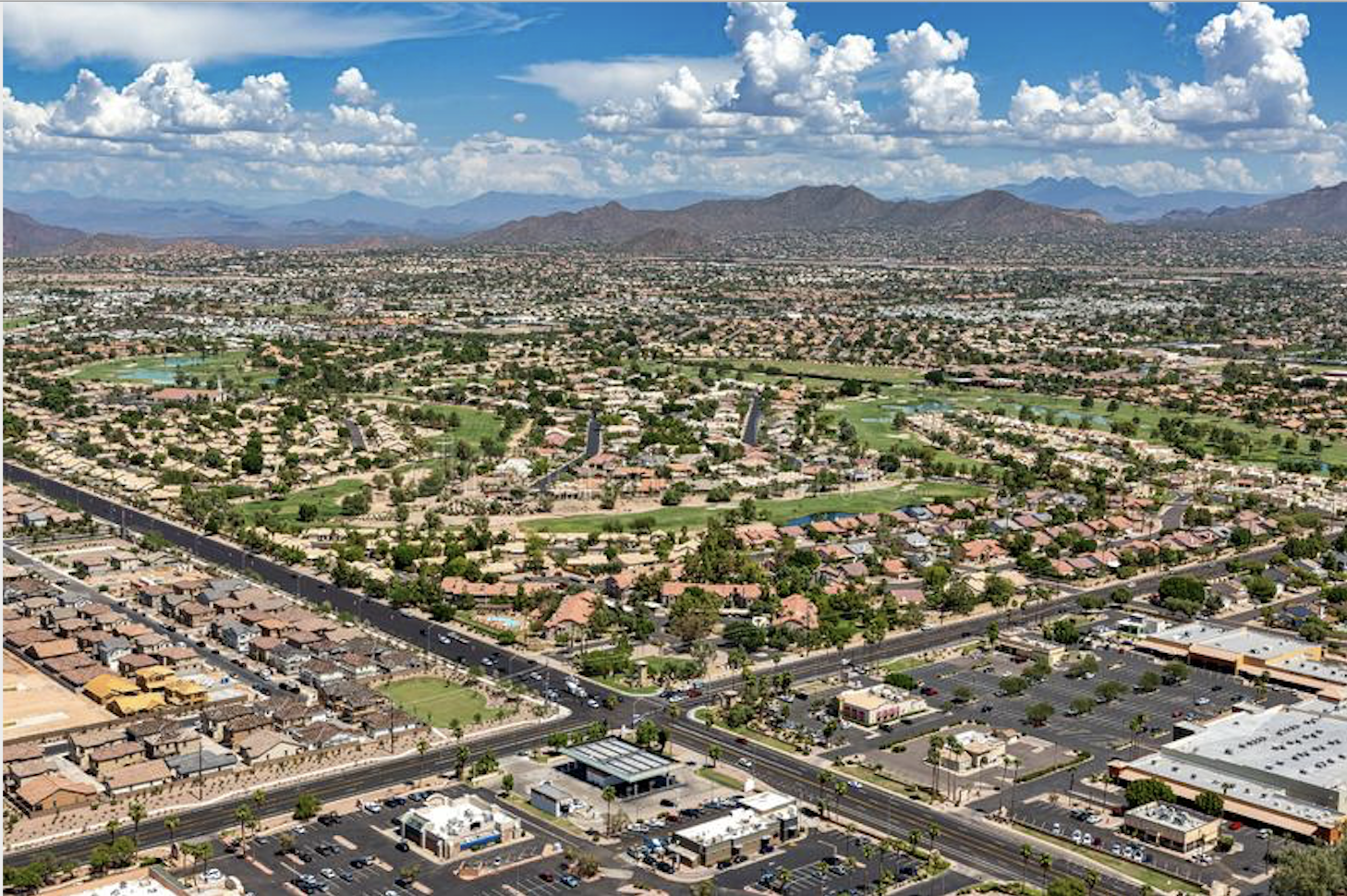

Even though the median home price in the U.S. has soared to new heights, some housing markets are rising faster than others. The temperature of a housing market can heat up and cool down based on a variety of factors. Places where the population is growing faster than the development of new housing units are hotter markets, and so are cities where median incomes and home values are increasing most rapidly. Keeping these factors top-of-mind, SmartAsset analyzed data to identify and rank the top rising housing markets and Phoenix, Mesa, and Glendale all ranked among the top 25 rising housing markets in America.

READ ALSO: Here’s how much home $400,000 gets you in Arizona

To do so, we compared 322 of the largest cities in the country across the following metrics: housing demand (i.e. the difference between population growth and housing unit growth), four-year change in median home value and four-year change in median household income. For details on our sources and how we compiled our final rankings, read the Data and Methodology section below.

This is SmartAsset’s sixth annual study of the top 10 rising housing markets. Check out the 2021 version here.

Key Findings

• The Denver area is rising quickly. The housing markets in both Denver and Arvada, Colorado – a suburb northwest of the city – are among the hottest in the country. Denver, which ranked 59th in our study last year, ranks second overall in this year’s study as the population grew significantly faster than housing stock between 2016 and 2020. In Arvada, the median home value increased by more than 50% during that same time, driving it up 69 spots this year to claim the No. 7 ranking.

