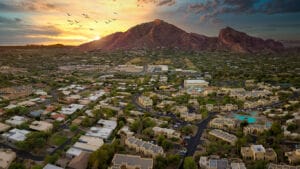

Phoenix housing prices dropped by 2.0% over the year in September based on the S&P Cotality Case-Shiller indices. It was not alone, as 11 of the 20 cities in the indices registered a drop in house prices over the year. Nationally, house prices were up 1.3% in September compared to 1.4% in August. The 20-city composite had an annual gain of 1.4%, down from 1.6% the previous month. Chicago was the metropolitan area with the largest increase in house prices year-over-year, at 5.5%, followed by New York at 5.2% and Boston at 4.1%. At the other end of the spectrum, Tampa reported the most noteworthy decrease in prices at -4.1%, followed by Phoenix at -2.0%, and Dallas at -1.3%. This reverses a trend from the last few years when Florida, Texas, and Arizona were among the states with the biggest price gains. -Valorie Rice

LOCAL NEWS: 10 Arizona housing events that offer festive charm

INDUSTRY INSIGHTS: Want more news like this? Get our free newsletter here

Arizona was among six states reporting a decline in annual housing price changes for the third quarter of 2025. The one-year change in prices for the state was -0.3%, compared to an increase of 2.3% nationally based on the U.S. Federal Housing Finance Agency (FHFA) House Price Index. The state with the highest annual appreciation in the third quarter was Illinois, at 6.9%, followed by New York at 6.8%, and North Dakota at 6.3%. Florida ranked last with a -2.3% change in house prices, followed by Colorado at -1.2%, and Vermont at -0.9%. State-level data contain purchase-only data, whereas the data available for all Arizona metropolitan areas are compiled with the all-transactions index, which includes purchases and refinance data. Price changes for Arizona metro areas in the third quarter of 2025 were 1.6% in Flagstaff, 2.1% in Lake Havasu City-Kingman, 0.9% in Phoenix, 5.5% in Prescott Valley-Prescott, 2.1% in Sierra Vista-Douglas, 1.7% in Tucson, and 1.7% in Yuma. For comparison, the all-transaction changes for the U.S. and Arizona were 3.3% and 1.3%, respectively. -Valorie Rice

The U.S. Consumer Price Index (CPI) for all items increased 0.3% over the month in September, down from 0.4% in August. Over the year, the all-items index was up 3.0, similar to the August increase of 2.9%. The core index (all items less food and energy) also rose 3.0% in September. The energy CPI was up 2.8% over the year, while the food CPI rose 3.1%. In September, the shelter index was up 3.6% nationally, but down 0.4% in the Phoenix MSA. -George Hammond

U.S. nonfarm jobs ticked up in September 2025 by 119,000 over the month. Health care; food services and drinking places; and social assistance posted the largest gains. Both the July and August estimates were revised down. Over the year, U.S. jobs were up 0.8%, matching the August increase. Average hourly wages were up 3.8% during the past 12 months. The seasonally adjusted unemployment rate was 4.4%, little changed from August, but up from 4.1% a year ago. -George Hammond

The U.S. Product Price Index for final demand rose 0.3% in September (seasonally adjusted), after declining in August. The acceleration in September was driven by a 0.9% increase in goods prices, the largest increase since early 2024. Much of the increase in the final demand goods index was attributable to gasoline prices. Over the year, the final demand index was up 2.7%. The index for processed goods for intermediate demand increased 3.8%. -George Hammond

The August goods and services trade deficit came in at $59.6 billion, down $18.6 billion from a revised $78.2 billion in July. August exports rose $0.2 billion from July to $280.8 billion, and imports fell $18.4 billion to $340.4 billion. The decrease in the deficit reflects a decrease in the goods deficit of $18.1 billion to $85.6 billion and an increase in the service surplus of $0.5 billion to $26.1 billion. Year to date, the goods and services deficit increased 25.0%, or $142.5 billion, from the same period in 2024, with exports rising 5.1% or $108.4 billion, and imports rising 9.2% or $250.9 billion. The largest surpluses, in billion, occurred with Netherlands ($5.1), South and Central America ($4.9), and Hong Kong ($1.7), while the greatest deficits were with Mexico ($16.3), China ($15.4), and Vietnam ($14.4). -Delaney O’Kray-Murphy