The number of Generation Z members is estimated at 69.58 million, or about 21% of the U.S. population. Born between 1997 and 2012, they’re already making their mark on American society. And these up-and-comers are looking for a place to call their own where they make a difference. But where? And which Arizona cities offer the greatest hope for Gen Z homeownership in the future?

READ MORE: AZ Big 100: 50 real estate companies to watch in 2024

Moving out and getting your own place has never been easy. However, this is painfully true for America’s youngest, who have already faced a pandemic, crippling inflation, historically high mortgage rates and an overall turbulent economy. The most recent Census data shows that the share of Gen Z householders (adults younger than 25) who own their home is less than 17%. Naturally, despite market hurdles, this percentage is only expected to continue to grow, just like the demographic itself.

Yet, only a few young adults dare to dream of homeownership — and even fewer actually get the opportunity to do so. That’s because, on top of the high mortgage rates and equally high home prices that define the modern U.S. housing market, many young people aspiring to buy must also face entry-level incomes, unemployment, and scarce housing options to boot. Even so, not all hope is lost.

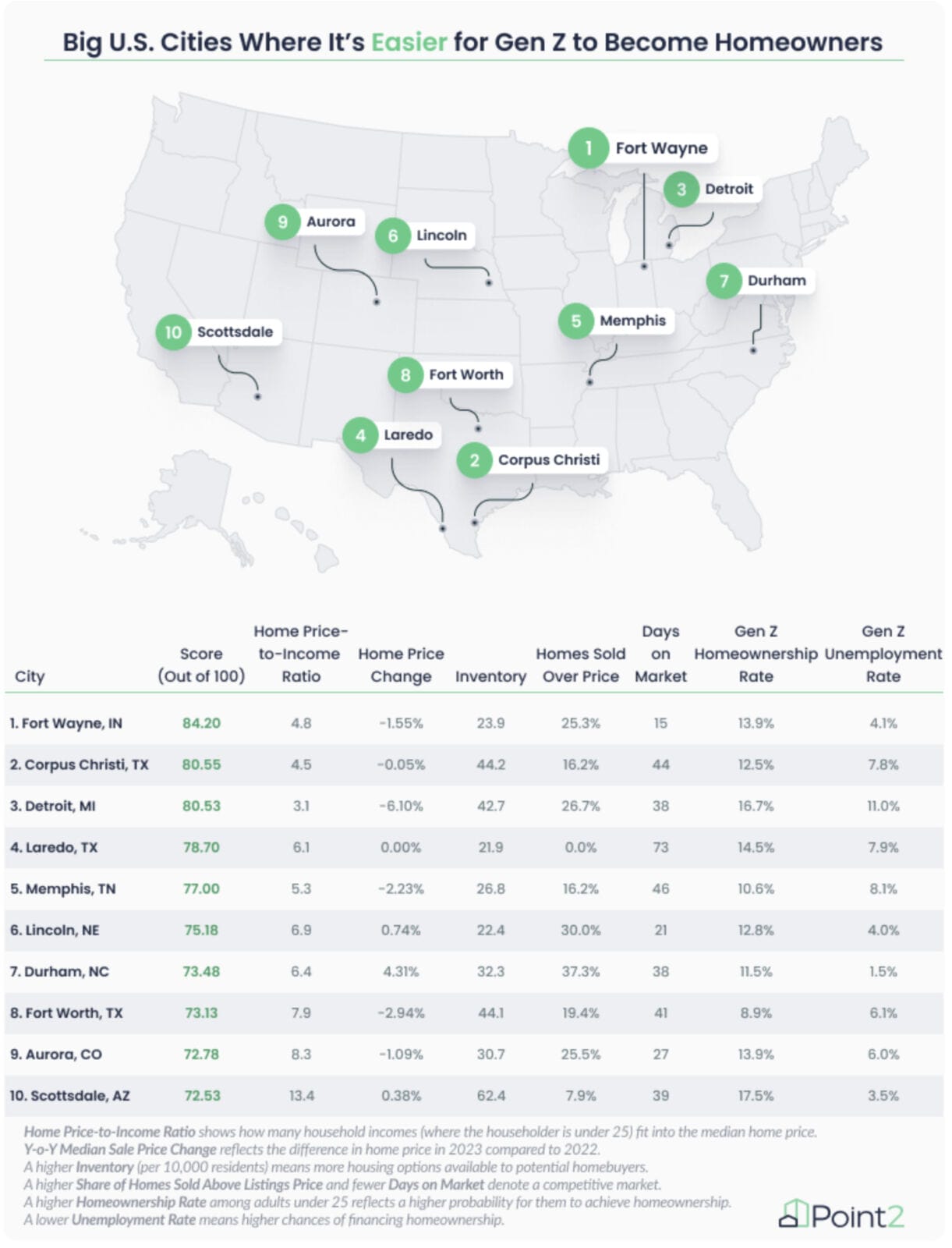

To assess the feasibility of Gen Z homeownership in the country’s 100 major cities (including the five New York City boroughs), Point2 ranked them based on seven metrics:

- Home Price-to-Income Ratio – to see how many household incomes (where the householder is under 25) would be needed to reach the median home price in a market

- Median Sale Price Difference – to understand how home 2023 prices are more impactful compared to 2022

- Inventory (per 10,000 residents) – to evaluate how many housing options are available

- Share of Homes Sold Above Listing Price – to assess bidding wars and competitivity in a market

- Days on Market – to determine how quickly homes fly off the market and measure competitivity

- Homeownership Rate – to assess the real probability of adults under 25 achieving homeownership

- Unemployment Rate – to see where young adults have lower chances of financing homeownership

We then used weighted averages of these metrics to calculate where young adults under 25 have the best chances of becoming homeowners. As it turns out, major cities in the South and the Midwest might have what it takes to help Gen Z start putting down roots. Scottsdale secures the 10th spot among the 100 large cities analyzed where homeownership is more accessible for the younger generation. Gilbert also shows promise for young buyers with the lowest youth unemployment rate and the highest young homeownership rate in the state.

