United States healthcare is on the brink of change.

Soaring costs, advanced technology, a sudden influx of newly insured patients delivered by the Affordable Care Act, and, especially, new thinking about the optimum way to provide the best healthcare, make up the critical mass to power the transformation.

As the delivery model evolves, so will the real estate – the structures that house healthcare services.

Hospitals and medical office buildings, doctors’ offices, labs and rehabs, emergency rooms and surgical suites, clinics and telemedicine call centers will eventually change or rearrange to accommodate the new framework.

In fact, those who say the physical structure changes influenced by the ACA will be minimal, rely on the fact that forward-thinking healthcare providers have already been focusing on the emerging trends.

Banner Health, Arizona’s largest healthcare provider, was moving toward a “keeping people healthy” focus rather than just treating sick patients long before the ACA arrived to accelerate the process.

“The ACA is only a piece of the picture,” says Kip Edwards, Banner Health’s vice president of development and construction. “The bigger piece is where healthcare needs to go – toward population health management.”

That means emphasizing preventive and primary care, and making it easy, accessible and affordable, he says. To accomplish that, we need to place primary care physicians and specialists, imaging, labs and wellness services in neighborhoods — and sometimes even at the other end of a phone or computer screen.

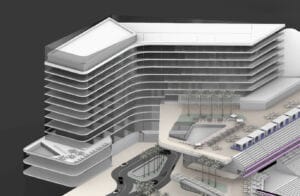

To that end, Banner is developing community-based “health centers,” that are multi-specialty clinics ranging in size from 20KSF to 100KSF, with space for as many as a dozen doctors, diagnostic testing capabilities and extended hours.

So far, Banner has opened eight in Maricopa County and more are needed, Edwards says.

Dr. William Ellert, Abrazo Health System’s Chief Medical Officer, also identifies the ideal healthcare delivery model as community-centered.

Abrazo, Arizona’s second largest healthcare provider and parent of six Arizona Hospitals, school-based health centers and a health group plan with 19 clinics, opened the state’s first stand-alone emergency department in Peoria in 2010, and located a second one in Buckeye a year later.

Abrazo has now teamed up with Dignity Health to form the Arizona Care Network — more than 2,000 physicians linked in an integrated system to provide collaborative patient care. Dignity Health is parent to St. Joseph’s Medical Center, which includes Barrow Neurological Institute, as well as Chandler Regional Medical Center and Mercy Gilbert Medical Center. Phoenix Children’s Hospital also joined the expanding network.

The consolidation and collaboration of healthcare services — and providers — is driven by clinically sound principles, Ellert says, but cost effectiveness is the bonus by-product.

Most importantly, it’s the optimal path toward improving overall health outcomes.

“The United States is 37th in the world in outcomes,” he says. “It’s not a pretty picture.”

That’s because traditional U.S. healthcare systems focused on treating sick people instead of trying to keep them from getting sick.

CHANGING FOCUS

But the changing focus and the provider collaborations will need more and differently designed facilities.

And the big obstacle, Edwards and Ellert say, toward developing the ideal healthcare network – and the appropriate real estate to service it — is an antiquated “fee for services” remuneration system.

“Transition is not easy,” Ellert says. “If you have a lot of hospital beds, the desire is to keep them full. But we want to just have the right people in hospitals. We don’t want to be paid for heads in beds, we want to be paid for outcomes, to be rewarded for keeping people healthy.”

That, Edwards says, means getting paid to take on the overall healthcare for a population of patients, and not getting paid for the number of MRIs performed or the number of office visits or in-hospital days logged.

Banner and Abrazo see the ideal healthcare delivery system as focused on total patient care, with wellness as the prime goal, and primary care physicians as the key drivers.

Arizona’s healthcare giants also agree that the new delivery system will eventually need a new real estate structure to align with the new goals.

Eventually is the key word.

While the experts look forward to more medically effective — and more cost effective — systems and structures, theories about what those facilities will look like, what they will house, and where they need to locate varies.

