The American household is changing as homeownership is not a priority for everyone, especially not for Millennials and Gen Zs. With 43 million families living in apartments, the highest level in half a century, renting is popular even among high-earners who are able to buy but prefer to rent their home instead. In fact, our most recent analysis of IPUMS data shows that the number of renters with annual incomes of over $150,000 grew by 82% between 2015 and 2020, faster than renters overall, who inched up by 3.2% during the same time frame. There are now 2.6 million high-earners living in rentals in the U.S. and among them is a new ritzy kind of tenant: millionaire renters.

Here are the main highlights:

- Amid a spike of 75% in wealthy-renters, Scottsdale is home now to the second biggest rich-renter community in Arizona, with 5,302 residents. In addition, rich renters represent 13% of the city’s total renter population.

- Although Scottsdale is a magnet for affluent renters, it is not a preferred destination for millionaire renters. Instead, those who make more than $1,000,000 per year opt instead for major urban areas such as New York, San Francisco and Los Angeles.

- What is the situation in the Phoenix-Mesa-Chandler metro? Phoenix takes the lead when it comes to the most populous high-earner renter community in Arizona due to a 122% increase since 2015. However, in the suburbs, Surprise has seen the biggest leap in high-income renters (336%). Meanwhile Chandler and Glendale more than doubled the number of wealthy renters in the past 5 years.

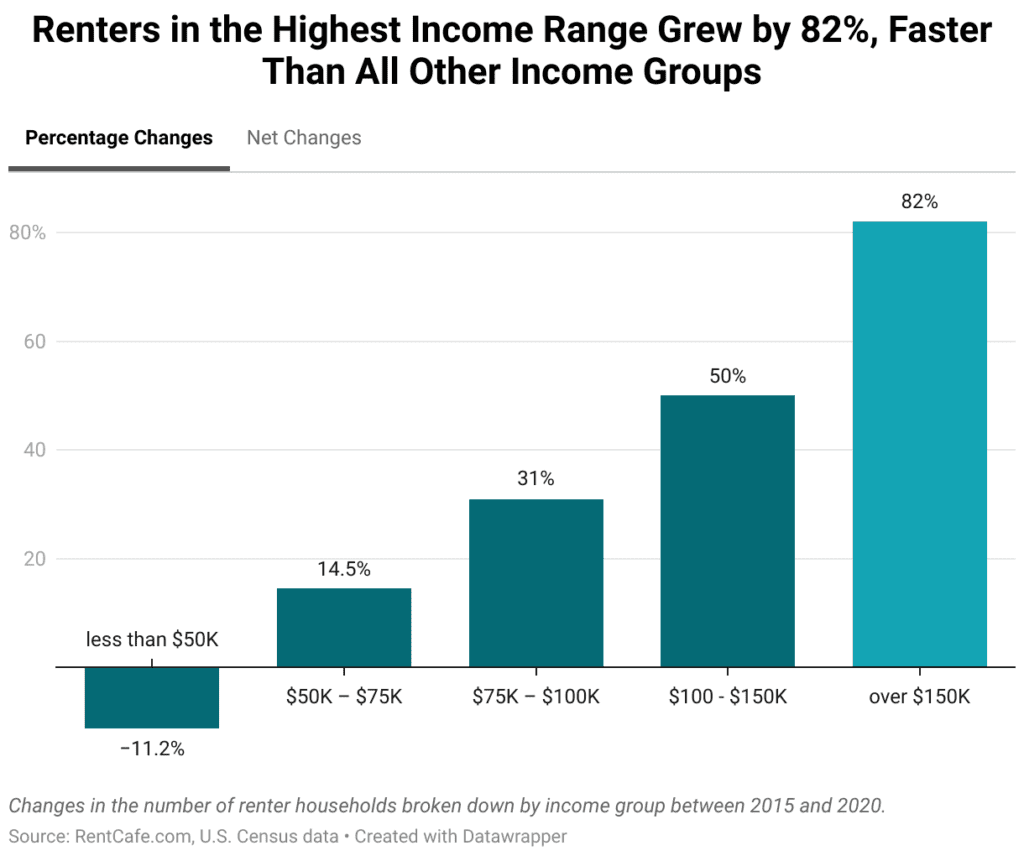

High-income renters earning $150,000 or more saw rapid growth of 82% in five years — the most significant increase among all income groups — followed by renter households with annual incomes between $100,000 and $150,000. At the same time, middle-income renters grew at a slower pace, but still posted double-digit increases. The only segment to register a drop was that of households earning less than $50,000, which decreased by 11.2%. This is explained by low-income renters moving in with family members when the pandemic started, as well as households whose earnings grew and transitioned to higher income groups.

