After three decades in real estate, I’ve learned that successful property transactions depend as much on timing as they do on location and price. The ability to read market signals and understand cyclical patterns can mean the difference between maximizing your investment returns and missing opportunities that may not resurface for years. Today’s real estate landscape presents unique challenges that require both historical perspective and forward-thinking analysis to navigate successfully.

Understanding when to buy and when to sell isn’t just about personal readiness—it’s about recognizing market conditions that align with your financial goals and risk tolerance. The interplay between interest rates, inventory levels, economic indicators, and seasonal patterns creates windows of opportunity that savvy investors and homeowners learn to identify and leverage.

Economic Indicators That Drive Market Cycles

Real estate markets don’t operate in isolation—they respond to broader economic forces that create predictable patterns over time. Employment rates serve as one of the most reliable leading indicators, as job growth drives housing demand while unemployment typically correlates with reduced buyer activity and increased foreclosure rates.

Interest rate movements create immediate impacts on buyer purchasing power and seller motivation. Rising rates reduce affordability and often slow buyer activity, creating opportunities for cash buyers and patient sellers. Conversely, falling rates typically stimulate buyer competition and can drive rapid price appreciation in inventory-constrained markets.

Inflation affects real estate in complex ways, often benefiting property owners through asset appreciation while simultaneously reducing buyer purchasing power through higher living costs. Understanding these relationships helps predict market timing opportunities and risks.

Consumer confidence indices provide insights into buyer psychology and spending willingness. High confidence levels often coincide with increased real estate activity, while declining confidence can signal upcoming market softening before transaction volume reflects the change.

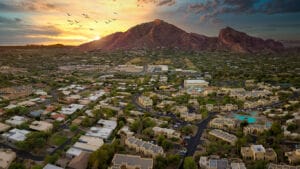

MORE NEWS: 10 best resorts in Arizona for 2025, according to Travel + Leisure

Inventory Levels and Market Balance

The relationship between housing supply and demand creates the fundamental dynamics that drive pricing and negotiation leverage. Months of inventory—the time required to sell all available properties at current absorption rates—provides a reliable measure of market conditions.

Seller’s markets typically emerge when inventory drops below four months of supply, creating competition among buyers and upward pressure on prices. These conditions favor sellers but require buyers to act quickly and often pay premium prices for desirable properties.

Buyer’s markets develop when inventory exceeds six months of supply, giving purchasers more choices and negotiation leverage while pressuring sellers to reduce prices or improve terms to attract offers. These periods provide opportunities for strategic buyers but challenge sellers to differentiate their properties effectively.

Balanced markets, with four to six months of inventory, create conditions where neither buyers nor sellers hold significant advantages, often resulting in more predictable pricing and reasonable negotiation processes.

Seasonal Patterns and Cyclical Trends

Real estate markets exhibit reliable seasonal patterns that create timing opportunities for both buyers and sellers. Spring markets typically bring peak buyer activity as families prepare for summer relocations, creating competitive conditions that favor sellers but may require buyers to pay premium prices.

Summer markets maintain strong activity levels but often see slight moderation as vacation schedules and outdoor activities compete for attention. Late summer can provide opportunities for motivated sellers to capture buyers before school year constraints limit relocation flexibility.

Fall markets often present opportunities for serious buyers, as reduced competition combines with motivated sellers facing winter market concerns. Families settled into school routines may offer less competition, while sellers may accept reasonable offers rather than risk winter market conditions.

Winter markets typically favor buyers through reduced competition and motivated seller psychology, though inventory limitations may restrict choices. However, serious sellers remaining active during winter months often demonstrate flexibility that can benefit qualified buyers.

Local Market Variations and Microclimates

While national trends provide context, successful timing decisions require understanding local market conditions that may diverge significantly from broader patterns. Employment diversity, population growth trends, and regional economic health create local market dynamics that override national influences.

University towns, military communities, and areas dependent on specific industries often exhibit unique seasonal patterns and economic sensitivity that differ from general market trends. Understanding these local factors becomes crucial for timing decisions in specialized markets.

Infrastructure developments, zoning changes, and major employer relocations create localized opportunities and risks that can dramatically impact timing decisions. Staying informed about municipal planning initiatives and economic development projects provides valuable insights for strategic timing.

Interest Rate Impact on Timing Decisions

Interest rate environments significantly influence optimal timing for both buying and selling decisions. Rising rate periods often create urgency among buyers seeking to secure financing before further increases, potentially accelerating transaction timelines and creating seller advantages.

However, rising rates also reduce buyer pools over time, eventually shifting market dynamics toward buyers as affordability constraints limit competition. Understanding this lag effect helps predict market transitions and timing opportunities.

Falling rate environments typically stimulate refinancing activity and buyer demand, creating competitive conditions that may favor sellers but require buyers to act decisively. These periods often coincide with price appreciation that can benefit existing homeowners while challenging new buyers.

Rate volatility creates uncertainty that can freeze buyer decision-making, creating opportunities for decisive market participants willing to commit during uncertain periods.

Regional Economic Health Indicators

Local employment trends provide crucial insights for timing decisions, as job growth typically precedes housing demand increases while employment declines often signal upcoming market weakness. Monitoring major employer announcements, corporate relocations, and industry health helps predict local market direction.

