Corporations are now able to electronically file their income taxes to the Arizona Department of Revenue (ADOR). The corporate e-file solution starts with 2019 income tax returns and includes partnership tax returns.

“Arizona is open for business, and more companies are choosing Arizona every year,” said Governor Ducey. “We’re proud of the progress we’ve made in shaping a more efficient and accountable government. Expanding e-file is another way we’re making it easier to do business in our state.”

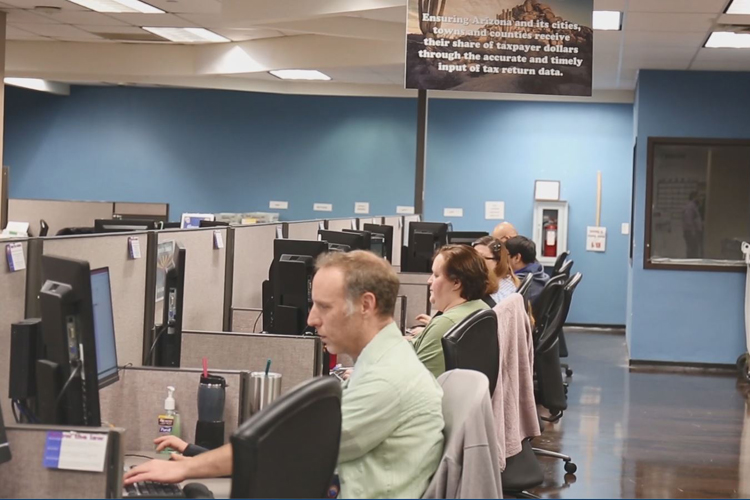

“The Arizona Department of Revenue is pleased its commitment to enhancing efficiencies for its customers has taken another step forward in expanding electronic filing to corporate taxpayers,” said Department of Revenue Director Carlton Woodruff. “In addition to e-filing being faster and more secure, returns are verified quicker than paper submissions, which benefits taxpayers if there are any errors that require their attention.”

Legislation signed into law in 2017 gives companies an e-file option in 2020 for tax year 2019 and becomes mandatory for corporations starting in 2021 for tax year 2020 returns.

The 2017 legislation also initiated a multi-year phase-in period for businesses required to file and pay transaction privilege tax (TPT) electronically. In 2019, the e-filing threshold was $10,000 with 77 percent of the more than 2.1 million TPT returns filed electronically. For 2020, businesses with an annual transaction privilege tax and use tax liability of $5,000 or more during the prior calendar year, will be required to file and pay electronically. In 2021, the threshold is reduced to $500 or more during the prior calendar year.

“Thousands of businesses already file transaction privilege tax electronically and now have the ability to e-file corporate income and partnership tax returns,” said Deputy Director Dr. Grant Nülle. “The phased-in approach gave the department time to modify its infrastructure systems to begin corporate e-filing.”

In tax year 2018, 183,000 corporate tax returns were filed with the Department of Revenue.

Electronic filing by individual income taxpayers has been growing in the state of Arizona with 83 percent of the 3.4 million individual income tax returns being e-filed in the 2018 tax year.

Check out the Arizona Department of Revenue’s website at www.azdor.gov for information.