Homeownership is one of the best ways to build wealth. According to the U.S. Census Bureau, Americans who own property have a median net wealth nearly 75 times greater than those who rent. However, owning a home remains expensive, and prospective buyers must hurdle the financial barrier to homeownership. With that in mind, how long does it take for Metro Phoenix households to save for a home?

MORE NEWS: 50 Arizona commercial real estate leaders to watch in 2025

After several years of climbing home prices and interest rates, some markets are now reaching an equilibrium, making homeownership slightly more affordable. However, households who have already spent years saving for a down payment must also balance the high cost of living. Additionally, mortgage rates have only decreased marginally in the past year, and buyers in coastal areas face larger insurance premiums due to climate change.

More and more households, especially low- and middle-income, still struggle to come up with funds to meet the 20% down requirement, even if their city now has a lower cost of homeownership.

To better understand the financial barriers homebuyers across the country face, we at RealtyHop looked at the years required to save up for a down payment in the top 100 most populated cities in the U.S.

Key Findings

- The report found homebuyers in Phoenix would need to save for 6.17 years to afford a $95,000 down payment on a home. The city currently ranks 36/100 in terms of greatest barrier.

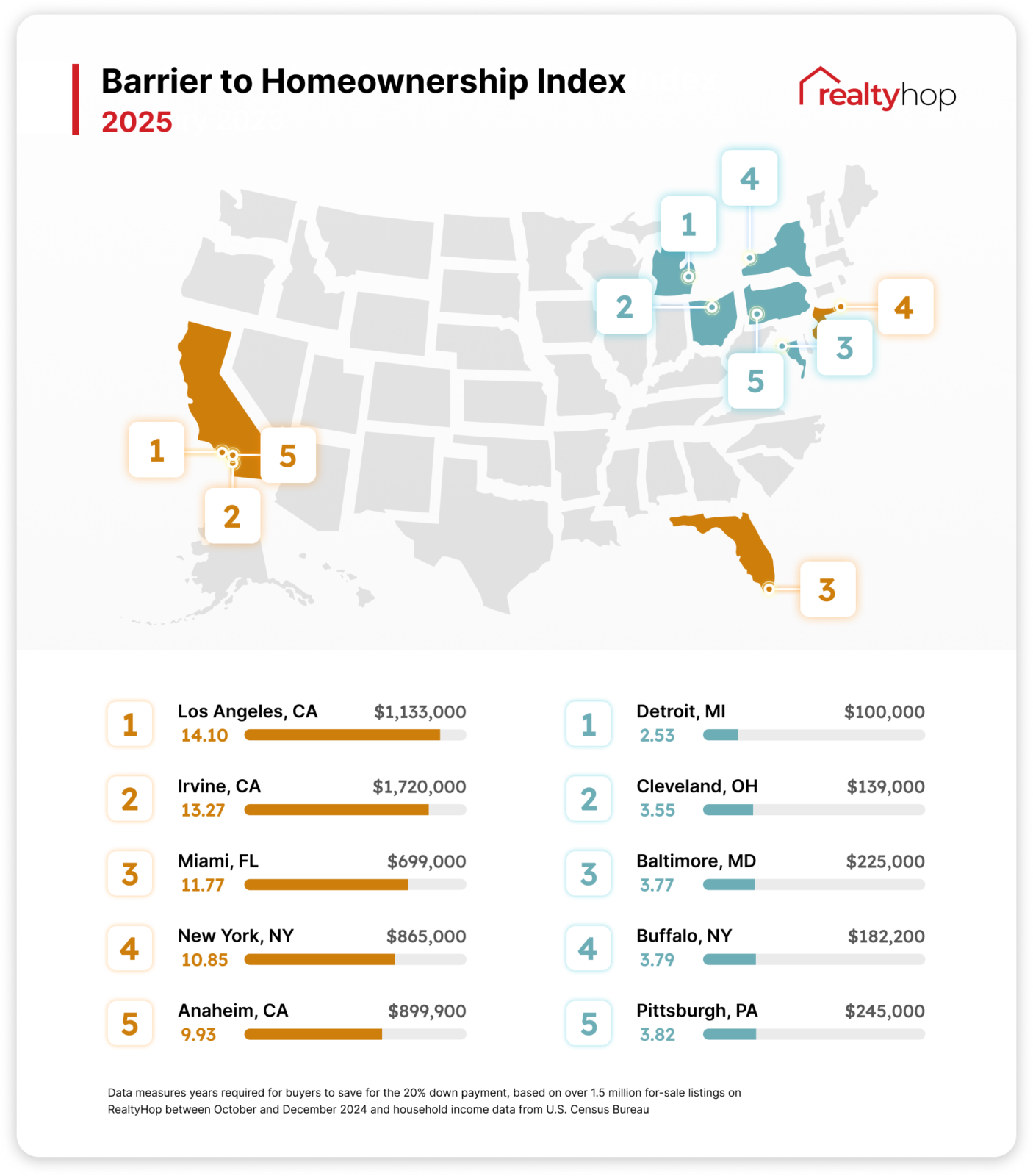

• Los Angeles is the city with the worst barrier to homeownership. It takes 14.10 years for an average family in L.A. to save enough funds and qualify for a conventional loan. - On the other hand, it takes only 2.53 years for a family in Detroit to afford the 20% down payment on a home.

- California outranks all other states, with six cities in the top 10, including Los Angeles, Irvine, Anaheim, Long Beach, San Jose, and San Diego.

- The barrier to homeownership is generally higher along the West and East coasts. In Chicago, the third most populous city in the U.S., it takes 4.66 years for a household to qualify for a mortgage, with 20% down. This number is 6.19 years lower than the largest city, New York, and 9.44 years lower than Los Angeles.

Here’s how Arizona cities rank

The 5 Cities with the Biggest Barrier to Homeownership

1. Los Angeles, CA

With a median list price of $1,133,000, Los Angeles ranks as the city with the most significant barrier to homeownership. If an average L.A. family sets aside 20% of their annual income – $16,073 or $1,339 a month – for the down payment on a home, it will take a whopping 14.10 years of savings to meet the loan requirement. While the barrier to homeownership decreased by 1.64 years since the start of 2024, the high cost of property still makes this market unapproachable for new buyers.

