A new RentCafe study delves into historical housing costs and spending patterns in nearly 200 U.S. metros, using IPUMS data. Specifically, we looked at how much Gen Z and Millennials are poised to spend on renting or owning a home by the time they reach 30. That said, how much do Phoenix Zoomers spend on rent by age 30?

LEARN MORE: Here’s how Buckeye leads the West Valley as a hot spot for development

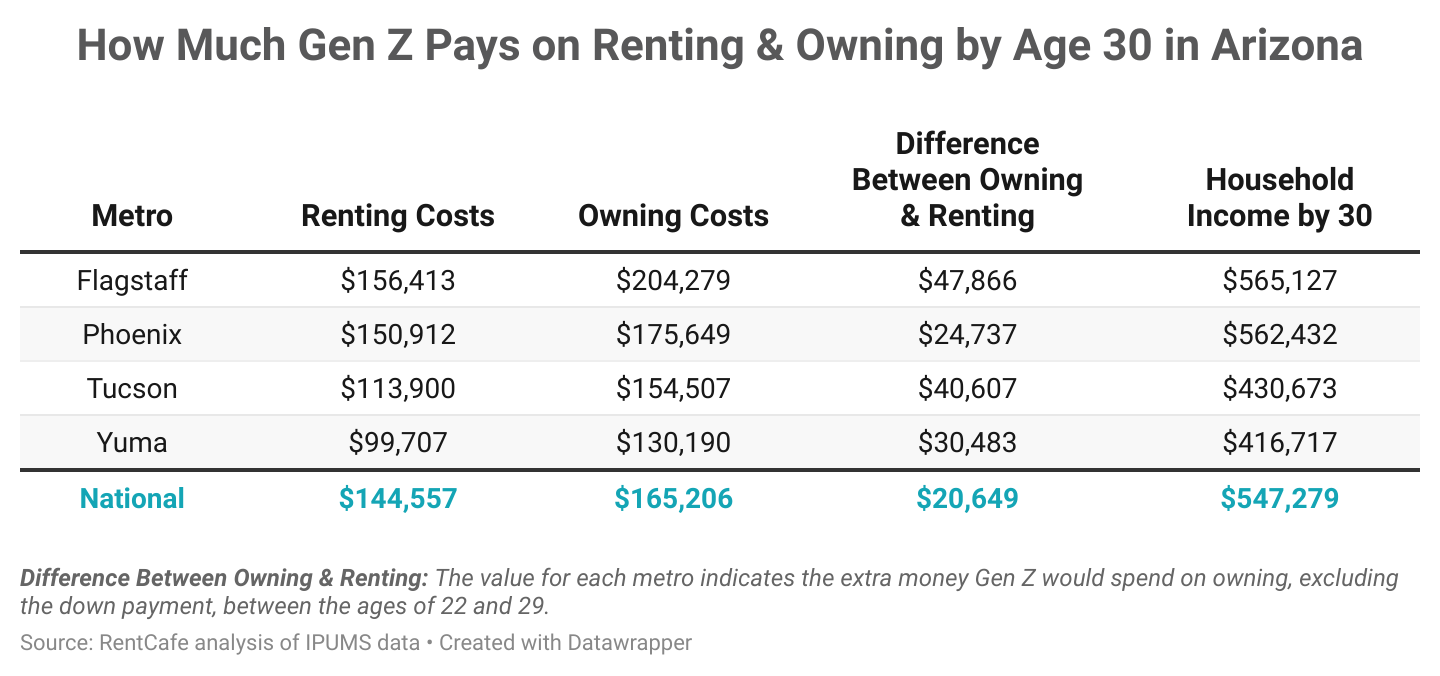

Although Zoomers in Phoenix face the second highest costs for renting and owning in the state, the gap between the two is the smallest. In fact, it’s half of what Gen Zers in Flagstaff need to become homeowners. Moreover, Phoenix Gen Zers’ household income is expected to surpass a total of $560K between the ages of 22 and 29.

Here are the highlights:

- For Zoomers in Phoenix, the costs of renting amount to $150,912 by the time they hit 30, enough to cover the mortgage for a home in Rochester, NY; Baton Rouge, LA; or Kansas City, MO. Owning a home in Phoenix requires $175,649 (covering the mortgage, taxes and fees, but excluding the downpayment).

- While Zoomers in Flagstaff earn the same as those in Phoenix ($565,127) and spend a similar amount on rent ($156,413), homeownership comes with a heftier price tag of $204,279. In other words, Gen Zers in Flagstaff need an extra $47,866 to switch from renting to owning, compared to $24,737 necessary for the transition in Phoenix.

- Zoomers in Yuma spend the least on rent ($99,707) and the least on owning a home ($130,190), but they also earn the least in the state ($416,717). However, Yuma Gen Zers’ potential transition to homeownership is smoother than for their peers in Flagstaff and Tucson, with a gap between owning and renting of $30,483.

- Phoenix Millennials spent less on rent ($126,190), but more on homeownership ($182,568) in the first decade of their adulthoodcompared to Zoomers. Specifically, Millennials in Phoenix forked out $56,378 to switch from renting to homeownership in their twenties— all while their income amounted to $525,302. That’s $37,130 less than what Zoomers are expected to earn over the course of eightyears.

- Nationwide, San Jose’s Gen Zers face the widest gap between renting and owning in their 20s ($170,890). Renting costs Zoomers here nearly $300,000 before turning 30 years old, while the cost of owning a home, excluding the down payment, can reach $466,000 within this eight-year period. At the same time, owning is a non-brainer in Ann Arbor, MI, as it’s $21,400 cheaper than renting.