• The West dominates the top housing markets. Of the top 25 rising housing markets, 20 are located in the West, including 12 in California. The East Coast is not seeing nearly the same kind of growth and demand. In fact, Florida is the only East Coast state with cities represented in the top 25 (namely, Port St. Lucie, Lehigh Acres, Lakeland and Palm Bay).

1. Jurupa Valley, CA

Jurupa Valley, California is a city of nearly 107,000 people about 50 miles west of Los Angeles. The city’s population grew 9.41% faster than the number of new housing units between 2016 and 2020, the third-highest rate in our study. Median household income also increased by 32.18% during the same time period (12th-best overall), while the median home value shot up 45.25%, which ranks 49th out of 322 cities.

2. Denver, CO

Denver’s population grew by nearly 8% between 2016 and 2020, outpacing housing unit growth by 5.61% during that time. That’s the 13th-largest difference between population growth and housing unit growth in our study. Denver also experienced the 29th-largest jump in median household income, as it rose 29.16% between 2016 and 2020. The median home value in this city of nearly 716,000 residents also went up 49.09%. That’s a larger increase than 87% of cities in our study.

3. Everett, WA

Everett, Washington is located 25 miles north of Seattle and ranks in the top 10% of cities for all three metrics we considered. Everett had the 26th-largest median household income growth between 2016 and 2020, rising 29.63%. The city also saw its median home value rise 48.60% during that time (28th-highest overall). Meanwhile, the city had the 30th-highest housing demand across our study, as its population grew 3.20% faster than the number of new housing units.

4. Stockton, CA

The median home value in Stockton, California rose by 56.13% between 2016 and 2020, the 10th-most across all 322 cities. The city of 311,000 residents also saw population growth outpace housing unit growth by 2.75% during that time (41st-best overall). Finally, the median household income rose 26.85% over that four-year period, ranking in the top 50 cities for that metric.

5. Vallejo, CA

Vallejo, California experienced the fifth-largest increase in median home value between 2016 and 2020 (59.23%). This Bay Area city also saw its population grow 4.28% faster than new housing units during that time (21st-most). The city ranks 72nd out of 322 cities for four-year change in median household income, which increased 23.94% between 2016 and 2020.

6. Sunnyvale, CA

Between 2016 and 2020, Sunnyvale, California had the third-largest change in both median home value (62.64%) and median household income (37.04%). Meanwhile, housing demand is more muted. The city’s population grew about a percentage point faster than the city’s housing stock during that same time, ranking 106th-highest overall.

7. Arvada, CO

This suburb of Denver saw its median home value rise 52.50% from 2016 to 2020, which is the 22nd-largest increase across our study. Home to 120,000 people, Arvada’s population grew 1.74% faster than its housing stock (69th overall) during that four-year period, while the median household income rose 28.69% (31st-highest overall).

8. Moreno Valley, CA

Population growth in this southern California city outpaced housing unit growth by 4.45% from 2016 to 2020. That’s the 19th-highest housing demand in our study. Meanwhile, Moreno Valley had the 51st-largest increase in median home value (45.07%) during the same four-year stretch and the 61st-biggest jump in median household income (24.67%).

9. Oakland, CA

Oakland, California’s median household income rose by 38.71% between 2016 and 2020, the second-largest increase across our study. The city of over 422,000 residents also had the 45th-largest four-year change in median home value (45.85%), while the population grew 1.32% faster than housing units.

10. Port St. Lucie, FL

The first and only East Coast city in the top 10, Port St. Lucie, Florida, had the 26th-largest increase in median home value, which rose 50.20% between 2016 and 2020. The population grew by 11.46% during this stretch, outpacing housing unit growth by 3.33% (the 27th-largest difference). The median household income also increased by 22.73% from 2016 to 2020 (83rd-most).

Data and Methodology

To find the top rising housing markets, we looked at data for the 322 U.S. cities with a population greater than 100,000 in 2020. We analyzed this information across the following three metrics:

Housing demand. This is the percentage point difference between population growth and housing unit growth from 2016 to 2020.

Home value growth. This is the percentage change in median home values from 2016 to 2020.

Income growth. This is the percentage change in median household income from 2016 to 2020.

Data for all metrics comes from the Census Bureau’s 2016 and 2020 5-year American Community Surveys.

First, we ranked each city in each metric. Then we found each city’s average ranking, giving each metric equal weight. Using this average ranking, we created our final score. The city with the highest average ranking received a score of 100. The city with the lowest average ranking received a score of 0.

Home Buying Tips

Talk with a financial advisor. A financial advisor who offers financial planning services can help you set a budget and integrate your home purchase into a holistic financial plan. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Run the numbers. Before you begin your search, it's important to scrutinize your budget. SmartAsset has a calculator designed specifically to help you determine how much house you can afford, as well as a mortgage calculator for estimating your monthly mortgage payments.

Reconsider renting. If you're on the fence about buying a home, see if renting makes more sense for you financially. SmartAsset's rent vs. buy tool can help you determine which is best suited for you.