ValuePenguin by LendingTree’s comprehensive review of all health insurance plans on the marketplace in 2026 reveals a troubling trend for Arizona: Arizona health insurance premiums for the most popular health plans in the state are rising 29% in 2026, the 12th largest rate increase in the U.S.

READ MORE: AZ Big Podcast: Pam Kehaly of AZ Blue talks evolving landscape in healthcare

LOCAL NEWS: Want more stories like this? Get our free newsletter here

According to ValuePenguin by LendingTree’s 2026 Health Insurance in Arizona report:

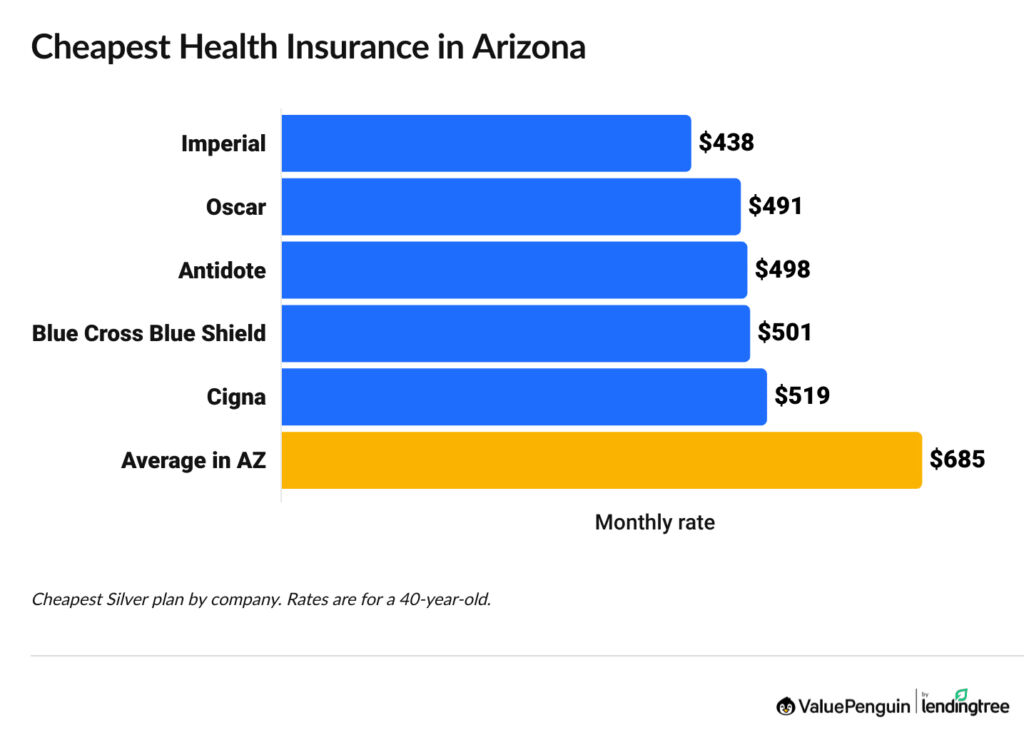

- In 2026, health insurance premiums in Arizona reached a record $2,189/month for a family of four, and $685 per month for individuals on a silver-tier plan, the state’s most popular option. Silver plans are getting 29% more expensive in 2026.

- Health insurance premiums in Arizona rose 25% for all 2026 plans. Bronze plans saw the largest increase, costing 33% more in 2026 compared to 2025. Gold plans are up 20%. Catastrophic plans, which had the smallest increase, are also rising 19% in 2026.

- Even after subsidies and discounts, Arizonans could pay $190/month on average for health insurance in 2026, significantly more than the $89 per month average they paid in 2025, with enhanced subsides.

- Premiums for the cheapest Silver tier plans from Ambetter, Antidote, Blue Cross Blue Shield of Arizona and Imperial vary by $591 a month across the 15 counties ValuePenguin’s analyzed.

Imperial, Oscar and Antidote have the cheapest health insurance in AZ, with Silver plans starting at $438 per month before discounts, called subsidies.

Best health insurance companies in Arizona

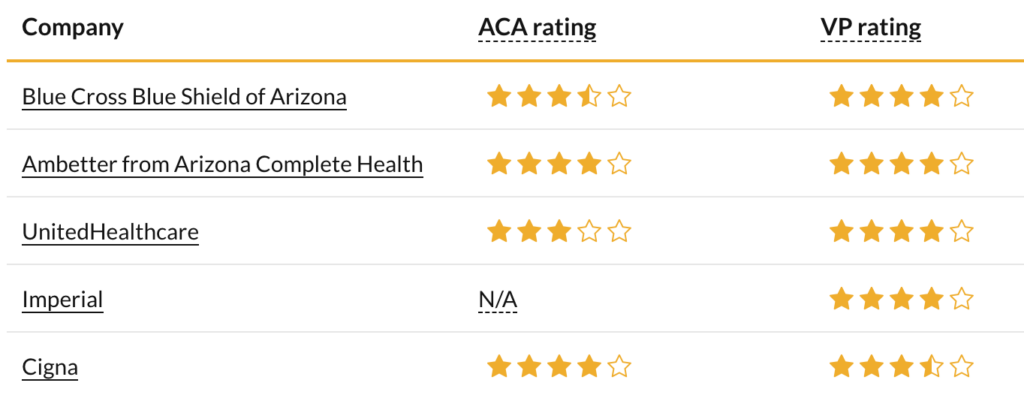

Blue Cross Blue Shield of Arizona has the best health insurance in AZ for both individuals and families, according to the analysis.

Blue Cross Blue Shield of Arizona (BCBSAZ) has a perfect 5-star rating in Arizona for member experience. This means most customers have good experiences with their health coverage from AZ Blue. Overall, Blue Cross Blue Shield of Arizona has a good rating of 3.5 out of 5 stars from HealthCare.gov because of its high-quality plans. The company also stands out for its affordable quotes.

Best-rated health insurance companies in Arizona