Arizona, possibly because of that uncertain outlook, is foot-dragging, says Greg Vidor, president and CEO of the Arizona Hospital and Healthcare Association, the largest and most influential advocacy group representing the state’s healthcare providers and their patients.

“Organizations are looking at what’s coming and where it’s headed,” Vigdor says. “But the picture is muddled.

“The status quo isn’t really an option, but which way to go? The dominant theme has been merge, affiliate, partner. That is, ‘If we all get bigger, it will get better.’”

But for the developers, owners, managers and investors in the MOBs preparing for the evolving delivery systems, it’s like a giant guessing game. It’s an expensive proposition if they guess wrong.

“Arizona has come out of the recession slower, and we as a state have not reacted as quickly to ACA implications as other states have,” says Healthcare Trust of America CEO Scott D. Peters.

The Scottsdale-based REIT has invested more than $3B in healthcare real estate, with a current portfolio of more than 14 MSF in 27 states, 1.4 MSF of that in Arizona.

HTA “likes Arizona as an investment,” Peters says, and his company is ready to react when the state legislators and the state’s physicians and providers sort out their direction and timing.

Ensemble Real Estate Solutions CEO and managing director Bill Molloy, agrees.

Phoenix-based Ensemble manages, leases and develops medical office buildings in three states with a current portfolio of 169 properties totaling 8 MSF.

Among the national system changes both Peters and Molloy note is the integration of healthcare providers to create cost efficiencies and eliminate redundancies — for example, physicians clustering into large groups to share overhead and clout, and hospitals hiring physicians or affiliating with the big physicians’ groups.

That’s the “merge” trend described by Vigdor and evidenced by the Arizona Care Network link-up of Abrazo, Dignity and PCH.

“We travel across the country to compare notes,” Molloy says. “Five years ago, all the hospitals were talking about acquiring doctors. We thought, ‘That’s not happening here.’ We do seem to have a pioneer mentality, and that’s probably why we are resistant. But the train has left the station, and this is the healthcare future. We are doing it now, but somewhat reluctantly.”

Kate Morris, CBRE Healthcare Services Group’s first vice president, agrees that a wait-and-see attitude has partially paralyzed those who build, renovate or invest in Arizona’s healthcare buildings of the future.

The good news, she says, is that the local real estate market is finally starting to react.

“There’s been a lot of new activity in the last six months,” she says.

And what is the MOB concept du jour designated to handle the system transformation?

The single-doctor suites will “go away,” Morris says, and the new MOB model will be a bigger building with larger suites for the physician groups and expansive quarters for medical services such as labs and imaging centers.

Many of the older MOBs can be “repurposed” to fit the needs of the changing system, says Morris’ colleague Vince Femiano, while new ones will be built to suit the new format.

“It’s exciting,” Femiano says. “There is a new opportunity to build 30KSF to 50KSF MOBs in secondary markets, and as for the older MOBs, investors want to bring them up to new standards.”

Among the major factors accelerating the process, now that the ACA is a done deal, is anticipation of a big spike in the number of people insured — a whopping 32 million people nationwide, about 900,000 of them in Arizona, says Chelsea Maddox, director for the Cushman & Wakefield’s Phoenix-based Healthcare Practice Group.

“There are millions who didn’t have access before, and who will now be able to see a physician,” she says. “First and foremost, there will be an increase in the need for space based on the increase in volume. The efficiency of space is becoming extremely important.”

Maddox expects new MOBs to pop up in currently under-served neighborhoods, stretching deep into the communities rather than on or near hospitals, even though the physicians and services may be part of — or affiliated with — the major hospital systems.

She defines the new framework as a “hub and spoke system,” with the primary care facilities treating outpatient needs within the communities and pushing those who need inpatient care to the parent hospitals.

Peters, however, expects those new and newly remodeled MOBs to cluster on or around hospital campuses, where doctors and their patients can find the supporting services they need for cost-effective care.