2. Irvine, CA

Another California city made the top five this year, moving up from fourth place to second. While households in Irvine have a high median household income of $129,647, it still takes over 13 years for a typical family to accumulate enough cash to cover a 20% down payment of $344,000.

3. Miami, FL

Miami continues to grow less affordable for prospective buyers. The median list price rose to $699,000 in the past year, meaning local Miami families with a median income must save for 11.77 years to accumulate a down payment.

4. New York, NY

Despite increasing housing costs, the barrier to homeownership slightly improved in New York City this year due to a growing household income. Households now earn a median income of $79,713 and will spend 10.85 years saving for a down payment of $173,000.

5. Anaheim, CA

Anaheim moved up three spots this year to become the city with the fifth largest barrier to homeownership. Households in this city will need to save $18,117 for 9.93 years if they plan to afford a home with a median list price of $899,900.

The 5 Cities with the Lowest Barrier to Homeownership

1. Detroit, MI

Detroit remains the city with the lowest barrier to homeownership in 2025. However, the barrier did increase this year. While the median household income grew to $39,575, prospective buyers will now need to save for 2.53 years to afford a home with a median list price of $100,000.

2. Cleveland, OH

Due to relatively low asking prices, homeownership in Cleveland is still attainable for most. An average family can spend 3.55 years saving $7,837 yearly, or $653 monthly, to afford a home. The median list price slightly increased to $139,000 this year, so families now need to save $27,800 for a down payment.

3. Baltimore, MD

Baltimore moved in the rankings and now boasts the third lowest barrier to homeownership. Households with a median income of $59,623 will need to save $45,000 for 3.77 years for a down payment in the city.

4. Buffalo, NY

Buffalo has become more affordable for prospective buyers since last year. The median list price for a home decreased to $182,200, and the household income increased to $48,050. Buyers now only need to spend 3.79 years saving for their 20% down payment.

5. Pittsburgh, PA

The barrier to homeownership decreased in Pittsburgh this year due to a rising household median. An average family making $64,137 can now spend 3.82 years saving $1,068 monthly to afford a down payment for a home in their area.