Population migration patterns indicate long-term market strength or weakness, as in-migration typically supports sustained demand while out-migration suggests potential market challenges. Census data, school enrollment trends, and utility connection statistics provide insights into demographic movements.

Regional development projects, transportation improvements, and infrastructure investments often create multi-year appreciation opportunities that benefit strategic buyers and sellers who understand timing implications.

Recognizing Seller’s Market Conditions

Multiple offer situations, rapid price appreciation, and shortened time-on-market statistics signal seller’s market conditions that favor disposal strategies over acquisition approaches. These periods reward sellers who can bring properties to market quickly and efficiently.

Buyer pre-approval requirements, escalation clauses, and waived contingencies become common during seller’s markets, creating challenges for buyers but opportunities for sellers with desirable properties. Understanding these competitive dynamics helps optimize timing strategies.

Inventory shortages in specific price ranges or property types create micro-markets within broader conditions, allowing strategic sellers to capitalize on niche demand even during otherwise balanced market periods.

Identifying Buyer’s Market Opportunities

Extended time-on-market statistics, price reductions, and seller concessions indicate buyer’s market conditions that favor acquisition strategies. These periods provide opportunities for patient buyers willing to conduct thorough searches and negotiate strategically.

Foreclosure activity, distressed sales, and motivated seller situations become more prevalent during buyer’s markets, creating opportunities for investors and owner-occupants seeking value purchases.

Financing incentives, builder concessions, and seller-paid closing costs often emerge during buyer’s markets as sellers compete for limited buyer attention.

Personal Financial Readiness Factors

Market timing means nothing without personal financial readiness to capitalize on identified opportunities. Debt-to-income ratios, credit scores, and available down payment funds determine ability to execute timing-based strategies effectively.

Pre-approval processes and financial documentation preparation become crucial for buyers hoping to act quickly during competitive market conditions. Sellers benefit from understanding their equity positions and potential tax implications before market timing decisions.

Emergency fund adequacy and income stability influence risk tolerance for market timing strategies, as real estate transactions involve significant transaction costs and potential market exposure during transition periods.

Technology and Market Information Access

Modern technology provides unprecedented access to market data and trend analysis, enabling more sophisticated timing decisions than previous generations could achieve. Multiple listing service data, automated valuation models, and market analytics platforms provide real-time insights into local conditions.

However, information availability also increases competition among market participants, requiring faster decision-making and more precise timing to capitalize on identified opportunities.

Alternative Transaction Strategies

Traditional market timing assumes conventional financing and retail marketing approaches, but alternative strategies can provide timing flexibility during various market conditions. Cash transactions eliminate financing contingencies and can accelerate closing timelines when speed becomes valuable.

The importance of local market knowledge becomes particularly evident when timing pressures require rapid decisions. Metropolitan areas like Milwaukee present complex market dynamics where each suburb and neighborhood responds differently to broader economic trends. Understanding these micro-market patterns allows for more precise timing strategies that account for local employment centers, school district performance, and community development projects.

Investment companies and cash buyers often provide alternatives to retail market exposure, particularly valuable during uncertain market periods or when personal timing needs conflict with optimal market conditions. In my recent experience working within the Milwaukee market, I’ve observed how companies specializing in specific local markets, such as New Berlin cash buyers, often understand neighborhood-specific timing factors and can provide rapid transaction capabilities when conventional market timing becomes impractical.

These alternatives typically involve pricing trade-offs but can provide certainty and speed that traditional timing strategies cannot match during challenging market periods.

Risk Management in Market Timing

No timing strategy eliminates market risk entirely, making risk management crucial for successful real estate timing decisions. Diversification through multiple property types, geographic markets, or investment strategies can reduce timing risk exposure.

Understanding personal risk tolerance and financial capacity for potential timing mistakes helps establish appropriate strategy boundaries and prevents overextension during attractive market opportunities.

Long-term vs. Short-term Timing Strategies

Real estate timing strategies vary significantly based on investment horizons and personal objectives. Long-term investors may focus on demographic trends, infrastructure development, and economic diversification when making timing decisions.

Short-term strategies often emphasize seasonal patterns, interest rate cycles, and inventory fluctuations that create opportunities within 12-24 month timeframes.

Understanding your investment horizon and personal circumstances helps determine which timing signals deserve priority attention and which market movements may be less relevant to your specific situation.

Conclusion: Balancing Analysis with Action

Successful real estate timing requires balancing comprehensive market analysis with decisive action when opportunities align with personal circumstances. Perfect timing rarely exists, but understanding market cycles, economic indicators, and personal readiness factors enables strategic decisions that improve outcomes over time.

The key is developing systems for monitoring relevant market indicators while maintaining flexibility to act when conditions align with your objectives. Whether buying, selling, or holding real estate investments, timing awareness provides competitive advantages that can significantly impact long-term financial success.

Remember that real estate markets reward preparation, patience, and strategic thinking over emotional reactions to short-term market movements. By understanding the factors that drive market cycles and maintaining readiness to act during optimal conditions, you can position yourself to benefit from real estate market opportunities regardless of broader economic conditions.