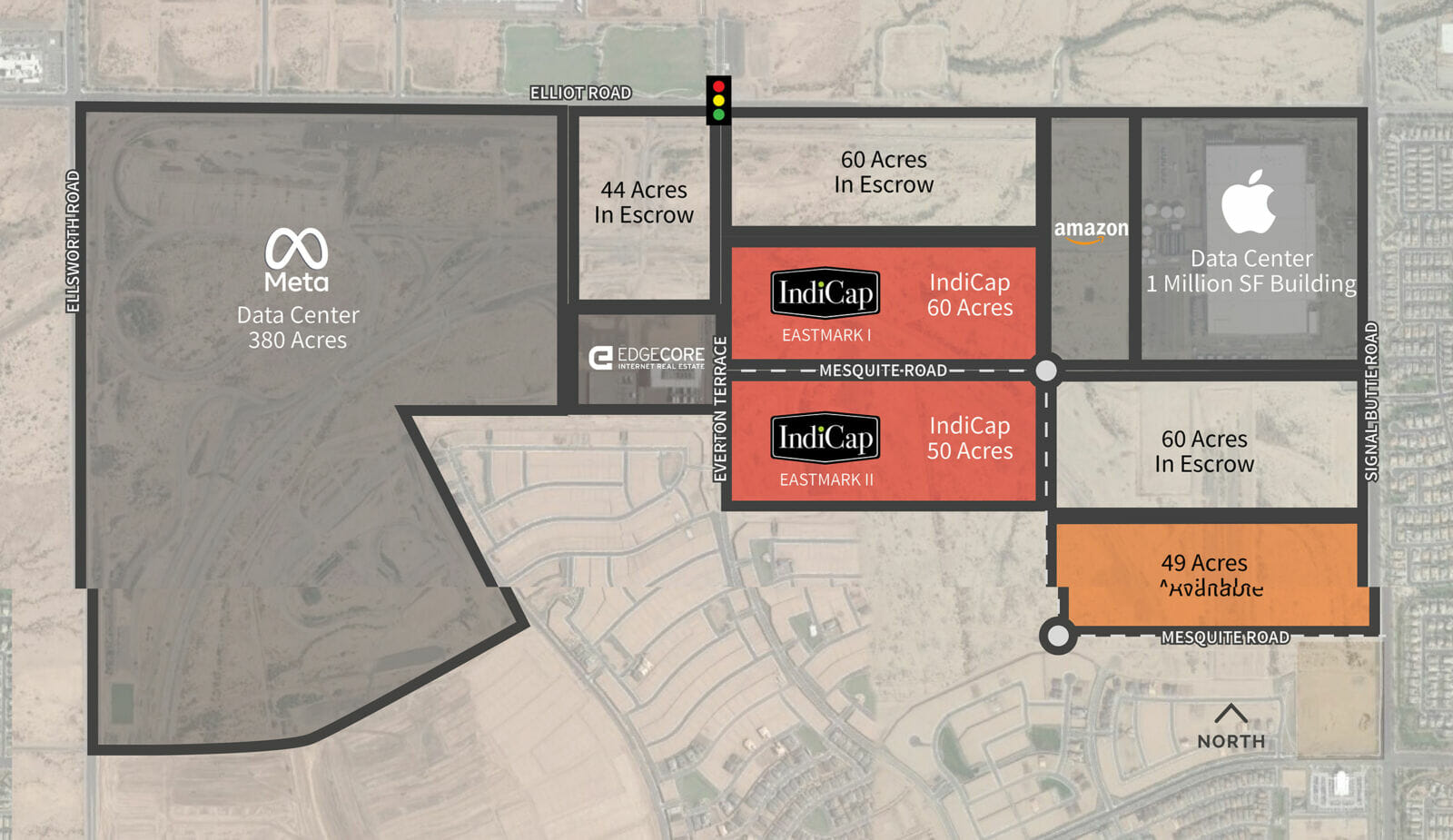

IndiCap, a newly formed boutique commercial real estate company specializing in industrial investment and development in the Arizona and Nevada sectors, in a joint venture with AECOM-Canyon Partners, announced its entry into the Phoenix real estate market with the recent $48 million acquisition of two parcels of land totaling 113 acres in the Eastmark master-planned community located in the heart of the Mesa Gateway submarket.

The project, Eastmark Center of Industry, will contain 10 buildings totaling over 1.6 million square feet of mid-bay and cross dock industrial buildings. Cornerstone companies assisting in the land acquisition and development include Layton Construction, Kimley Horn, Deutsch Architecture and Snell & Wilmer. Pat Harlan, Steve Larsen and Jason Moore from the Phoenix office of JLL represented IndiCap in its site selection and land acquisition.

READ ALSO: Landing 3 industrial development in Mesa sells for $130M

Formed by real estate industry leaders Mike Chernine and Jason Kuckler, the IndiCap development team brings over 100 years of collective experience to the Arizona and Nevada real estate markets. Todd Ostransky, IndiCap’s senior vice president of development (AZ) and Aaron Asmus, development manager (AZ), will lead upcoming Arizona projects including the recently acquired parcels of land. Ostransky is known for his work in the Arizona market and brings over 25 years of experience and a background in bids, negotiations and preconstruction management. Asmus brings over 20 years of national development management services experience.

AECOM-Canyon Partners, a joint venture partnership between AECOM Capital, the real estate investment arm of global infrastructure firm AECOM, and Canyon Partners Real Estate, the real estate direct investing arm of Canyon Partners LLC, a global alternative asset management firm, is providing joint venture equity capital as well as best-in-class development expertise to the project.

“We are excited to kick off our first project in Phoenix’s burgeoning commercial real estate market,” said Jason Kuckler, one of the principals at IndiCap. “This location was strategically selected to allow for easy access through multiple freeway entrances and it offers an incredible opportunity to lease and purchase buildings amongst some of the biggest household names. We see Phoenix as an industrial juggernaut in the Western U.S. which could quickly mature into a core market.”

Buildings at Eastmark Center of Industry will range from 83,200 square feet to 426,400 square feet with 30’ to 36’ clear height and 160’ to 500’ building depth. Future phases may include the opportunity for build-to-suit. The project is located within the Elliot Road Technology corridor, minutes from a full-diamond interchange at Santan Loop 202 and Elliot Road, as well as the State Route 24 extension.

“This Class A project will meet the needs of a wide range of corporate and advanced manufacturing users, from pharmaceuticals to the semiconductor industry,” said Moore. “JLL research shows that metro Phoenix ended 2021 with the strongest leasing activity on record, with almost 26 million square feet of space leased. The Southeast Valley represented 47.8% of those deals. This is a region that is primed for growth and IndiCap is well positioned to take advantage of, and continue to drive, that growth.”

Through their strong local relationships, the IndiCap team will continue their pursuit of prime industrial land in the Phoenix metroplex throughout 2022 and beyond. IndiCap has multiple new industrial projects in its pipeline totaling 37 buildings with over 8 million square feet spread out through the Loop 303 Corridor, Central Phoenix, Mesa, Gilbert and Casa Grande.