Housing inventory is expected to come from a number of sources over the next year, including from existing homeowners and home builders — but very little is expected to come from homeowners foreclosed upon after the expiration of key federal protections, according to a Zillow survey of experts. The housing market is expected to stay largely stable as homeowners exit forbearance, while rents and vacancies are not expected to rise dramatically following the end of the federal eviction moratorium.

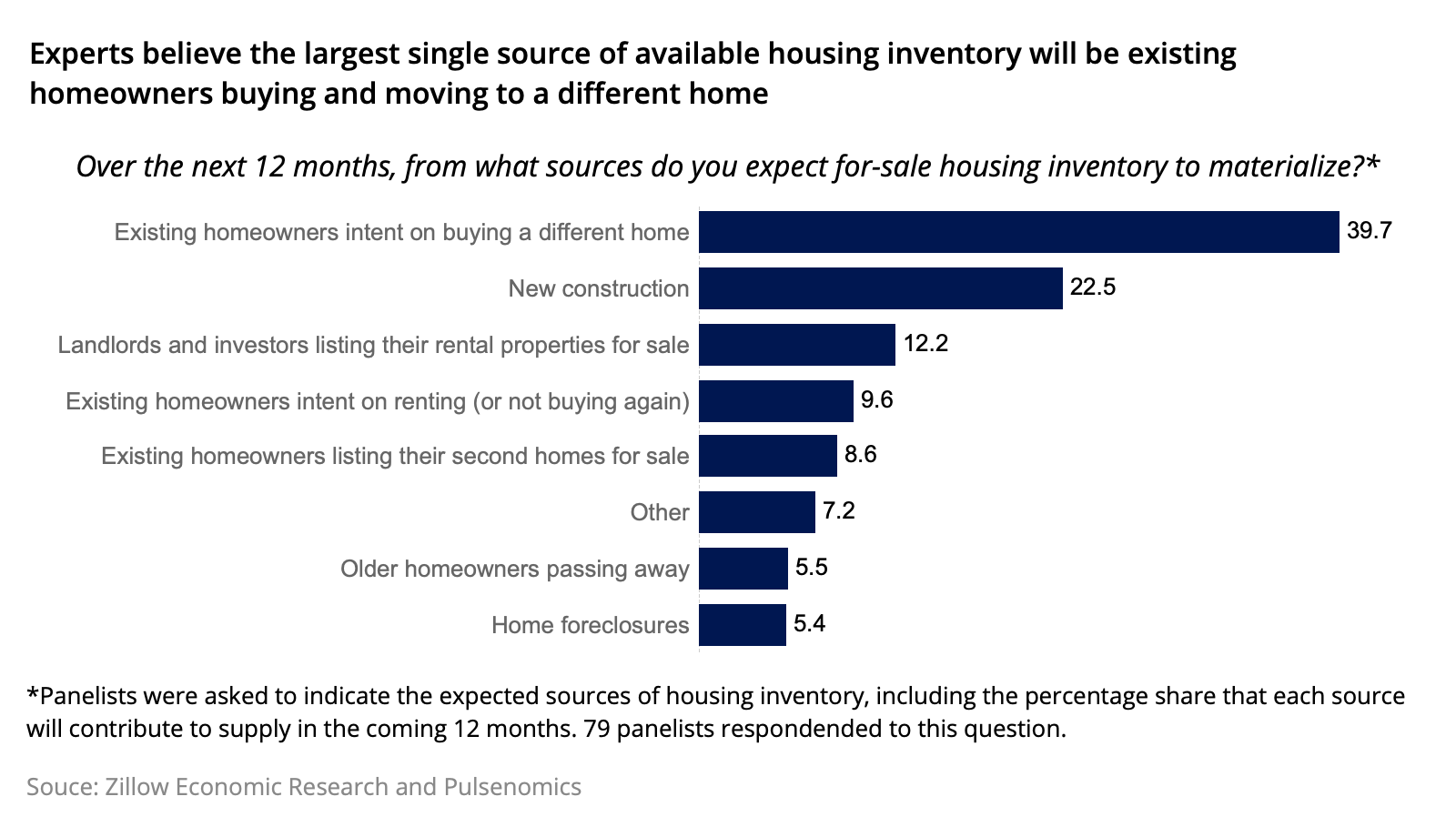

As part of the Q3 2021 Zillow Home Price Expectations Survey, more than 100 real estate experts and economists nationwide were asked for their thoughts on expected home price appreciation over the next five years, inventory and the state of the market once key pandemic-era housing protections end. The survey is sponsored by Zillow, and conducted quarterly by Pulsenomics. Panelists said they expect the largest single source of available housing inventory will be existing homeowners buying and moving to a different home, comprising 39.7% of the supply that is expected to hit the market over the next year.