He defines the on-campus MOBs as “core critical,” although he says HTA has some successful outlying properties in other states, and he is eyeing some northeast Phoenix land as attractive for possible future development.

Edwards of Banner Health says both on- and off-campus MOBs will be essential for a cost-effective system.

“Cardiologists and surgeons will need to be close to the hospitals where the bulk of their care happens,” Edwards says. “But primary care physicians, specialists and imaging labs will be needed in the communities.”

Regardless of where they think the MOBs of the future will be located, all the experts agree there is a growing need for bigger and differently configured facilities to house the bigger physician groups and more outpatient services.

“There is so much pent-up demand for new, efficient space,” Maddox says. “There’s a lot of buzz about new development.”

As for the existing MOBs, many are in the right places now and can be easily converted to handle the larger doctor groups and the added services, says Donna Jarmusz, senior vice president for Strategic Healthcare Initiatives for Alter+Care.

“From a real estate perspective, under the new delivery system, the hospitals will be locating outpatient facilities in outlying areas, close to where people live and work,” Jarmusz says. So even if formerly entrepreneurial doctors practicing in smaller suites in smaller buildings join a hospital network or physician group, they may get to stay in place — at least for the short term — if that place is geographically desirable.

ENOUGH BEDS

As for the hospitals, with the shift from inpatient to outpatient care, most of the experts agree that Arizona has enough beds for now.

“My opinion is we are at about the right number, because the population insured is increasing but the need per person is decreasing,” says Edwards.

Still, Banner just built a new patient tower at Estrella because some of the beds, like some of the MOBs, are not necessarily in the right place for the population growth.

But even that new development was designed to include the most cost-effective use of resources from building materials to technology, said Chris Jacobson, vice president for healthcare pre-construction at McCarthy Building Companies.

“ACA is not driving change as much as is the rising cost of healthcare,” he says.

Jacobson sees a much greater demand for his future services in retrofitting hospitals for new technology, improved infrastructure and more cost-efficient operations than for building new.

For at least the next few years, new healthcare construction in Arizona will be concentrated on outpatient facilities, he says.

So, if all the experts agree that there is a growing need for more and different ambulatory care facilities, when can we expect to see this burgeoning bubble of new building to begin?

“The time has come,” Jarmusz says.

Several East Coast communities have jumped feet first into the muddied pool, she says.

They have employed various approaches to the new focus on wellness and cost efficiency from providing virtual healthcare through telemedicine techniques to renovating doctors’ offices as time-shares to building health facilities in retail centers.

But, like Arizona, most states are testing the waters and tweaking the system – and real estate development plans – at a cautious pace, she says.

Jarmusz sees the radical makeover unfolding nationwide within a five- to 10-year time frame.

In fact, Arizona is not as far from the front lines as some may believe, thanks to forward-thinking local healthcare leaders.

Long-term, Jarmusz foresees all the older, smaller MOBs ultimately being replaced by the healthcare villages – the new concept that Banner Health has already been developing in Arizona.

And she describes the emergence of “free-standing ERs with no beds,” developed by some East Coast-based healthcare trendsetters, as “revolutionizing” the industry.

By that definition, Abrazo would qualify as among the generals leading the charge.

Arizona’s healthcare providers have the foresight, and they would like to move even faster towards the ideal, they say, but they remain encumbered by the outmoded cost-system and an outdated physical structure.

Ellert of Abrazo, says morphing to the ideal system “without bankrupting everybody” is “dangerous territory.”

“That’s the balancing act,” he says. “We still have a fee for service (payment structure), and we want to keep our healthcare systems healthy while we are in transition. We’re going to struggle for a while.”

Edwards of Banner agrees.

“The most perplexing question is how to transition,” he says. “We have to function in today’s system or we won’t have the money to get there.”

The good news for Arizona is its desirability as a destination.

“The advantage is our population is growing,” Ellert says. “In terms of real estate, since we are growing, we can build the new models because we are having to build anyway.”