High-End Distress: The housing crash is now hurting the Valley’s luxury home market

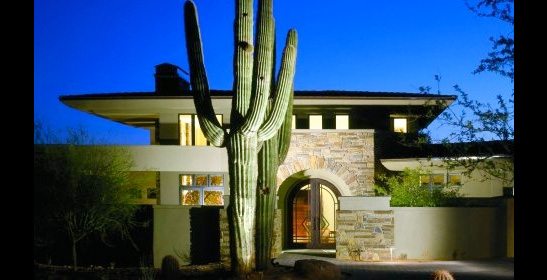

A meticulous five-bedroom, remodeled home sits nestled in one of Paradise Valley’s most beautiful neighborhoods. But the most remarkable thing about this home is not its one-acre lot, new flooring or up-to-date kitchen. It’s the “For Sale” sign that has graced the front yard for two years.

Two years, two different realty companies and several price reductions later, the home finally is generating some energy and a contract is in the works. But, according to information from Coldwell Banker’s luxury home experts with The Walt Danley Group, that never would have happened if the price hadn’t dropped 20 percent in one year and 40 percent from the time it first went on the market.

This scenario is playing out to varying degrees throughout the Valley’s high-end home submarkets, from the Biltmore area to Paradise Valley to North Scottsdale. Real estate professionals say that while wealthy clients clearly are insulated from some of the economic hardships that face production-home buyers, they are not completely immune from them.

Inventory is high, homes are sitting on the market longer and Realtors must convince sellers to lower their expectations on price.

“What’s happening in the marketplace,” says Sandra Wilken of Sandra Wilken Luxury Properties, “is we are trying

to get our sellers to be extremely realistic on their list price. The ridiculous prices of three years ago are not going to happen.”

In 2007, Wilken says buyers in Paradise Valley purchased 133 properties worth $2 million or more. The most expensive ho

me sold for $8.8 million. This year, 62 homes have been sold in that range, with the highest fetching $7.62 million.

Information from the Arizona Regional Multiple Listing Service in two high-end zip codes, Paradise Valley’s 85253 and North Scottsdale’s 85256, shows inventory climbing through 2007 and the first half of 2008 compared to accepted offers. The average price for a property sold in Paradise Valley in September 2006 was $2.328 million. This past August it was $1.606 million.

Break it down

It is important to understand that in the luxury home market, different segments are performing in different ways.

Buyers who can afford a $2 million to $4 million home, or higher, are more insulated from current market conditions.

Tom Fisher calls them “program buyers,” successful and affluent business people who are on track to build homes that some call “family resorts.”

Fisher, owner of Fisher Custom Homes, builds houses that start at $2 million. His clients’ income or cash flow often is tied to the stock market, and while that has bred caution in their spending, in his experience it hasn’t derailed many building plans.

Walt Danley agrees there still is activity in the high-end market, but poor economic conditions fostered by sub-prime lending have, in a sense, trickled up.

Credit crunch

Credit in the form of jumbo loans, or loans for more than $417,000, has dried up as well. Several years ago, buyers could purchase a $1 million home with as little as 5 percent down, says Dean Bloxom, president of iMortgage Services in Phoenix. Some banks asked for 10 percent on $2 million.

Today, loans are available but banks want at least 20 percent down, and clear, documented evidence of someone’s assets and income — a correction that should have happened earlier, Bloxom says.

There are indications the market may pick up some velocity, says Cionne McCarthy, an agent with Russ Lyon Sotheby’s International Realty.

The Luxury Home Tour, which showcases homes in Paradise Valley and the Arcadia and Biltmore districts, recently released figures that show homes in August spent less time on the market.

From Aug. 8 to Sept. 6, homes spent an average of 151 days on the market, compared to an average of 223 days between August 2007 and August 2008.