For the last five years, the Department of Labor has investigated 16 companies in Utah and Arizona for misclassifying employees as contractors. It came to a close on April 23 with $700,000 owed in back wages, damages and penalties for more than 1,000 construction industry workers in the Southwest.

However, this is hardly the end of the DOL’s targeting of the construction industry for illegal labor and wage practices.

“Many employers are feeling the squeeze in the construction industry from the recession and they’re looking for answers and sometimes innocently stumble on the answer of making people independent contractors,” says John Doran, attorney at Sherman & Howard.

The aforementioned case, for instance, included a company that asked its employees to form LLCs. It went from having employees one day to having none.

Misclassification of employees and contractors is more often than not unintentional, experts say. The easier said than done solution is educating employers and employees.

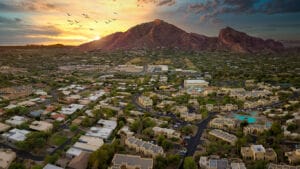

“Arizona does present additional challenges as a border state,” says Jesús Olivares, community outreach specialist for the DOL’s wage and hour division. “A lot of migrant workers and transient employees work here and then move on to other states. It’s a culture in which employees think in order to keep a job, they can put up with these illegal practices. Migrants have no options and that creates an additional obstacle for us. I think here, locally, more than 60 percent of employees who have been misclassified are Hispanic.”

Even if employees seem happy, says Tracy Miller, attorney at Ogletree, Deakins, Nash, Smoak & Stewart, it only takes one person to set an investigation in motion. Sometimes that catalyst is a competitor who is getting underbid by a company that can afford to charge less for a project due to money being saved by misclassifying employees. On average, misclassifying workers can save a company 30 to 35 percent of worker overhead, Olivares says.

“We try to educate our members,” says Arizona Builders Alliance Executive Director Mark Minter. “Employment law attorneys come to our conventions … I hope, as a result of those efforts, people are more aware of potential pitfalls.”

Minter says most calls from members seeking advice concern issues of travel time and apprenticeship classifications, not about righting the misclassification of employees. Minter understands the consequences of misclassification, citing a personal friend who lost his business because he improperly reported sales tax and was audited by the Department of Revenue.

The solution, for Minter, is transparency from the DOL. He recalls that shortly after the American Recovery and Reinvestment Act was passed, a lot of government projects were swept into the pipeline and scooped up by contractors who may have not understood federal classification rules.

“We tried to get guidelines from the DOL, but we were told, ‘We’ll look at the situation and advise after the fact,’” Minter recalls. This led to expensive misinterpretations of federal guidelines, he said.

Olivares, in concert with industry leaders, such as Sacks Tierney lawyers Matt Meaker and Helen Holden, and organizations like the ABA, launched the Employee Misclassification Compliance Assistance Program about a year ago to further the educational mission.

The EMCAP program is a self-audit tool developed to help contractors assess their classification practices. The program also offers a good faith model in which the agency will waive money going to the federal government.

“Peer pressure is a powerful tool,” says Meaker. “If the right players are involved and the right players know what they’re looking for, we’re going to make the light shine forward and force the bad actors into the dark further.”