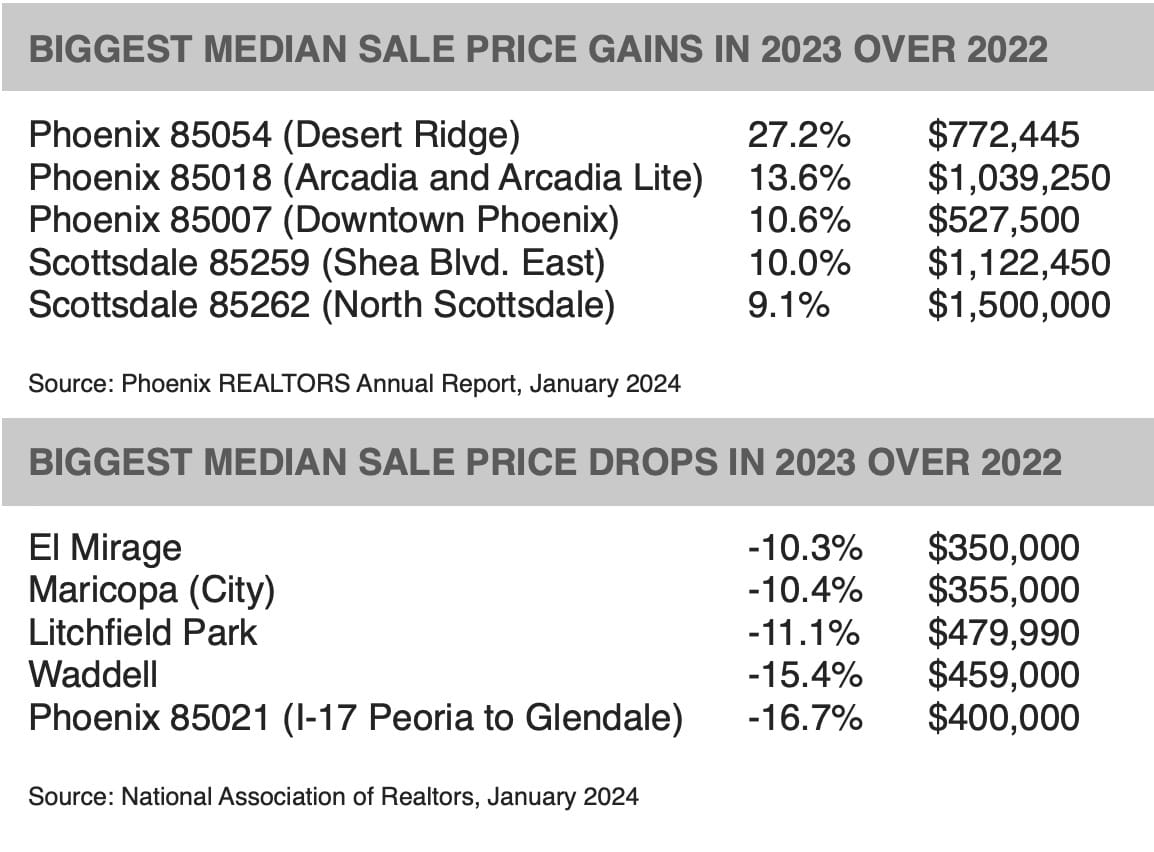

Here are the five Metro Phoenix ZIPO codes with the biggest home sale price increase and the five with the biggest decrease:

Median sales prices were only down 4.3% in 2023 compared to a year earlier, yet the more than $440,000 per home was the second-highest annual median in Valley residential real estate history. Though prices are holding relatively steady, new listings dropped by 23.8% from a year earlier, yet the monthly inventory supply was up 3.7%.

“With fewer homes available and demand increasing, the number of days a home was on the market ended the year at 65, down from nearly 70 four months earlier,” Bowden said. “This means that we should be seeing faster turnover into 2024.”

Workforce-priced housing, homes selling under $300,000, moved quickly with an average of 57 days on the market. Homes between $300,000 and $500,000 waited about the same as the previous year’s 65-day average until sold. Homes listed at over $500,000 were on the market a little longer, 67 days.

Phoenix REALTORS’ data set recapping 2023 also revealed that the percent of asking price buyers gleaned in 2023 was down slightly, 1.7% under list price, compared to 2022 when buyers received the listed price. The most robust market came from homes priced between $300,000 and $400,000, gaining 5.1% in sales over 2022.

More homes in the $500,000 plus range sold than those priced under $400,000, with 26,247 premium-priced homes compared to 26,050 others.

Home size also played into the numbers, with a 13.5% year-over-year increase for homes over 2,500 square feet compared with two-digit declines for homes under 2,500 square feet.

Phoenix and the East Valley had the strongest price gains in 2023. Primarily, the west side and outlying communities had the weakest price performance.

Looking ahead, Bowden sees significant opportunities for improvements over 2023. With declining interest rates and the Federal Reserve Bank’s intention to avoid increases, she believes sellers will become more motivated to offer their homes and move to downsize or change neighborhoods.

“We have several major employers coming online late in 2024 and early in 2025,” Bowden said. “This means another influx of new families moving to the Valley over the next two years and needing housing.”

Bowden says many long-time owners in family-sized units have significant equity and may downsize to empty-nester homes with all-cash or very low mortgage requirements.

“This could make for a strong comeback in 2024,” she said.