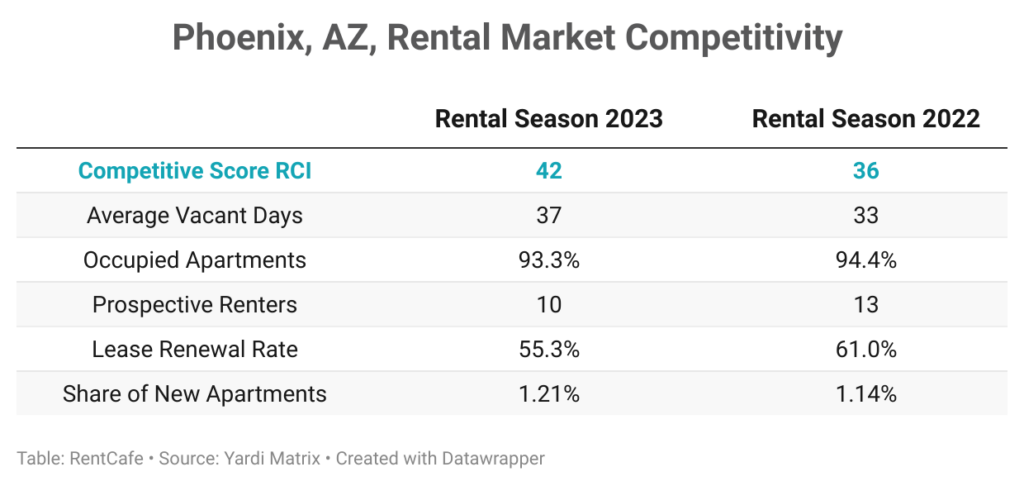

RentCafe just released the highly anticipated Market Competitivity Report, which unveils how easy — or how difficult — it was to find an apartment and how many renters compete for each vacant apartment in peak rental season in 139 U.S. markets. The report is based on 5 relevant metrics: number of prospective renters per vacant unit, number of vacant days for an apartment, occupancy and lease renewal rates, share of new apartments.

DEEPER DIVE: Higher rents and low supply create major shifts in Phoenix multifamily

Despite an influx of new apartments and below-average occupancy and renewal rates (which offer more options to choose from), apartment-seekers still faced a tough competition to secure a place to stay in Phoenix in peak rental season.

Here’s an overview of Phoenix’s competitiveness and a look at how many renters compete for each apartment:

- This summer, 10 prospective renters applied for each vacant unit in Phoenix, down from 13 applicants one year ago.

- Apartments were vacant for an average of 37 days, only 4 days longer than in the peak rental season of 2022.

- Phoenix saw a whopping 1.21% uptick in recently built apartments — one of the highest increases in the nation. This, combined with the lag effect of the pandemic construction boom when 28,000 new units were built throughout the metro, offered renters in Phoenix a larger pool of options to choose from in peak rental season.

- This pushed the occupancy rate below the national average, at 93.3%, especially as more renters decided to move this summer compared to the peak rental season of 2022.

- Only 55.3% of apartment-dwellers in Phoenix renewed their leases, significantly below the share of renters who renewed the same time last year (61%).

- Based on these metrics, Phoenix earned a Rental Competitive Index (RCI) score of 42 in peak rental season, below the national average of 60. But despite the changes in Phoenix’s competitivity in 2023, renters still have a hard time finding an apartment here.

- Taking a broader view, the top 20 is dominated by the Midwest and Northeast, although Miami holds tight to the #1 most competitive spot for the second summer in a row, with a record of 25 renters per vacant unit and a very high occupancy rate of 97.1%. Nearly three-quarters (73%) of renters here renewed their leases in peak rental season, despite an increase of 1.04% in newly built apartments.

- New York made a post-pandemic recovery. To that extent, revived Manhattan joined the top 20 rental markets for the first time in almost two years, boasting an occupancy rate of 94.7% and amid zero new apartments opened recently.

- The highest-ranking Western market is Denver, landing at #33 among the most competitive markets in the nation, where 11 applicants compete for each vacant unit.

Looking ahead, renters in Phoenix have reasons to be optimistic: 14,600 new units are scheduled to be completed here by the end of 2023, making the Phoenix metro area America’s 6th busiest builder this year.