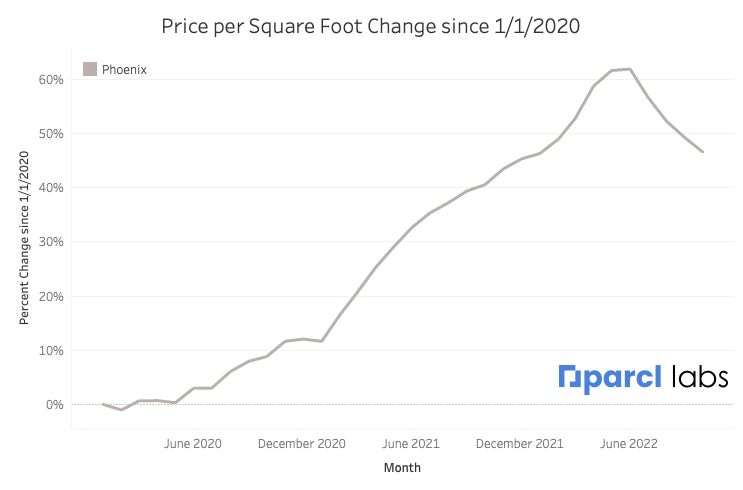

The Phoenix real estate market was a major pandemic winner, up over 50% from the COVID lows in spring 2020; this price performance ranked third out of 20 major U.S. metros. Since Phoenix peaked in Summer 2022, an all time high, it is now down 10%. Surprisingly, iBuyers still hold major inventory in Phoenix despite price cuts.

READ ALSO: Arizona No. 2 for largest house price appreciation

Parcl Labs data indicates that top iBuyers currently hold nearly $1 billion worth of homes in the Phoenix area. For context this dwarves iBuyer activity in other major markets; it is over 2x the next largest market (Atlanta).

iBuyers are changing prices fast. These entities are changing prices of active inventory every 2 weeks in Phoenix. This is the steepest bi-weekly price cutting activity relative to other markets with top iBuyer activity. Other sellers are changing prices just as fast, which is not what we typically see across other markets with significant iBuying activity (iBuyers normally cut prices ~25% faster than non-iBuyers). There is a race between institutions and individuals to find out where the market clearing prices sit in Phoenix.

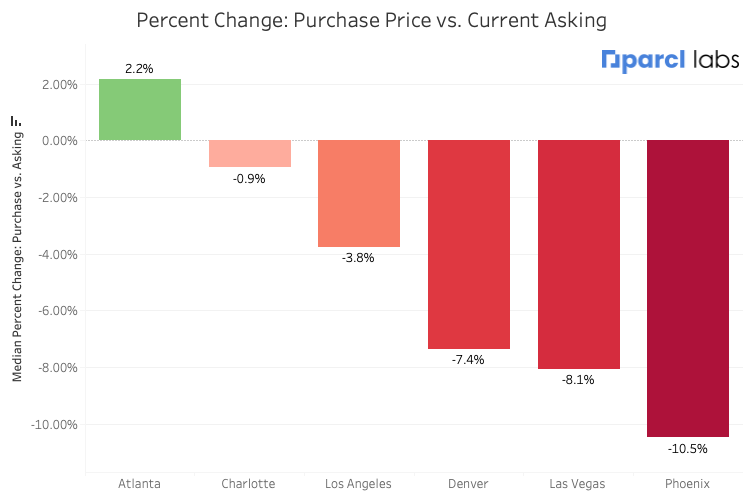

If iBuyers sold their active inventory at current asking prices, we estimate that they would lock in $90m in losses relative to their original purchase prices.

Denver, Las Vegas, and Phoenix have the widest margins to the downside relative to original purchase prices and current asking prices.

Based on what we know about October sales right now, October could be the worst inventory turnover ratio (# sales/total units) month in Phoenix in a decade. External sources have highlighted the rapid rise in total unsold inventory in recent months. Our data corroborates that market liquidity is deteriorating rapidly.

Between elevated iBuyer activity, worsening liquidity, and higher interest rates at the national level, we believe that all of the conditions are in place that could preempt a steeper ‘market crash’ in Phoenix.