America’s Youngest Homebuyers Stand a Better Chance in the South & Midwest

Although still new in the housing market, Gen Z’s homebuying patterns already diverge from those of older generations due to their unique lived experiences. Growing up during a global crisis, they have a heightened focus on wellbeing and going with whatever feels right. And for many, what feels right is having stability earlier in their lives compared to, say, millennials when they were the same age.

Student loans and the rising cost of living means that Gen Z inherited the affordability concern from millennials. So, when we factor in multiple metrics that might influence the attainability of homeownership for young people — such as household income among adults younger than 25 years old, Gen Z homeownership rate, and unemployment rate among this cohort — some cities emerge as homebuying pockets for America’s youngest.

First, Fort Wayne, IN, offers the highest chances of homeownership by ranking particularly high in terms of home price-to-income ratio and the unemployment rate among the younger segment of the population. Next up is Corpus Christi, TX, where homes cost about five times Gen Z’s median income, which propels it to the top of the list of cities that make homeownership a less-distant reality for youngsters.

Similarly, Gen Z would have the third-best chance of becoming homeowners in Detroit. Despite ranking in the bottom half in terms of youth unemployment rate and homes sold above listing price, the city compensates by having a 6.10% drop in home prices, the best home price-to-income ratio among all of the cities analyzed, and one of the highest homeownership rates among Gen Zers at 16.7%.

Gen Z Homeownership Close to Impossible in Big California Cities &… Lexington, KY

There have been increasing reports on how Gen Z leans toward a more simple life and refrains from putting down roots in expensive hubs like LA, for example. of course, this is just as well because homeownership in such a powerhouse city is a pipe dream nowadays.

There’s no love lost between America’s youngest potential homebuyers and Fremont, CA. Here, million-dollar home prices are almost 23 times the average young person’s household income, yet homes are flying off the market in just 10 days — often going above the listing price. To put it into perspective, the cost of living in this exclusive city is 77% higher than the national average. It’s no wonder that Fremont has the lowest percentage of Gen Z homeowners among all large cities analyzed.

Likewise, San Diego does not make things easier for young people looking for their place in the sun. The housing shortage has been an ongoing issue here — not that a young professional under 25 would have the means to buy in the city even if there were more homes for sale as sale prices approach the $1 million mark.