READ ALSO: Ranking Arizona: Top 10 best places to live for 2022

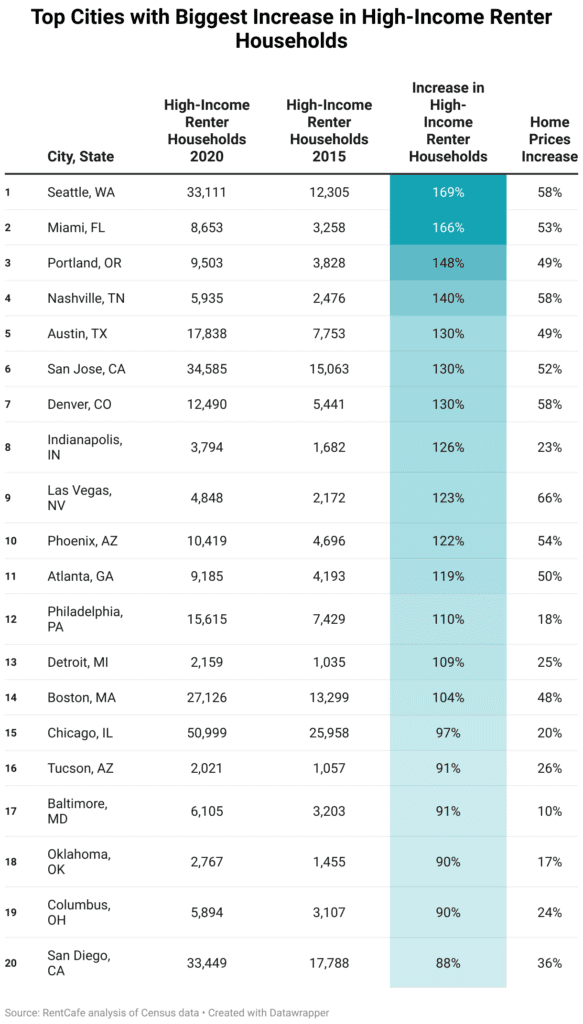

What makes those who can afford to buy turn to renting? Part of the answer may be found in high home prices, which made homeownership less attractive, especially for those well-heeled residents in pricey locations. And this becomes even more obvious when comparing home prices to renter income in the cities with the highest increases in high-income renters: In nine of the 10 cities where the number of top-earning renters leapfrogged considerably, growth in home prices was higher than the national average (29%).

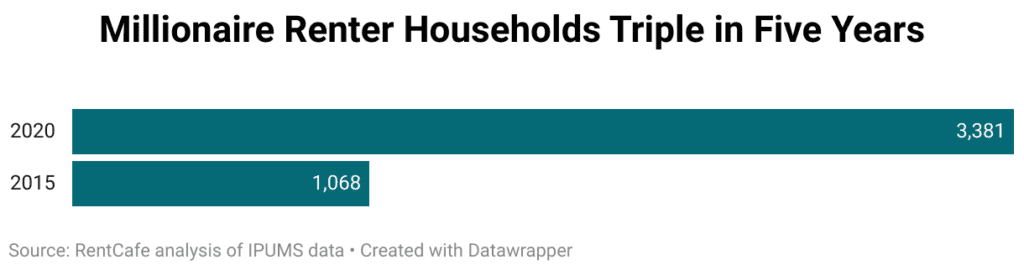

An even more interesting phenomenon of the past few years is the rise of an unlikely new kind of tenant — the millionaire renter. The number of renter households with incomes of more than $1 million reached a record high of 3,381 in 2020 — three times as many as there were in 2015, when 1,068 millionaires were renting their homes in the U.S., according to the most recent data from IPUMS.

If you live in a fancy New York or San Francisco neighborhood, the renter next door might be a… millionaire!

While home prices could be considered an obstacle even for high-income renters, what stops some millionaires from stepping on the homeownership ladder? Well, it might be an issue of comfort and smart investing. Often homebuyers are struck with the realization that their new property needs more maintenance than expected. Couple this with the flexibility of moving between cities to pursue new career opportunities and you can see why even the most affluent sometimes choose to rent their home. Additionally, some high-earners, including some millionaires, prefer to funnel their cash into other types of assets that hold value.

