Today’s cooling market may be difficult for new homebuyers to navigate, but it’s important to keep in mind the saying: “Marry the house, date the rate.” If you find a home you love and can afford, don’t let current interest rates scare you away from buying. Keep in mind that your rate can be refinanced in the future.

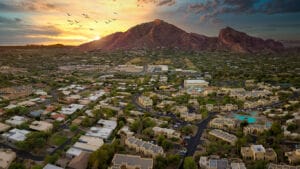

Right now, inventory is up across the Valley. This also increases your chances of finding the right home for you and your family. Rather than focusing on the interest rates, keep these four home buying tips in mind to ensure you find a home that you can afford and is “marriage” material.

READ ALSO: Arizona No. 2 for largest house price appreciation

1. Don’t settle on the first home

As mentioned above, there is a wider selection of homes on the market now than the last couple of years. Work with your agent to schedule several home tours to get a feel for what you need and want from your dream home. Even if you love the first home that you see, check out a few others to ensure it is the best choice.

2. Be open to refinancing

Refinancing will save you money long term, build equity and help pay off your mortgage faster by allowing you to lower the interest rate on your loan terms. When purchasing a home, you lock in a certain rate for your mortgage. However, if rates go down in the future, you can apply for that new rate. Work with a loan officer to help you plan a refinance and provide direction on when you can apply for it.

3. Create a monthly budget

Budgeting gives you a clear picture of what you can afford during the early stages of homeownership when you will be paying the higher interest rates. Calculate your monthly expenses and make sure you can afford your mortgage and other homeowner expenses. Then, once you refinance it will be like getting a raise since you’ll be spending less on bills.

4. What are your goals with this investment

Knowing your goals before buying a property is crucial when it comes to the buying process. Are you buying a home for your family to live in for a while or to flip and resell? If this is a long-term investment, you can ride the interest rate wave and refinance when they decrease. If you are flipping a home and selling quickly, then the interest rate will be less of an issue because you will pay back your loan quicker.

Buying a home is an investment, and the terms are flexible. If you find your dream home, remember that you can refinance later down the line and take advantage of the high inventory and cooling costs now.

Author: Rich La Rue is the Designated Broker for HomeSmart Phoenix, the flagship brokerage operation in the HomeSmart system. For more information, visit www.richlarue.com.