The Phoenix commercial retail market continues to improve in vacancy and increased leasing activity. Vacancy rates, once hovering near 14% have now dropped to 10.6% through the 2nd quarter of 2014. Leasing activity of 2.6 million square feet in 2013 was the strongest recorded since before the Great Recession six years ago. Additionally, in the first two quarters of 2014 the market has recorded absorption of 750,000 square feet. These three factors combined position the market to continue to improve through the balance of 2014.

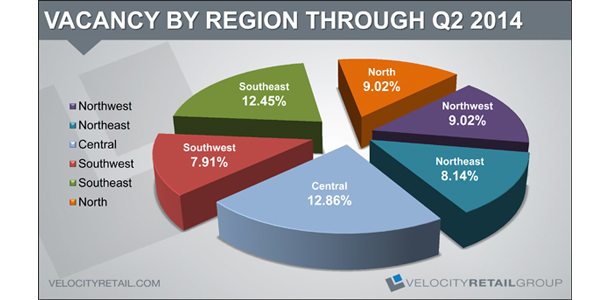

Of the six regional areas, all but two are in single-digit vacancy as of the 2nd quarter. The Central and Southeast regions continue to be hit with higher big box vacancies that drive the vacancy higher in these regions. Overall in Phoenix big boxes total 38% of our total vacant space. However, in the Central region big boxes account for 46% of the vacancy, and in the Southeast region it is 42%. With 261 vacant big boxes in Phoenix, this component of the retail market continues to be a cause for concern.

A bright spot on the horizon is that retailers and restaurants are active with national and regional concepts announcing their arrival in the market. Activity for shop space is increasing and rental rates for premium buildings are holding strong. Retailers who have remained relatively dormant during the last five or six years are cautiously starting up their expansion plans once more.

With little to no new construction on the horizon we are accelerating the rate that vacancy declines, and even with continued steady absorption, we are projecting that the entire market will be in single-digit vacancy with every regional area recovering to near pre-recession vacancy levels. Phoenix is poised for continued progress in 2014.