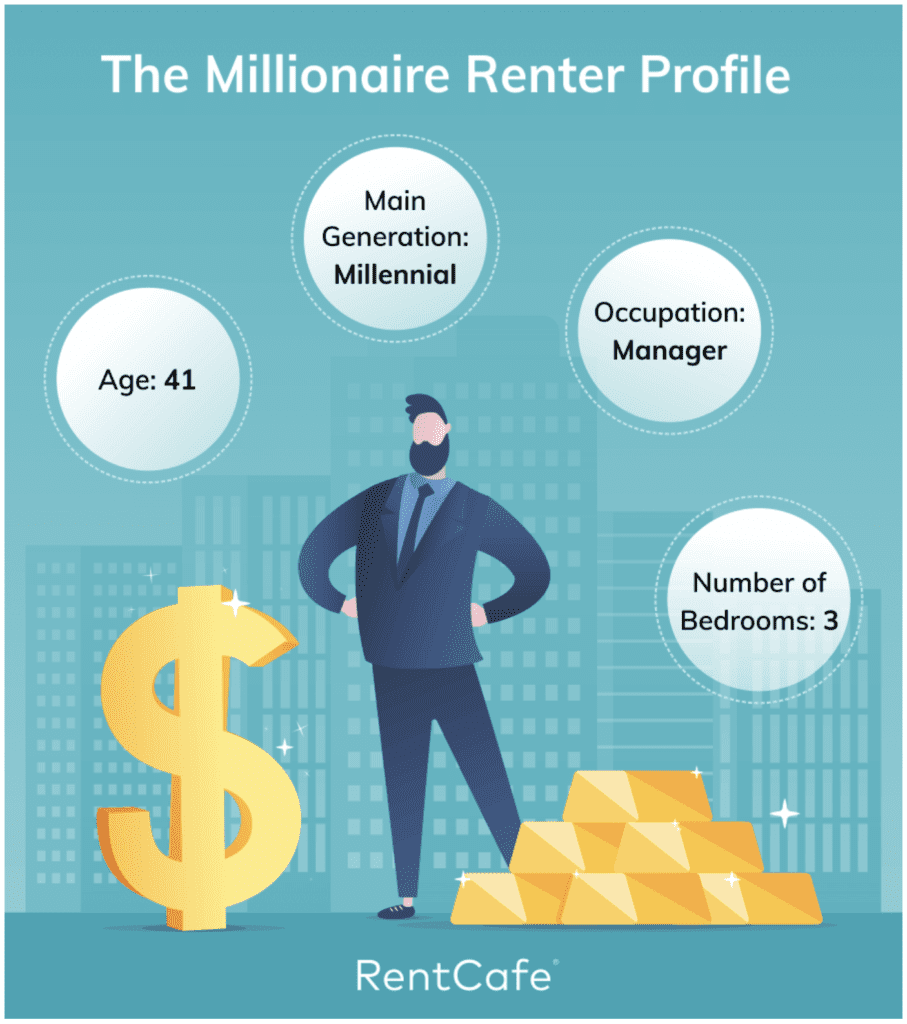

So, what does this new breed of renter look like?

According to a survey from Charles Schwab, Americans consider that an average net worth of 1.1 million represents being “financially comfortable”. And it seems that being financially comfortable is a Millennial trait, with this demographic making up a majority (28%) of millionaire renters. For many Millennials of homebuying age and with above-average incomes, lifestyle renting is a better choice than owning. This mindset is mirrored among millionaire Millennials, too, who, unlike their Baby Boomer parents, decide to rent despite having the financial resources to own.

Gen X follows closely behind, making up 23% of millionaire renter homes. As the first generation that redefined and broke away from the American dream of homeownership, Gen Xers initially turned to renting due to the strain brought on by the 2008 housing crisis. Today, they’re following the same lifestyle renting trends as their younger counterparts.

Millionaire households skyrocket; San Francisco, Los Angeles & D.C. register the biggest spike

Wealthy renters live mainly on the coasts, specifically in California, New York and Washington, D.C. San Francisco, CA held second place in the number of millionaire renter households, but had the biggest spike between 2015 and 2020. The golden city’s rental homes inhabited by millionaires multiplied a whopping 17 times (1,629%), growing from 17 households in 2015 to a total of 294 in 2020. California is a millionaire magnet, as the number of seven-digit income renters also rose significantly in Los Angeles, by 361%, to 143 in 2020. Washington, D.C. has 121 renters who earn over one million dollars per year.

To that end, high-income renters nearly tripled in Seattle (169%) compared to 2015, making it the nation’s fastest-growing area for affluent renters. As a matter of fact, 17% of renter households in Emerald City have an income of over $150,000. Here, their number increased from 12,305 to 33,111 in just five years — thanks, in part, to a healthy and diverse job market. Technology titans, such as Amazon and Microsoft, are fueling the employment needs of Seattleites, along with a booming biotech industry. Despite this, not even well-off Seattleites could keep pace with the growth of home prices in the last 5 years: 58%.

A similar spike of 166% in wealthy renters pushes Miami, FL into second place. Granted, homeownership in Miami-Dade County has been dropping consistently even before the pandemic. So, it comes as no surprise that 2020 saw an influx of rich renters, reaching a high of 8,653 households (compared to 3,258 just five years prior).

In third place, Portland, OR registered a 148% rise in the number of high-earning renters, reaching 9,503 as of 2020. Despite salary increases rivaling home price increases, some well-off Portlanders still choose to rent.