READ ALSO: Are short-term rentals investors ruining Arizona housing market?

Inventory trended downward throughout 2020 and into 2021 as demand for homes took off, driven by the Great Reshuffling, low interest rates, and a demographic surge of millennial and baby boomer home buyers. The combination of low supply and high demand pushed prices into new territory, reaching record-high 17.7% annual appreciation in August. But at the same time, inventory rose from the month prior and the share of listings with a price cut grew for the fourth straight month, suggesting some modest improvement in buying conditions. In February, the panel accurately predicted that additional inventory would enter the market in the second half of the year as existing homeowners became more comfortable listing their homes under a widespread vaccine distribution.

• In Phoenix metro, inventory grew 3.6% in August but is still down 12% over the past year.

• Current annual home value appreciation in the Phoenix market is 31.8% over the past year.

The panel expects home foreclosures to make up the smallest source of available inventory, at 5.4%. Additional supply is expected to come onto the market over the next few months as homeowners exit forbearance and some sell their homes, according to previous Zillow research. The federal foreclosure moratorium ended on July 31, and roughly 850,000 borrowers are expected to exit forbearance programs before November 2021.

However, strong price appreciation over the past few years and very few loans with negative equity mean open market sales are a realistic option for the majority of distressed borrowers. That’s unlike in 2008, when financial conditions and a souring housing market pushed many homeowners into involuntary foreclosure.

New construction is forecast to be the second-largest source of inventory, at 22.5%. New home construction has been weighed down in 2021 due to shortages of key building materials, but even despite the setbacks has largely remained above pre-pandemic levels.

Existing homeowners intent on renting, or not buying again, should contribute 9.6% of supply, according to the panel.

Limited Rental Market Impact

In the rental market, in light of the expiration of the federal eviction moratorium, Zillow projects evictions will be roughly 1.5 times what they would typically have been before the pandemic.

After the moratorium expired on July 31, the Centers for Disease Control and Prevention imposed a new policy to prevent evictions in areas with high COVID infection rates. However, the Supreme Court blocked the new ban, leaving a number of renters at risk of eviction. Zillow estimates there will be more than 485,000 eviction filings in September and October after the Supreme Court’s ruling, with a projected 268,000 likely to be evicted — roughly 0.6% of the 43.9 million renters in the U.S.

The vast majority of survey participants do not expect rents to change much as a result of the moratorium ending. The largest single group of panel participants — 34% — said no change is likely to occur, while 26% expect rents to rise slightly. A total of 14% of respondents said rents will fall either slightly or modestly. Predictions for rents to rise modestly were cast by 20% of the panel, and those believing rents will increase significantly accounted for 6%.

When asked how rental vacancy rates will be affected, the largest share of respondents (38%) said vacancies would rise slightly as a result of the end of the moratorium, just ahead of predictions that vacancies would not rise (37%) and beyond calls that they would rise modestly (24%).

How many at-risk renters will be evicted will be greatly impacted by the pace of distribution of federal relief funds. According to the U.S. Department of the Treasury, only $5.1 billion of the $46.5 billion in rental relief has been distributed by state and local governments as of Aug. 25.

Silver Lining

Experts surveyed expect home prices nationwide to increase a cumulative 31.8% through 2025, the equivalent of an average annual rate of 5.7% — far below the current annual appreciation of about 17%.

“Across the U.S., home value appreciation rates and annual rent price increases are at historically high levels, and home price expectations are now the highest we’ve recorded in the 12-year history of this survey,” said Terry Loebs, founder of Pulsenomics. “The silver lining for aspiring homeowners is that the worst of the housing supply crunch looks to finally be behind us, and most experts believe that the past year’s rapid price boil has begun to simmer down.”