New data from the first quarter of 2023 shows buyers beginning to adjust to elevated mortgage rates, while low inventory spurs an increase in builder confidence despite growing recessionary fears, according to Christine Cooper, Chief U.S. Economist and Managing Director at CoStar Group. Data shows that home prices in Phoenix have fallen 2.1% since this time last year.

MORE INFORMATION: 10 hottest neighborhoods for home sales in Arizona

MORTGAGES: Mortgage rates remain more than 100 basis points higher than they were this time last year and are 330 basis points higher than two years ago, but home prices have hardly responded as buyers appear to be growing accustomed to a higher rate environment. The rise in mortgage rates has had a more pronounced impact on the number of homes sold than it has had on prices.

HOME PRICES: The median single-family home price of existing homes sold was down by 1.4% in March from a year before, yet 13.1% higher than two years earlier. After accounting for seasonal factors, the median price edged lower by 0.2% in March, after dipping by 0.4% in April.

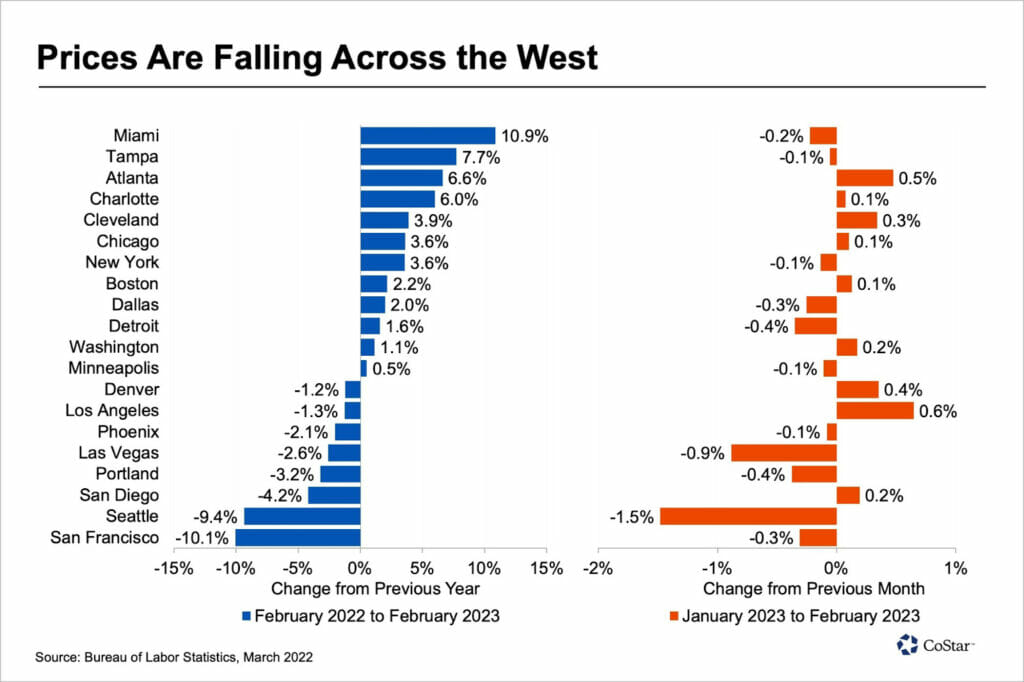

PRICES BY REGION: What may be keeping national home prices afloat is a combination of migration patterns and affordability measures across regions. Home prices in western cities like San Francisco, Seattle and San Diego are falling while home prices in the south like Miami, Tampa and Atlanta are seeing increases since February 2022.

INVENTORY: The National Association of Realtors reported that 980,000 homes were on the market at the end of March, well below the 2017 to 2019 average of 1.8 million. After accounting for the seasonal factors, for sale inventory fell by 2% in March after declining by 1.4% in February.

BUILDER CONFIDENCE: Developers had already pulled back in 2022, but sentiment has improved as many builders see better buyer traffic and strong demand. About 25% of the new homes sold were not even yet under construction, giving builders reason to put shovels to work. The National Association of Home Builders/Wells Fargo Housing Market Index improved in April for the fourth consecutive month.