A slowdown in venture capital funding has hit the life sciences sector in 2023, driven by rising interest rates, the collapse of Silicon Valley Bank, and general economic uncertainty. Yet, our latest U.S. office market reports continue to show that life science construction is booming and life science properties trade at a premium, the supply pipeline is robust, and the long-term outlook remains positive.

LEARN MORE: Phoenix No. 1 in U.S. for life sciences employment growth

In the previous decade, life science comprised less than 5% of all office construction. In the last two years, it has accounted for more than one out of four new projects, with over 23 million square feet of lab space beginning construction since 2022. The life science development boom was in full swing even before that. Since the start of 2021, 16.3 million square feet of new life science facilities have been delivered. By comparison, between 2010 and 2020, 23.9 million square feet were completed.

In the near term, a supply glut may be on the horizon. On top of the space delivered in the last few years, more than 33.5 million square feet of new life science space was under construction at the end of July, including owner-occupied properties, per the latest office real estate outlook. Yet, any risk of oversupply would be concentrated in just a few markets, as the life science sector remains clustered in select cities such as Boston, San Francisco, San Diego, Philadelphia, Houston and Seattle.

Overall, life science office market outlooks expect a continued expansion for the sector in the future, albeit not at the blistering pace seen in the last few years. Recent breakthroughs in mRNA and CRISPR will drive billions of dollars in investment from both private and public sources. A recent report from Pitchbook and the National Venture Capital Association showed that while the first half of 2023 saw the lowest amount of VC funding since 2019, investment this year will surpass any year before 2018.

Life science assets maintained strong price trends too, although the impact of venture capital funding —– or lack thereof – meant that office sales activity cooled across the board in 2023, including the life science sector. After totaling more than $6 billion in 2022, lab space sales only reached $386.6 million this year through the end of July. However, the properties that have sold, have traded at an average of $770 per square foot, nearly four times higher than the $196-per-square-foot national average for all office buildings.

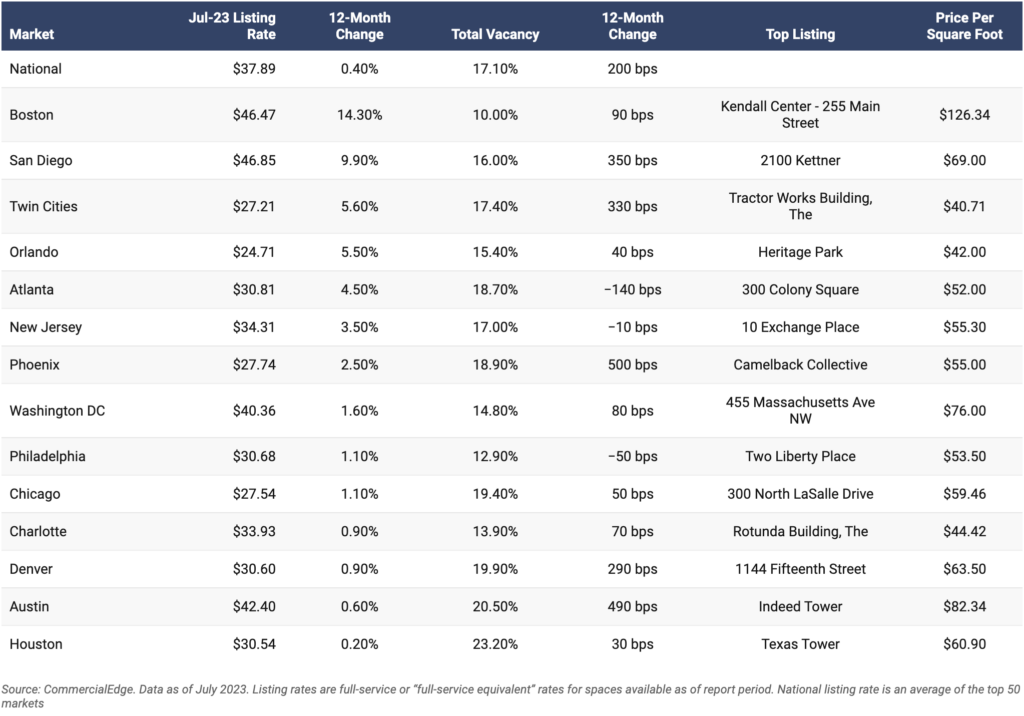

Listing Rates and Vacancy: U.S. Office Vacancy Rates Rise 200 Basis Points Year-over-Year

The average full-service equivalent listing rate was $37.89 per square foot in July, according to our latest U.S. office market report. That represented a 0.4% increase over the previous year and seven cents over June 2023.